The US dollar has gone back and forth during the trading session on Wednesday as we continue to see a lot of noise when it comes to trading this pair. This is because both of these currencies are considered to be “safety currencies”, therefore it tends to be very noisy due to the fact that the traders will be looking to short both of these currencies at the same time against other ones.

All things being equal, and in normal times, the pair tends to rise right along with the stock market, but if it is a general selling of the US dollar, it is likely that the pair could pull back simultaneously. In other words, it basically moves on a couple of different factors, and depending on what is going on that day, it can cause a bit of chaos. That has been the biggest problem trading this market, because it has continued to see so many moving pieces at the same time.

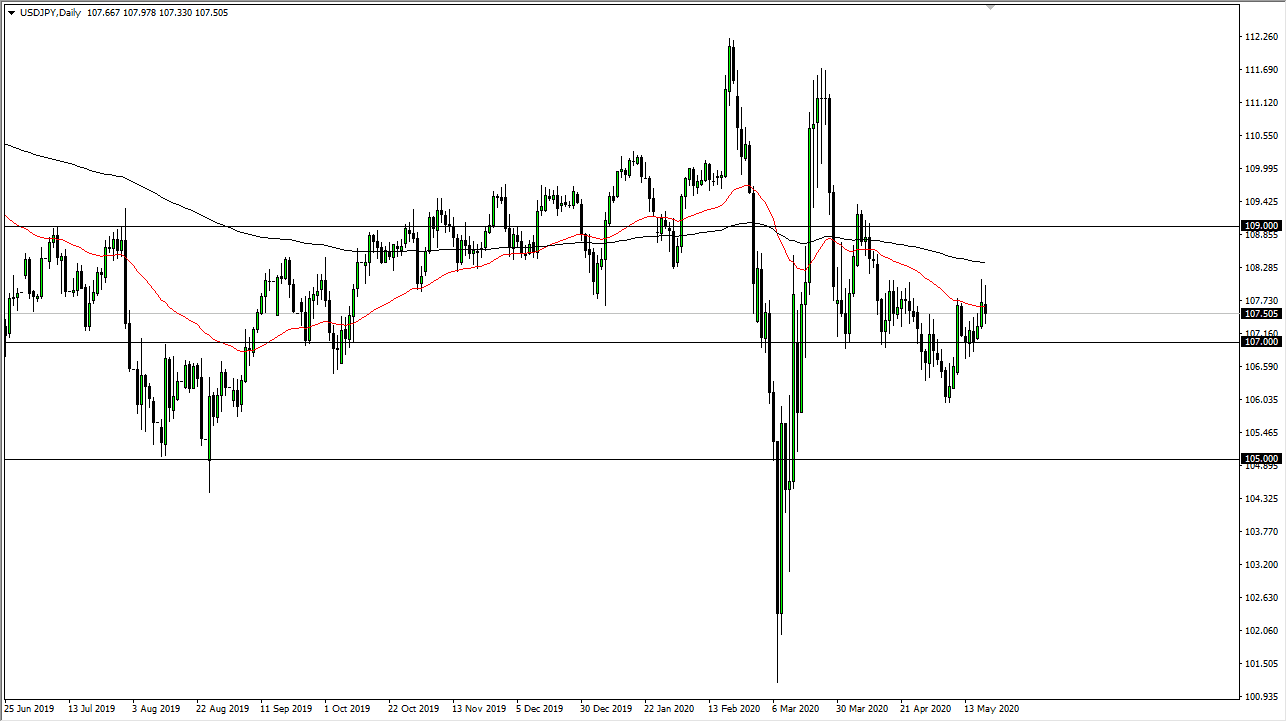

Looking at this chart, the market is going to also pay attention to the fact that it is at the 50 day EMA, and therefore it is likely that we will see technical traders pay attention to that as well. Because of this, expect noisy conditions but ultimately it should be an opportunity for traders to take advantage of a range in general. The ¥108 level is an area that has been resistive, and most certainly the ¥107 level has been supportive. I expect that to continue to be the case, as it will be extraordinarily noisy.

If we can break above the ¥108 level, it is highly likely that we will see the 200 day EMA come into play, offering significant resistance on the way to the ¥109 level. Ultimately, this is a market that I think is probably going to continue to be difficult to navigate as the “push pull” seems to be a major problem, and as a result I would pay quite a bit of attention to the position size that you have on, because you can get hurt quite quickly if you are not careful. Ultimately, this is a short-term trading type of environment you may find yourself in, and therefore position size needs to be small as it is going to take less to move the market back and forth. As far as a longer-term move, I will let you know when I see it, but we are nowhere near it right now.