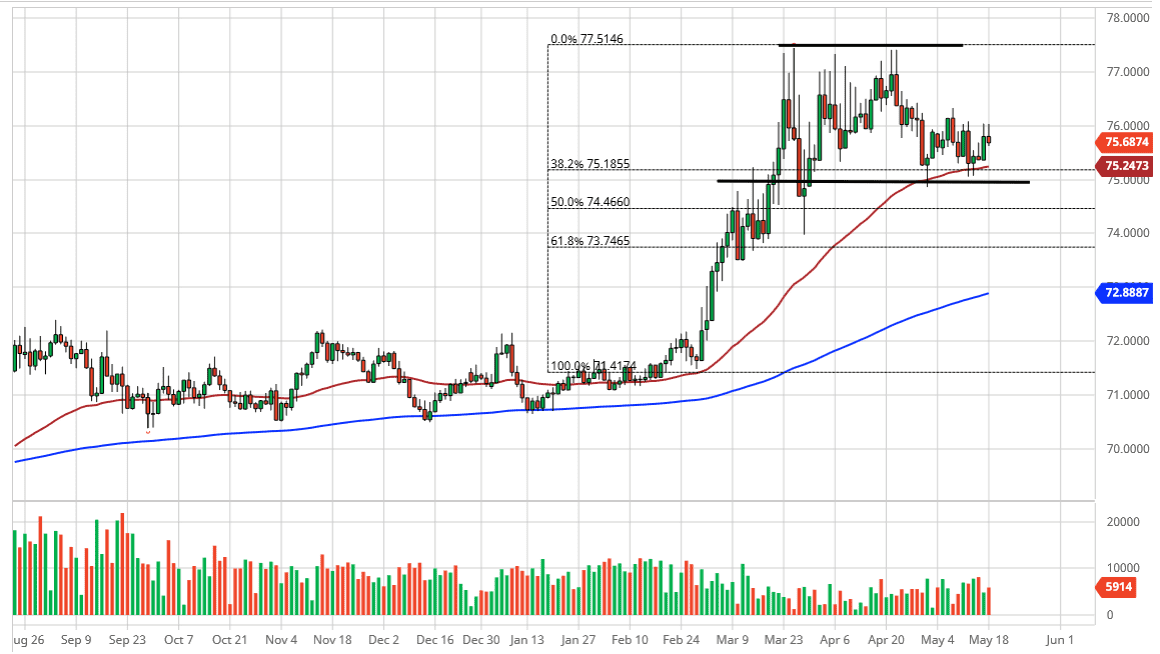

The US dollar has initially tried to rally during the trading session on Monday, reaching towards the ₹76 level before giving back the gains. This is a negative sign in the short term, and it shows that the market has most certainly found a range from which to bounce around. The ₹76 level has been the resistance level recently, just as the ₹75 level underneath has been massive support. In other words, the market looks likely to continue to go back and forth, perhaps offering short-term trading opportunities but in the end, it looks like we are trying to build up a certain amount of momentum.

With worth noticing is that we were down just 0.16% towards the end of the New York session, when the US dollar was beaten up against several of the majors. Ultimately, that suggests that the Indian rupee is still relatively week, at least in measuring it against other majors. Ultimately, the market is likely to continue to show a lot of back-and-forth in this 100 point range, but if we were to break above the ₹76 level, then the market is likely to continue to go higher, perhaps reaching towards the ₹77 level, maybe even the ₹77.50 level which has been crucial more than once.

To the downside, the 50 day EMA sits just above the ₹75 level, and as a result it is likely that we will continue to see a lot of support between here and there. With this, I am looking at this as a potential buying opportunity on a dip as well but if we were to break down below the 75 of rupee level, then it is likely that the market should go down to the ₹74 level, possibly even further.

This is a market that has been very choppy as of late, and as a result it is likely that you should continue to see the US dollar do relatively well against emerging market currencies, even on days when it is down. This lack of a major loss here where we had seen massive moves in other currencies tells you that the US dollar is still in high demand against certain Third World countries. If we were to break above the ₹77.50 level, then the market is likely to go looking towards the ₹80 level, but that is a longer-term trade. Until then, I favor the upside, but I recognize that it will be very noisy.