Indian Prime Minister Modi announced a $266 billion stimulus package, approximately 10% of GDP, to revive the stalled economy. It includes food and cash provisions for women and the elderly. It will focus on the cottage industry, MSMEs, laborers, middle class, and manufacturing. Details have not been released yet, a task the finance ministry will unveil over the coming days. It comes on top of the stimulus provided in March, which accounted for roughly 0.8% of GDP. A reluctance to sacrifice fiscal stability resulted in a delayed massive stimulus. Following the announcement, the Indian Rupee came under mild selling pressure, elevating the USD/INR in a temporary counter-trend move, from where a new breakdown sequence is favored.

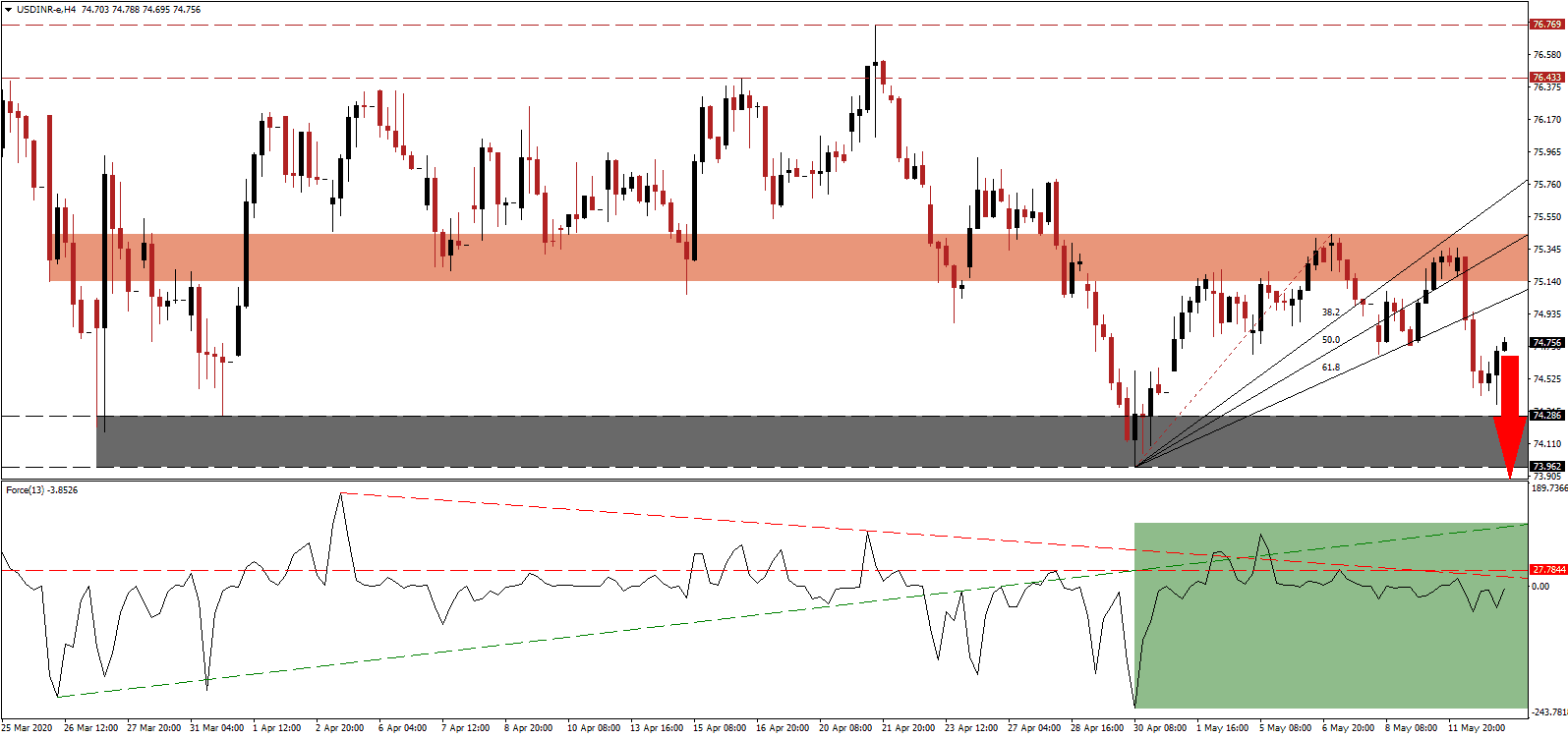

The Force Index, a next-generation technical indicator, remains below its horizontal resistance level and its descending resistance level, confirming the dominance of bearish pressures. With the ascending support level moving farther away, as marked by the green rectangle, a more massive collapse in the Force Index is expected. Bears are in firm control of the USD/INR, and this technical indicator is poised to slide deeper into negative territory.

Countering adverse stipulations of the Indian stimulus is the new $3 trillion aid package drafted by US Democrats. It follows the initial $3 trillion debt-funded relief and continues the preference to raise debt in combination with hopes of a positive economic impact. The unsustainable approach threatens a future collapse of the financial system, adding a distinct bearish catalyst to the USD/INR. After the breakdown in this currency pair below its short-term resistance zone located between 75.138 and 75.443, as identified by the red rectangle, downside momentum is elevated.

According to Prime Minister Modi’s vision for a self-reliant India, reconstruction of the post-Covid-19 economy will consist of four core pillars. They consist of infrastructure, technology, demography, and demand. While short-term challenges remain, the broader economic outlook is significantly more bullish as compared to the US, where complacency and a lack of willingness to adjust presents a tremendous obstacle. The collapse in the USD/INR below its entire redrawn Fibonacci Retracement Fan sequence expanded breakdown pressures. Price action is positioned to push through its support zone located between 73.962 and 74.286, as marked by the grey rectangle. Forex traders should prepare for an extension of the correction into the next support zone between 72.348 and 72.702.

USD/INR Technical Trading Set-Up - Breakdown Extension Scenario

- Short Entry @ 74.750

- Take Profit @ 72.350

- Stop Loss @ 75.550

- Downside Potential: 24,000 pips

- Upside Risk: 8,000 pips

- Risk/Reward Ratio: 3.00

In the event the Force Index spikes above its ascending support level, serving as current resistance, the USD/INR may be pressured into a temporary advance. A breakout above the ascending 38.2 Fibonacci Retracement Fan can lead this currency pair into its resistance zone located between 76.433 and 76.769. Forex traders are advised to consider this an excellent selling opportunity amid ongoing missteps by the US in regards to the Covid-19 pandemic.

USD/INR Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 75.950

- Take Profit @ 76.550

- Stop Loss @ 75.650

- Upside Potential: 6,000 pips

- Downside Risk: 3,000 pips

- Risk/Reward Ratio: 2.00