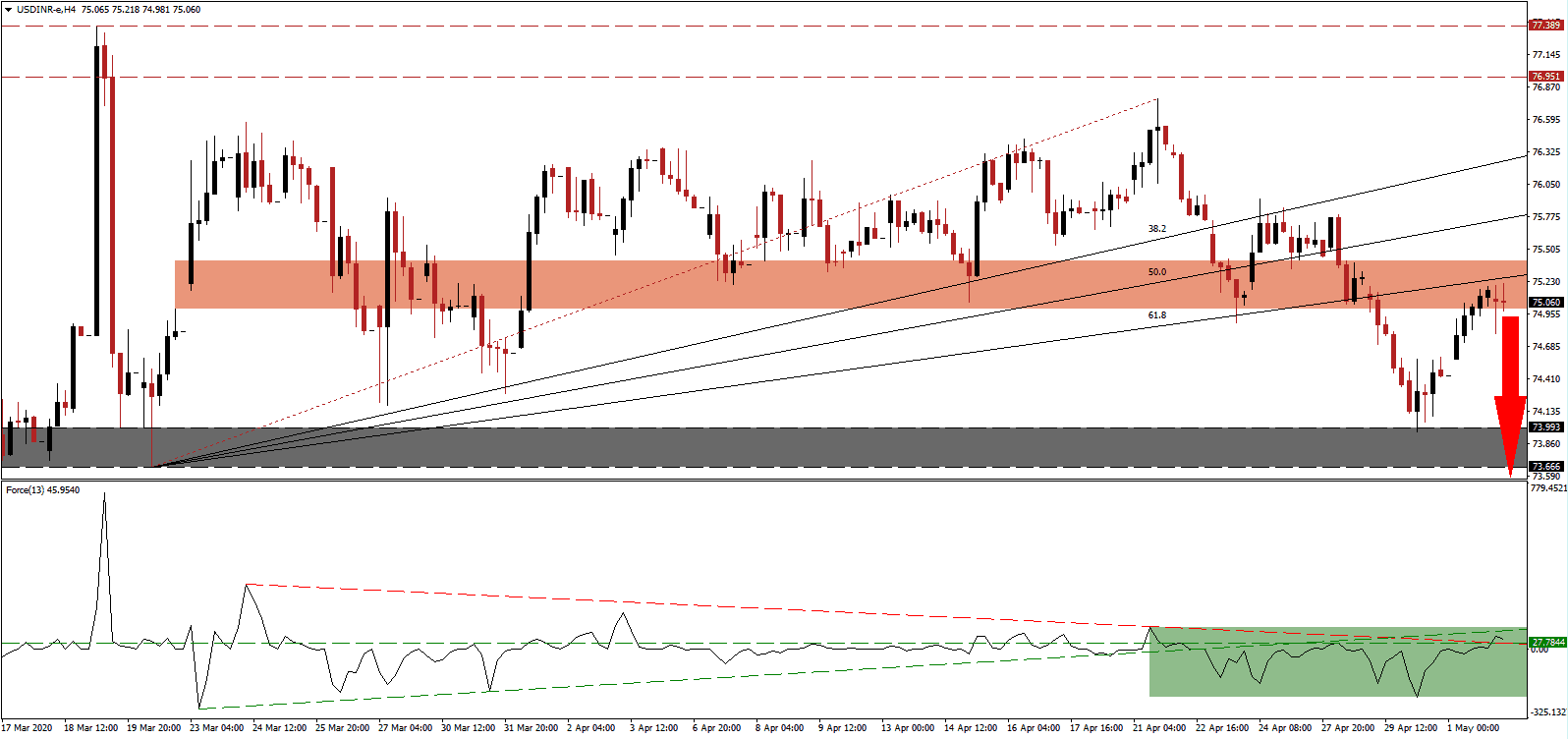

According to a snap poll conducted of 300 Indian CEOs, it will take the economy at least one year to return to normal after all lockdown measures are lifted. A growing number of countries realize that the initially communicated V-shape recovery is unrealistic. It allows them to identify areas of improvement and sectors where permanent change is unavoidable. The US is increasingly isolated from its approach that without implementing necessary change, the economy will bounce back more massively than before. After the USD/INR embarked on a healthy counter-trend reversal off of its support zone, ensuring the longevity of the long-term bearish chart pattern that remains intact, a renewed sell-off is expected.

The Force Index, a next-generation technical indicator, converted its horizontal resistance level into support and eclipsed its descending resistance level, resulting from the price action reversal. It remains below its ascending support level, as marked by the green rectangle. Given the rise in bearish pressures amid fundamental developments, this technical indicator is anticipated to complete a double breakdown and collapse into negative territory, allowing bears to take control of the USD/INR.

This currency pair recovered into its short-term resistance zone located between 75.003 and 75.404, as identified by the red rectangle. The ascending 61.8 Fibonacci Retracement Fan Resistance Level is crossing through this zone, increasing bearish conditions for the USD/INR. Despite the Indian manufacturing PMI for April collapsing more severely than forecast, the Indian Rupee remains resilient against the US Dollar, where Forex traders assess the latest tariff threats by President Trump against China.

Forex traders are recommended to monitor the intra-day low of 74.934, the base of the most recent rejection in this currency pair. A breakdown is likely to lead the USD/INR into an accelerated sell-off into its support zone located between 73.666 and 73.993, as marked by the grey rectangle. More downside should be considered, on the back of extended US weakness coupled with the failure to address necessary economic adjustments. Therefore, price action is well-positioned to correct into its support zone between 72.348 and 72.702.

USD/INR Technical Trading Set-Up - Renewed Breakdown Scenario

Short Entry @ 75.050

Take Profit @ 72.350

Stop Loss @ 75.750

Downside Potential: 27,000 pips

Upside Risk: 7,000 pips

Risk/Reward Ratio: 3.86

In the event the Force Index reclaims its ascending support level, the USD/INR can push farther to the upside. The next resistance zone is provided by its 38.2 Fibonacci Retracement Fan Resistance Level, but volatility is favored to increase. It will allow Forex traders to add to their short positions, as the outlook for this currency pair is increasingly bearish, with US economic disappointment dominant.

USD/INR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 75.950

Take Profit @ 76.350

Stop Loss @ 75.750

Upside Potential: 4,000 pips

Downside Risk: 2,000 pips

Risk/Reward Ratio: 2.00