India, home to the world’s fifth-largest economy and Asia’s number three, attempts to use the Covid-19 crisis as an opportunity to charter a new course based on self-reliance. With GDP forecast to plunge by as much as 45% in the second-quarter, Prime Minister Modi is under pressure to deliver a sustainable plan forward, as the nationwide lockdown is gradually lifted. The ₹20 trillion spending package will produce immediate assistance but needs to be followed by structural reforms to yield the desired results. With uncertainty persistent, the USD/INR reversed its breakdown back into the enforced short-term resistance zone. Volatility is expected to increase, while the bearish bias remains dominant, partially driven by weak US data.

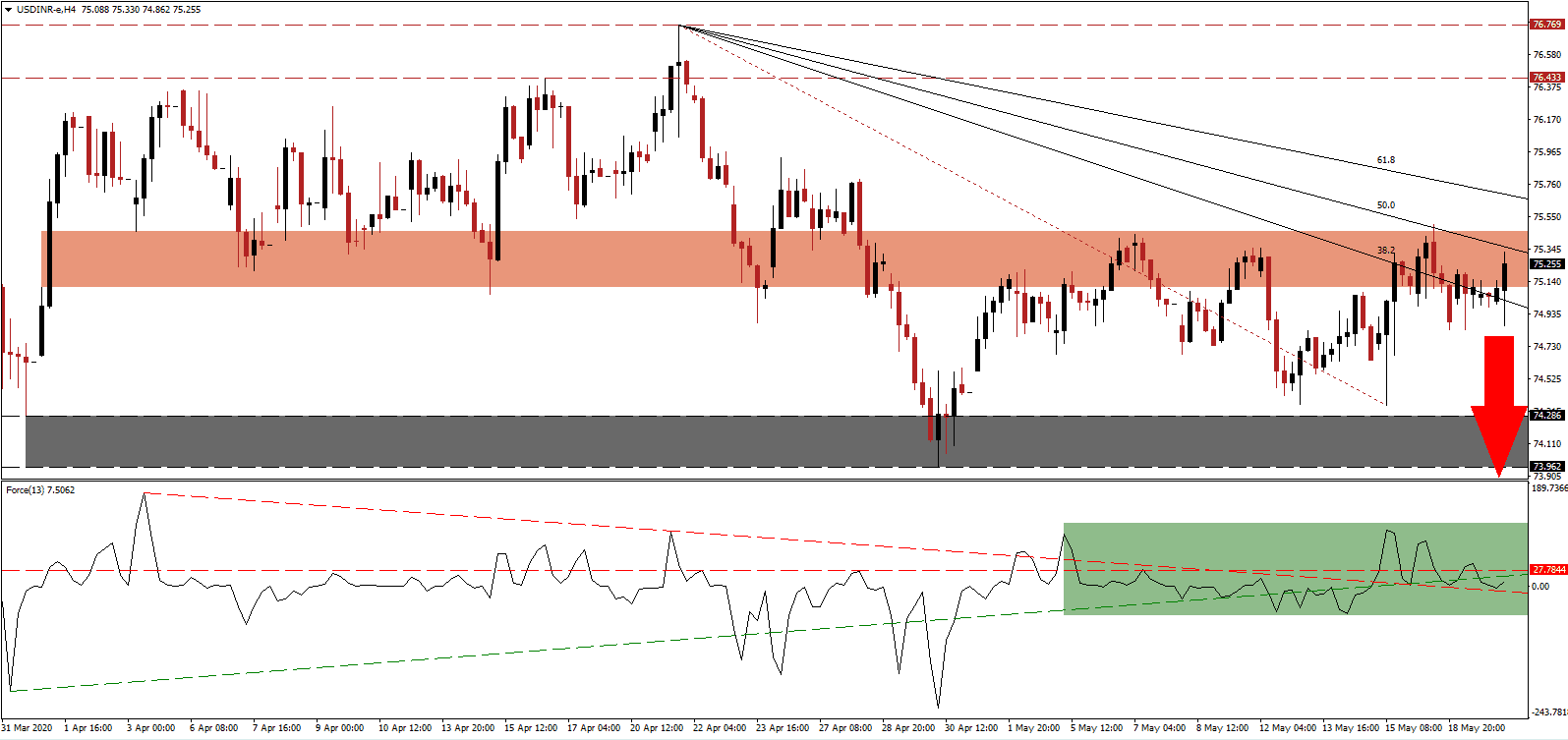

The Force Index, a next-generation technical indicator, shows the renewed increase in bearish momentum with a series of lower highs. It was able to bounce off of its descending resistance, as marked by the green rectangle, with the ascending support level serving as resistance below the horizontal resistance level. Bears wait for this technical indicator to retreat below the 0 center-line, due to mounting downside pressure, to regain full control of price action, in the USD/INR.

Per Prime Minister Modi’s aspirations, economic output will be increased by $5 trillion, nearly doubling its current level. The technology sector was highlighted as essential to India’s future, while the micro, small and medium enterprises create the backbone of its infrastructure. Before the Covid-19 pandemic, the services sector represented the fastest growing sector globally. The agricultural sector, which accounts for 17% of GDP and employs scores of unskilled labor, cannot be ignored in the push to modernize. How the government will incorporate it into its economic adjustment is paramount to a successful outcome. Breakdown pressures in the USD/INR are building inside of its short-term resistance zone located between 75.104 and 75.457, as marked by the red rectangle, and enforced by its descending 50.0 Fibonacci Retracement Fan Resistance Level.

One essential level to monitor is the 38.2 Fibonacci Retracement Fan Resistance Level, which crossed below the bottom range of its short-term resistance zone. A collapse in the USD/INR below it will accelerate the pending resumption of the long-term downtrend in this currency pair. The added volume will push price action into its support zone located between 73.962 and 74.286, as identified by the grey rectangle. Weaker than forecast US economic data, coupled with annualized interest payments in government debt exceeding $1 trillion, create conditions for an extension into its next support zone located between 72.348 and 72.702.

USD/INR Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 75.250

Take Profit @ 72.350

Stop Loss @ 75.800

Downside Potential: 29,000 pips

Upside Risk: 5,500 pips

Risk/Reward Ratio: 5.27

An extension of the drift higher, initiated by its descending resistance level serving as support, may entice the USD/INR into a breakout attempt. India’s willingness to reform its economy, coupled with the US complacency to adjust its debt-financed stimulus and bailouts, reduces the upside potential. Forex traders should consider any price spike, limited to the resistance zone between 76.433 and 76.769, as an excellent selling opportunity.

USD/INR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 76.000

Take Profit @ 76.550

Stop Loss @ 75.800

Upside Potential: 5,500 pips

Downside Risk: 2,000 pips

Risk/Reward Ratio: 2.75