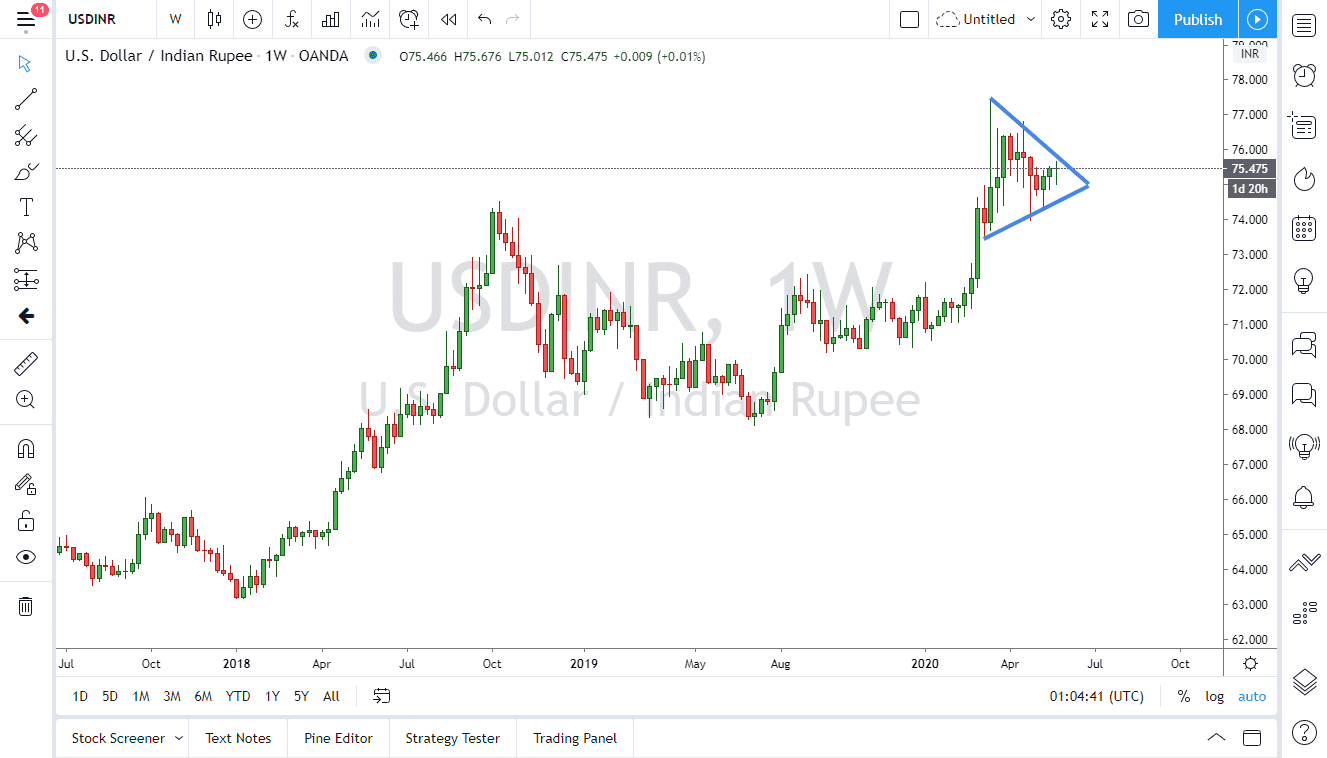

The US dollar has been grinding back and forth against the Indian rupee for the last couple of months, forming a bit of a massive symmetric triangle. Ultimately, this is a market that has been in an uptrend previously, which makes quite a bit of sense considering that the emerging markets continue to get bashed in a major “risk off” type of environment. In fact, this is quite an interesting currency pair to watch right now because while the US dollar has stopped gaining drastically, it has not exactly broken down either. This is interesting considering that stocks have rallied and what would be thought of “risk on”, does not seem to be translating into the currency markets, at least not in emerging market currencies. Obviously, the Indian rupee falls within that purview.

When you look at the chart, you can see easily that the ₹75 level has been an area of interest, and on short-term charts it does suggest that there is significant support between ₹74 and ₹75. Ultimately, if we can break above the downtrend line of the triangle, it is likely that we will clear the ₹76 level, on the way to ₹77 and then eventually the ₹77.50.

Furthermore, you could even make an argument for a bullish pennant, and a breakout above that light could open up the door for a 6 handle move, having the market look reach towards the ₹82 level given enough time. This does make sense, because quite frankly we are simply waiting for some type of negative news to have money flowing right back into the greenback. Beyond that, the Indian economy is highly levered to debt, which is all denominated in US dollars. That means that there will be a natural proclivity of the market to flow higher at this point as demand for the greenback is somewhat self-evident and built in. In fact, it is not until the global economy gets better than emerging market currencies can be bought with any type of conviction, so at this point it is very likely that we will see a break higher during the month of June, and when we do it could begin the next leg up, although I would not anticipate a move all the way to the ₹82 level during the month, rather I would expect it beginning of that leg higher.

The other possibility is that we break down below the uptrend line. I would be convinced of a significant pullback if we break down below the ₹74 level, perhaps opening up the door to the ₹72 level underneath, but at this point that seems less likely than breaking to the upside.