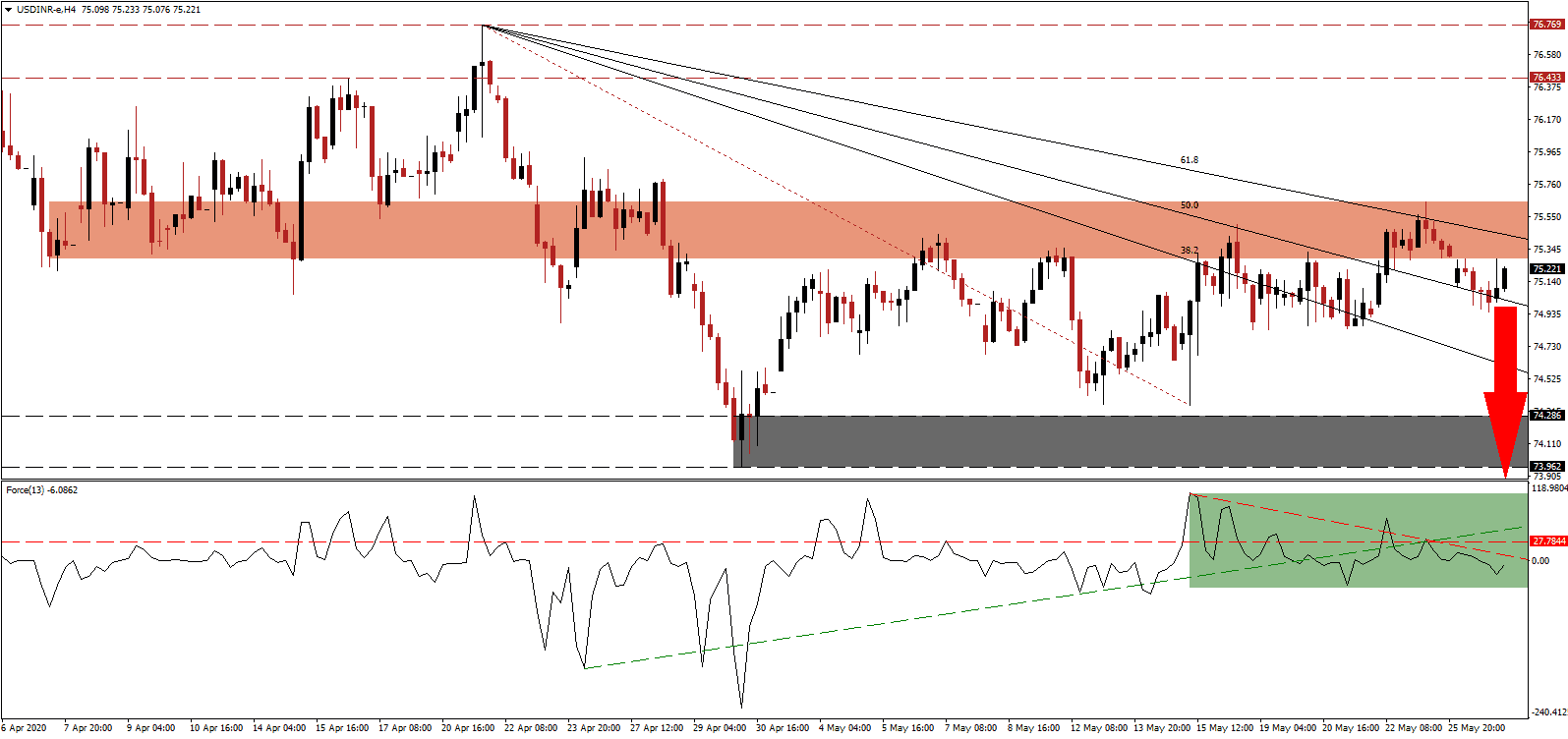

India faces a recession, like most other economies, due to nationwide lockdowns in response to the global Covid-19 pandemic. How the country plans to emerge and reposition will have a distinct impact moving forward. Prime Minister Modi’s ₹20 trillion spending package, short on fresh capital injections, has come under scrutiny. Critics point out the lack of short-term stimuli, but fiscal responsibility has the potential to strengthen the Indian Rupee moving forward. The USD/INR completed a breakdown below its downward adjusted short-term resistance zone, supported by an increase in bearish momentum.

The Force Index, a next-generation technical indicator, confirms the accumulation in bearish pressures after collapsing below its ascending support level, as marked by the green rectangle. It led to a conversion of its horizontal support level into resistance, and the descending resistance level is increasing downside momentum. Following the contraction in this technical indicator below the 0 center-line, bears regained complete control of the USD/INR, with an accelerated sell-off pending.

Agriculture is a rare bright spot for the Indian economy, but the worst locust outbreak in 26 years is now pressuring the sector. While food security is not at risk yet, it adds to a complex government response to the Covid-19 pandemic. Despite mounting problems, the USD/INR maintains a bearish bias due to a confrontational US foreign policy with major trading partners, primarily China. The breakdown below its short-term resistance zone located between 75.284 and 75.648, as identified by the red rectangle, is favored to lead to an extended correction in this currency pair.

Adding to bearish progress is the US debt load, poised to expand further, where annual interest payments now exceed $1 trillion. The descending 61.8 Fibonacci Retracement Fan Resistance Level is expected to enforce a breakdown extension in the USD/INR. Price action is cleared to challenge its support zone located between 73.962 and 74.286, as marked by the grey rectangle. More downside is probable with the next support zone located between 72.348 and 72.702. The Fibonacci Retracement Fan sequence is likely to guide price action into an extended correction.

USD/INR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 75.250

Take Profit @ 72.350

Stop Loss @ 76.000

Downside Potential: 29,000 pips

Upside Risk: 7,500 pips

Risk/Reward Ratio: 3.87

In the event the Force Index spikes above its ascending support level, serving as resistance, the USD/INR may attempt a new breakout sequence. Given intensifying negative news flow out of the US, in conjunction with prospects of lasting job losses, any advance will present a secondary selling opportunity for Forex traders to consider. Price action will challenge its next resistance zone between 76.433 and 76.769.

USD/INR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 76.150

Take Profit @ 76.500

Stop Loss @ 76.000

Upside Potential: 3,500 pips

Downside Risk: 1,500 pips

Risk/Reward Ratio: 2.33