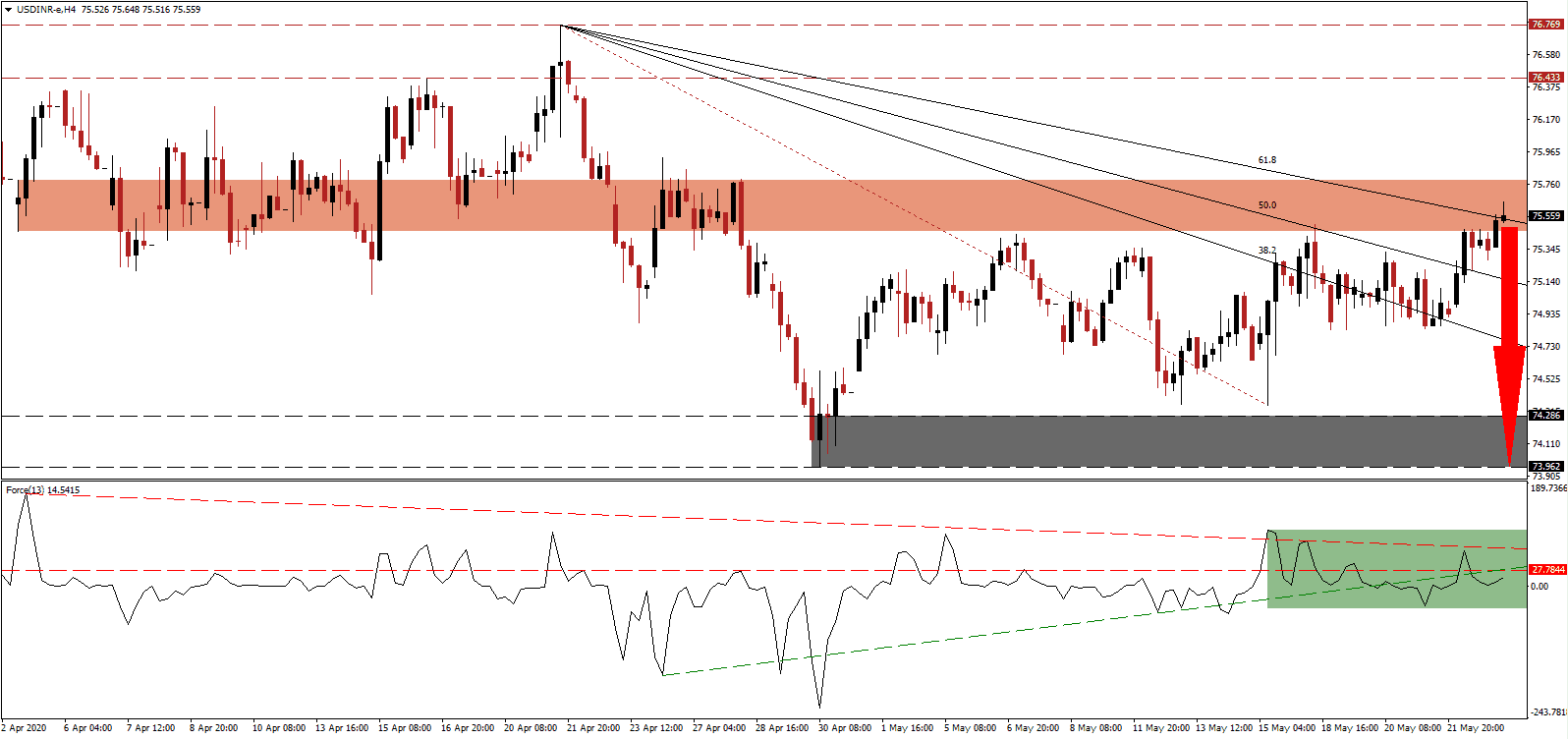

At a time the global economy is in the early phases of a recession, the US is rumored to announce sanctions against China in response to new security laws proposed for Hong Kong, one of its semi-autonomous regions. It has the potential to derail the hastily implemented phase-one trade truce, which sees tariffs remain in place. China warned the US against interfering in its domestic affairs, but tension flared up after US President Trump blamed China for the global Covid-19 pandemic. The USD/INR is nearing the end of its healthy counter-trend advance, as evidenced by the lack of bullish momentum after price action pushed into its short-term resistance zone.

The Force Index, a next-generation technical indicator, shows a drift higher but remains below its horizontal resistance level and its ascending support level, as marked by the green rectangle. Adding to bearish pressures is the descending resistance level, which is favored to result in a collapse in this technical indicator below the 0 center-line. Bears will then regain complete control of the USD/INR.

Adding to long-term bearish progress in the US Dollar is the potential of more stimulus. A fresh $3 trillion bill was narrowly passed by the House of Representatives, and the White House is open to more direct payments to consumers, ahead of the November elections. Annualized US interest payments on national debt have exceeded $1 trillion and continue to accumulate. After eclipsing its descending 61.8 Fibonacci Retracement Fan Resistance Level inside of its short-term resistance zone located between 75.457 and 75.781, as marked by the red rectangle, the USD/INR is well-positioned for a new breakdown sequence.

India is on course to enter a recession and has been economically impacted more severely than many other countries. Doubts over the government’s ₹20 trillion spending package have contributed to temporary selling pressure in the Indian Rupee. A lack of cash stimuli has increased short-term worries. While the total of economic assistance is approximately 10% of GDP, cash injections are estimated near 1%. Fiscal responsibility is adding a long-term bullish catalyst to the Indian currency. The USD/INR is anticipated to reverse into its support zone located between 73.962 and 74.286, as identified by the grey rectangle, guided lower by the Fibonacci Retracement Fan sequence. More downside is likely, but a new catalyst is required.

USD/INR Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 75.550

Take Profit @ 73.950

Stop Loss @ 76.000

Downside Potential: 16,000 pips

Upside Risk: 4,500 pips

Risk/Reward Ratio: 3.56

A breakout in the Force Index above its ascending support level may lead to a short-term extension of the current counter-trend rally in the USD/INR. Given the preferred domestic and foreign policy approach of the US, any spike higher from present levels will offer Forex traders a secondary short-selling opportunity to consider. The next resistance zone awaits this currency pair between 76.433 and 76.769.

USD/INR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 76.150

Take Profit @ 76.500

Stop Loss @ 76.000

Upside Potential: 3,500 pips

Downside Risk: 1,500 pips

Risk/Reward Ratio: 2.33