Expectations for a V-shaped recovery by this summer, which were severely disconnected from fundamentals, are quickly evaporating. Countries that understand a return to life before the virus is impossible are in a superior position to make necessary adjustments for the new economy. Businesses are favored to remain ahead of the curve, as politicians hold on to hopes for a swift recovery and a more robust overall economy. Canada and the US have failed to fully comprehend the severity of the slow transformation, throwing debt at the problem, hoping the Covid-19 pandemic will fade. The former is more willing to embrace change, adding a minor bearish catalyst to the USD/CAD, facing downside pressure after the breakdown below its short-term resistance zone.

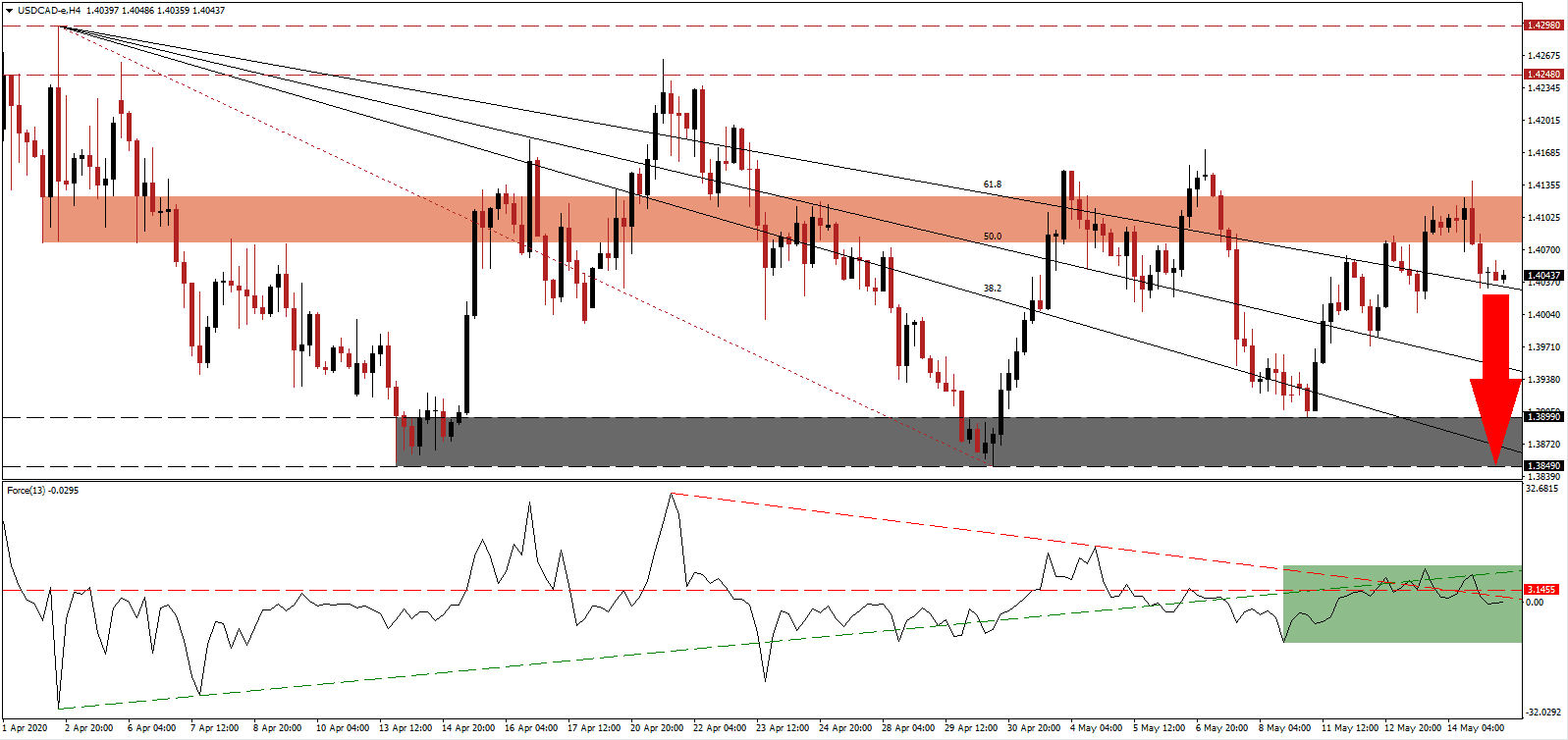

The Force Index, a next-generation technical indicator, was rejected by its ascending support level and reverted below its horizontal resistance level, as marked by the green rectangle. Increasing bearish momentum was the breakdown in the Force Index below its descending resistance level. Bears regained full control of the USD/CAD after this technical indicator moved into negative territory, adding the downside pressures in price action.

According to a survey commissioned by the Canadian Federation of Independent Business (CFIB), 40% of members believe they will permanently shut down if Covid-19 related social distancing restrictions remain in place until the end of May. The dire outlook is only trumped by the US, where a mix of complacency, a rush to reopen the economy without a proper test, trace, and isolate (TTI) infrastructure, and a preference for debt, is dominant. It positions the USD/CAD to enter a new breakdown sequence after moving below its short-term resistance zone located between 1.4077 and 1.4124, as identified by the red rectangle.

Speculation for more debt-funded stimulus out of the US, following the Democrats $3 trillion proposed aid package, add to bearish developments in the US Dollar, while reducing the recovery potential of the economy. Price action is favored to correct below its descending 61.8 Fibonacci Retracement Fan Support Level, converting it into resistance. It is likely to encourage the next wave of net sell orders, generating the required volume for the USD/CAD to extend down into its support zone located between 1.3849 and 1.3899, as marked by the grey rectangle.

USD/CAD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 1.4045

Take Profit @ 1.3850

Stop Loss @ 1.4110

Downside Potential: 195 pips

Upside Risk: 65 pips

Risk/Reward Ratio: 3.00

Should the Force Index spike above its ascending support level, presently providing resistance, the USD/CAD is expected to attempt a breakout. Due to ongoing bearish fundamental progress in the US, in conjunction with more debt to an already unsustainable level, the upside potential is confined to its long-term resistance zone between 1.4248 and 1.4298. Forex traders are recommended to view this as an outstanding selling opportunity.

USD/CAD Technical Trading Set-Up - Confined Breakout Scenario

Long Entry @ 1.4185

Take Profit @ 1.4285

Stop Loss @ 1.4135

Upside Potential: 100 pips

Downside Risk: 50 pips

Risk/Reward Ratio: 2.00