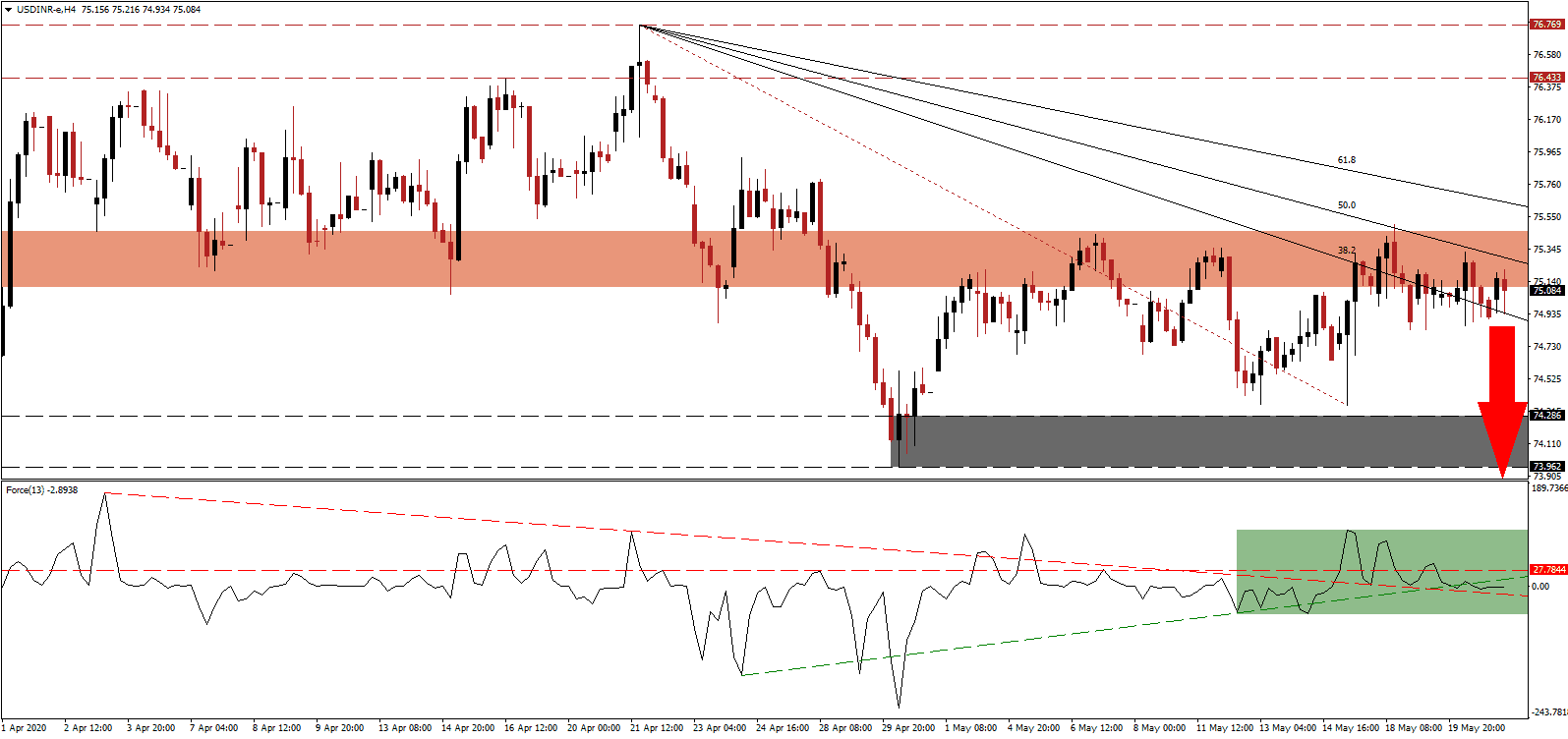

Despite new forecasts for a more severe recession in the Indian economy than previously anticipated, coupled with increasing doubt over the ₹20 trillion spending package announced by Prime Minister Modi, the Indian Rupee maintains its bullishness against the US Dollar. The quarter ending June could see a 45% plunge in GDP, followed by a 20% surge in the September quarter for a potential total fiscal year 2021, which ends in March, contraction of nearly 11%. Estimates for job losses and Indian’s pushed into poverty stand at 135 million and 120 million, respectively. The nationwide lockdown was extended to May 31st with confirmed Covid-19 cases exceeding 100,000. Breakdown pressures in the USD/INR have increased inside of the short-term resistance zone.

The Force Index, a next-generation technical indicator, confirms the accumulation in bearish momentum after three lower highs were formed. With the ascending support level and the descending resistance level switching roles, as marked by the green rectangle, a renewed push to the downside is pending. The Force Index remains below its horizontal resistance level, and bears await this technical indicator crossover below the 0 center-line to resume complete control of the USD/INR.

Doubts over the Indian government’s ₹20 trillion spending package are rising, as evident in the country’s equity markets. Analysts point out that the absence of a significant cash stimulus renders the assistance less powerful, expressly in the short-term. While the total represents approximately 10% of GDP, the cash component is estimated at roughly 1%. Maintaining a degree of fiscal responsibility provides a long-term bullish catalyst for the USD/INR, and explains the resilience in the Indian Rupee. Price action is, therefore, favored to push below its short-term resistance zone, located between 75.104 and 75.457, as identified by the red rectangle.

With the US government considering to increase its debt once again, in response to a significantly weaker economy than the US Federal Reserve and the White House hoped for, downside pressure on the US Dollar is expected to increase. Democrats in the House of Representatives narrowly passed a second $3 trillion stimulus bill, which is pending rejection in the Senate. The USD/INR is well-positioned to collapse below its descending 38.2 Fibonacci Retracement Fan Support Level and into its support zone located between 73.962 and 74.286, as marked by the grey rectangle. A breakdown extension into its next support zone between 72.348 and 72.702 is probably, driven by increasing weakness out of the US.

USD/INR Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 75.100

Take Profit @ 72.350

Stop Loss @ 75.800

Downside Potential: 27,500 pips

Upside Risk: 7,000 pips

Risk/Reward Ratio: 3.93

In the event the Force Index reclaims its ascending support level, the USD/INR is likely to attempt a push higher. With US interest payments to service its unsustainable debt burden exceeding $1 trillion annually, coupled with attempts of fiscal responsibility by India, any price spike from current levels will provide Force Traders with an outstanding short-selling opportunity. The upside potential is confined to its resistance zone located between 76.433 and 76.769.

USD/INR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 76.000

Take Profit @ 76.550

Stop Loss @ 75.800

Upside Potential: 5,500 pips

Downside Risk: 2,000 pips

Risk/Reward Ratio: 2.75