Switzerland reported an increase in its unemployment rate to 3.3% for April, which rose to 3.4% at the beginning of May. The State Secretariat for Economic Affairs (SECO) announced the need for an extra CHF14 billion for 2020 in the unemployment fund. According to SECO, comparisons to past crises are challenging, but images of the 1930s Great Depression are emerging. The wealthy Alpine nation avoided mass lay-offs with its short-term work program, where demand surged from 11,000 to 1.9 million, but SECO adds it cannot remain in place for an extended period due to tremendous costs. Bearish momentum in the USD/CHF is building up after price action recorded a lower high below its resistance zone, on the back of more pressing economic issues out of the US.

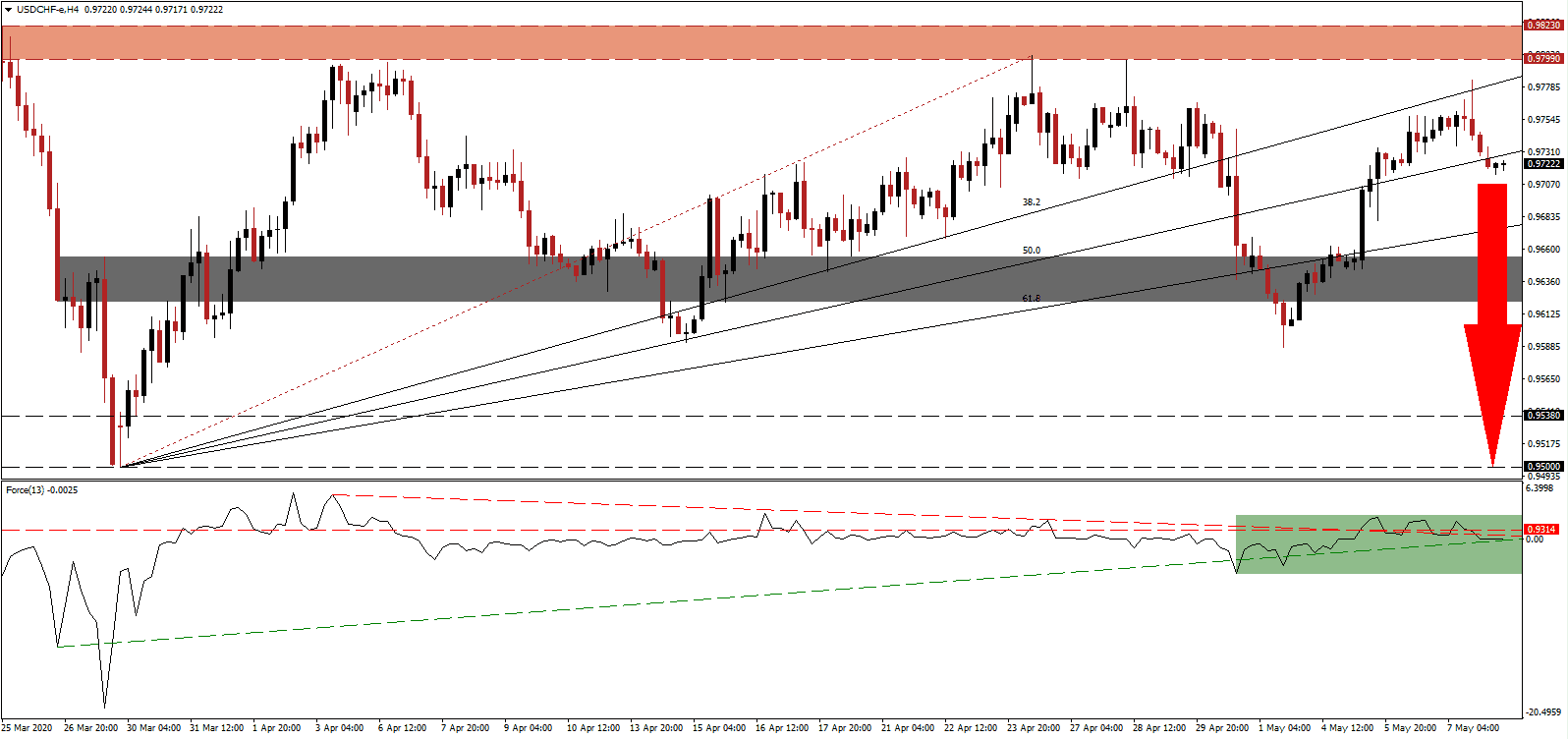

The Force Index, a next-generation technical indicator, corrected below its descending resistance level and converted its horizontal resistance level into support. It is now challenging its ascending support level in negative territory, as marked by the green rectangle. Bears are regaining control of the USD/CHF, and this technical indicator is expected to contract deeper below the 0 center-line, adding to breakdown pressures.

Today’s US NFP report will show the most massive job losses in its history. Expectations call for 22 million eradicated positions and a surge in the unemployment rate to 16.0%. It will follow the 701,000 lost jobs reported in March, with the risk of a more substantial figure elevated, while an upward revision cannot be ruled out. A disappointment today is likely to add to breakdown pressure in the USD/CHF, pushing it farther away from its resistance zone located between 0.9799 and 0.9823, as identified by the red rectangle.

Adding to bearish developments in this currency pair was the switch in the ascending 50.0 Fibonacci Retracement Fan Support Level into resistance, following the breakdown in the USD/CHF. Price action is well-positioned to collapse into its short-term support zone located between 0.9621 and 0.9654, as marked by the grey rectangle. Considering the series of economic disappointment printed by the US, a breakdown extension into its long-term support zone between 0.9500 and 0.9538 remains a distinct possibility.

USD/CHF Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 0.9720

Take Profit @ 0.9500

Stop Loss @ 0.9790

Downside Potential: 220 pips

Upside Risk: 70 pips

Risk/Reward Ratio: 3.14

In the event the Force Index completes a breakout above its descending resistance level, the USD/CHF could drift temporarily higher. Forex traders are recommended to consider any advance from current levels as an outstanding selling opportunity. Fundamental developments point towards more downside potential in this currency pair. Following a breakout, price action will challenge its next resistance zone between 1.0000 and 1.0023.

USD/CHF Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 0.9860

Take Profit @ 1.0000

Stop Loss @ 0.9790

Upside Potential: 140 pips

Downside Risk: 70 pips

Risk/Reward Ratio: 2.00