India faced its last contraction in 1980 with a 5.2% decrease. Before that, only four other annualized recessions were reported, three of them below the 1.0% mark. The fiscal stimulus implemented by the Indian government is modest in comparison to developed nations, but also more responsible for future growth. Despite a massive surge in debt, lead by the US, economic recoveries are anticipated to remain slow and painful, increasing debate over the necessity of the response and associated long-term negative impact. As long as the Modi government will not give in to short-term decision making, the USD/INR will maintain its bearish bias below its enforced resistance zone.

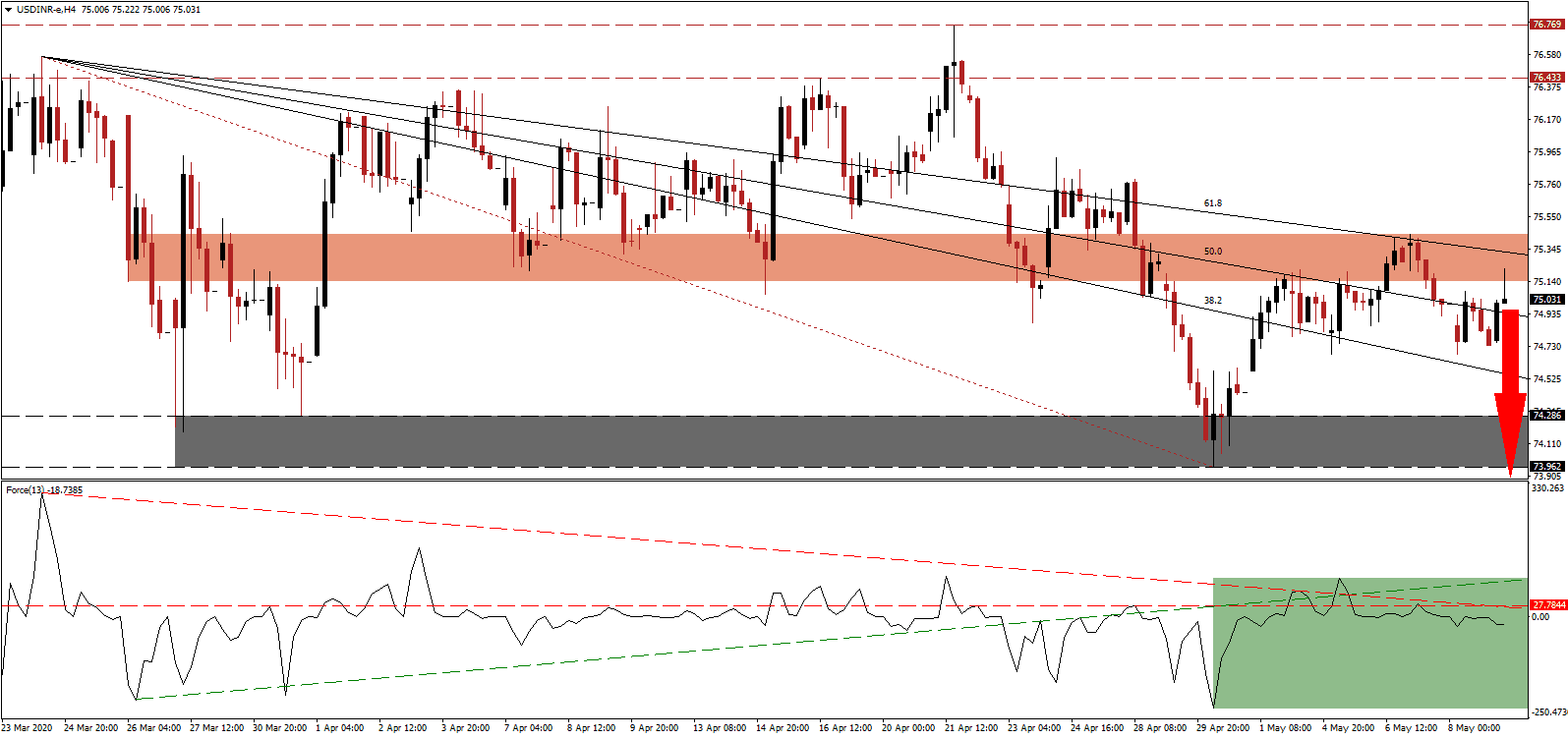

The Force Index, a next-generation technical indicator, confirms the dominance of bearish momentum, established following the breakdown below its ascending support level, after revering a temporary move above its descending resistance level. The Force Index is now drifting deeper into negative territory below its horizontal resistance level. Bears are in control of the USD/INR, and this technical indicator is well-positioned to extend its move to the downside.

Weak job creation and tightening credit in non-financial sectors, singled out as significant issues the Indian economy has to address, are problems many economies are facing. The US reported over 33 million lost jobs since March, and while the majority expect to return to work over the next six months, the outlook is notably more depressed. With the US pressing for a return to economic activity, the threat of a second infection wave in the summer with the newly mutated Covid-19 virus presents a mispriced risk. It adds to breakdown pressures in the USD/INR after being rejected by its short-term resistance zone located between 75.138 and 75.443, as marked by the red rectangle.

Enforcing the short-term resistance zone is the descending 61.8 Fibonacci Retracement Fan Resistance Level, currently passing through it. India is in the process of luring thousands of US firms out of China, adding a much-needed employment boost, but also increasing tensions with its strategic competitor on the Asian continent. With the US planning to issue more stimulus, the USD/INR is on course to challenge its support zone located between 73.962 and 74.286, as identified by the grey rectangle. A worsening US outlook is likely to force a breakdown extension into its next support zone between 72.348 and 72.702.

USD/INR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 75.000

Take Profit @ 72.350

Stop Loss @ 75.850

Downside Potential: 26,500 pips

Upside Risk: 8,500 pips

Risk/Reward Ratio: 3.12

In the event the Force Index advances above its ascending support level, the USD/INR could enter a limited counter-trend advance. Bearish fundamental developments, including a weaker than forecast US economy poised to elevate its unsustainable debt load, reduce the upside potential to its long-term resistance zone located between 76.433 and 76.769. It will offer Forex traders a second short-selling opportunity to consider.

USD/INR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 76.150

Take Profit @ 76.750

Stop Loss @ 75.850

Upside Potential: 6,000 pips

Downside Risk: 3,000 pips

Risk/Reward Ratio: 2.20