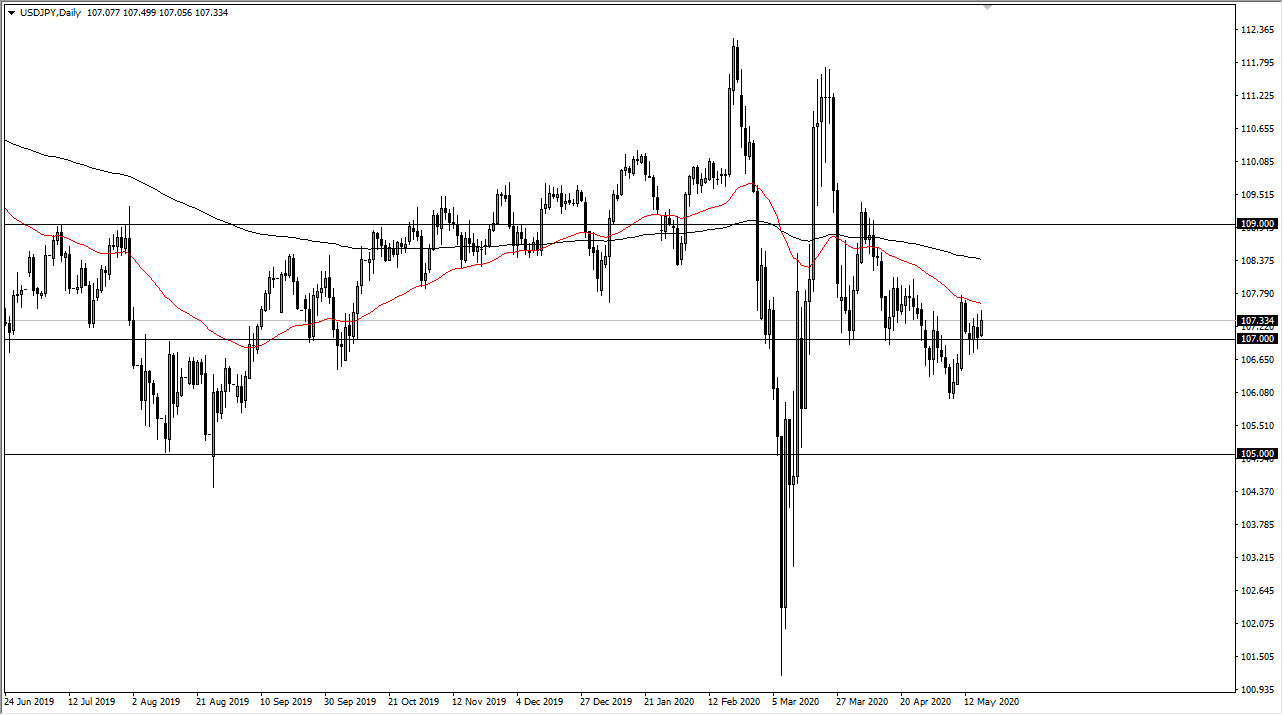

The US dollar has gone back and forth during the trading session on Monday to kick off the week, as we continue to see a lot of choppy in high-frequency trading just above the ¥107 level. This is an area that has been important more than once, but when I look at the chart from a longer-term standpoint, I recognize that the 50 day EMA comes into play and should be of importance. The ¥107 level has acted as a bit of a magnet, and therefore we should continue to see it act as a fulcrum for price. Between that and the 50 day EMA, there are a lot of forces moving in both directions.

All things being equal, I think that we are still very much in a downtrend from the peak, but this is a pair that tends to move with risk appetite in general. In other words, if the stock market goes higher, typically this pair will as well as the Japanese yen is considered to be an extreme “safety currency.” That being said, it seems very unlikely that the markets are suddenly going to go straight up in the air although looking at the stock market for the trading session on Monday, you would think that everything is over with now and we are suddenly going back to a bubble economy again.

If we broke down below the candles from the previous three sessions, it is highly likely that the market goes down to the ¥106 level, perhaps even down to the ¥105 level. Obviously, we need some type of negative headline or freak out to make that happen but that something that we have seen more than once. Ultimately, fading exhaustion is how I look at this market for the time being, but I also recognize that it is going to continue to be very choppy. Because of this, I would be cautious about my position size, and I do recognize that this is probably more or less going to be a short-term trading type of environment due to the fact that the market simply have nowhere to be in the short term. Longer-term, if we can break down below the three candlesticks then we could see a bit of an acceleration. To the upside, it seems exceedingly difficult for the market to break the ¥108 level, but if it does then the market is going to have to deal with the 200 day EMA after that.