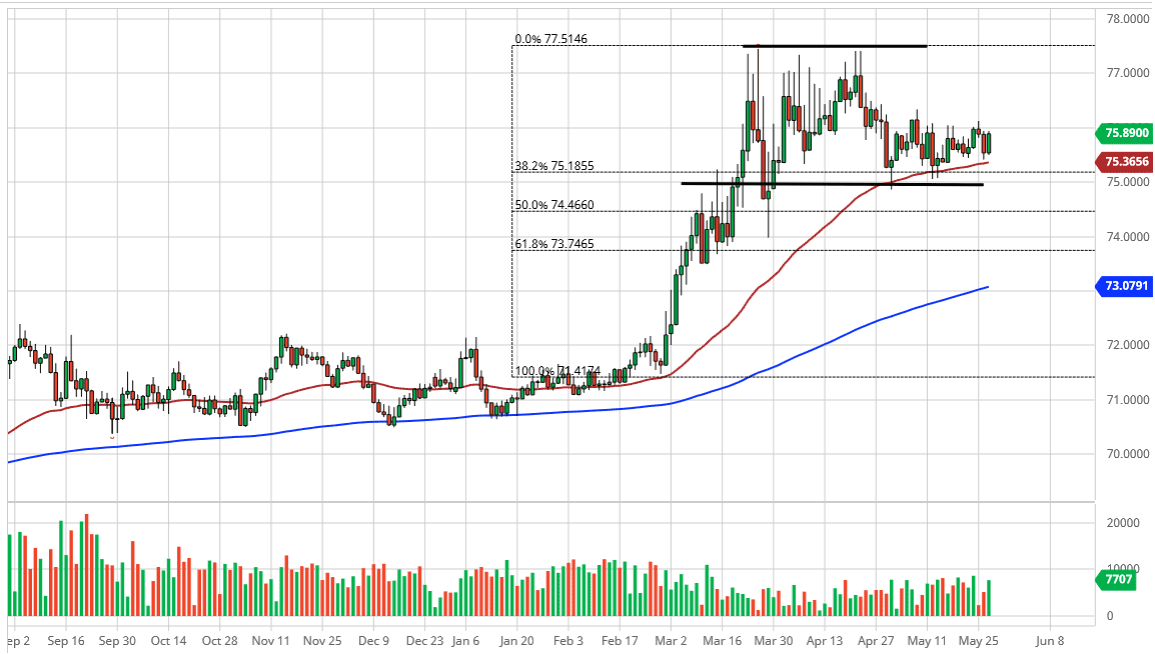

The US dollar rallied a bit during the trading session again on Wednesday as the “risk off trade” came back into play. At this point, it is obvious that the market is simply bouncing around the tween the ₹75 level and the ₹76 level. Furthermore, the 50 day EMA is offering a certain amount of support as well. I would also suggest zooming out and taking a look at the ₹75 level on the bottom for massive support in the ₹77.50 level offering significant resistance. Note that the 50 day EMA has started to slope higher, and still offers support.

Looking at the chart, the ₹76 level has offered significant resistance, but I do think that it gets broken eventually. It looks as if there is a bit of a “squeeze” coming into the market, and it would be a continuation of what we have seen. Ultimately, the market is likely to see a lot of noise in general, and I think what we are looking at an opportunity to perhaps pick up little bits and pieces of value on dips. To the downside, the ₹75 level will offer a significant amount of support, as it is not only a large, round, psychologically significant figure, but it is also the 38.2% Fibonacci retracement level.

All of this being said, the market is likely to continue to see a push higher but that does not mean that it will happen easily. Because of this, you are probably going to continue to see a lot of noisy behavior, but I certainly favor the upside in general. If we were to break down below the ₹75 level, then I would look again near the ₹74 level as it is near the 61.8% Fibonacci retracement level. Furthermore, by the time we get down there it is highly likely that we could see the 200 day EMA come into play, which of course will attract a lot of attention. Ultimately, that is a trend defining technical indicator that a lot of people pay attention to as well. Ultimately, this is a market that I think looks likely to see a lot of volatility, but keep in mind that the Indian rupee is a major emerging market currencies, and we are seeing EM get its head handed to it. If that continues to be the case, then the Indian rupee will be any different as Third World economies continue to oh massive amounts of debt denominated in US dollars.