Canadian companies are creating new jobs to comply with government-mandated Covid-19 protocols to allow a gradual resumption of economic activity. This short-term development is mirrored across economies and includes temperature checks, sanitation, and crowd control. A growing number of companies are considering if this will resemble the new normal unless an effective treatment is found. Economists are divided if the new job positions will provide a boost to output. The USD/CAD, driven to the downside by excessive US Dollar weakness, is poised to take a temporary pause after reaching its support zone.

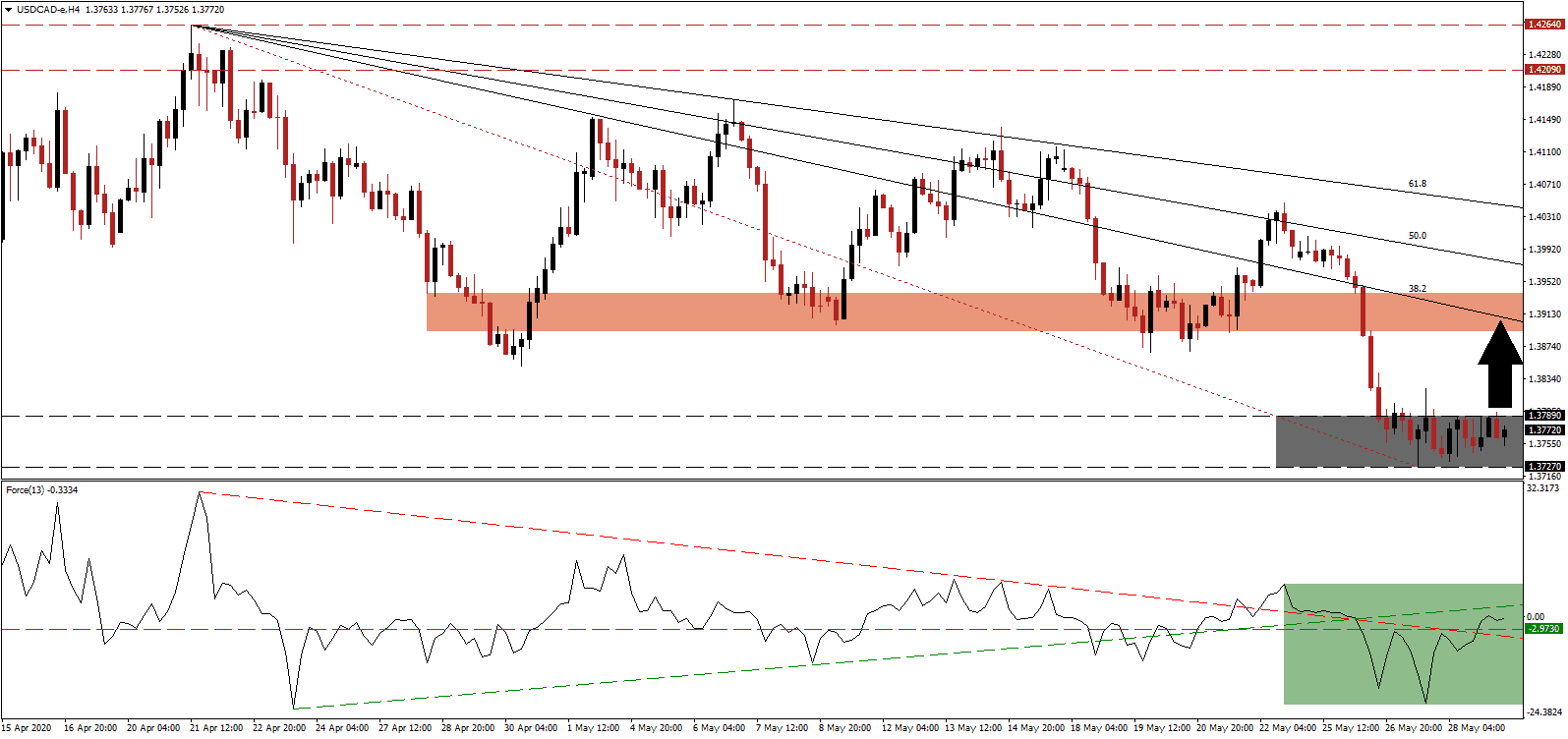

The Force Index, a next-generation technical indicator, recovered from its most recent low and push through its descending resistance level. Bullish progress continued with the conversion of its horizontal resistance level into support, as marked by the green rectangle. A brief breakout in the Force Index above its ascending support level is possible, with bulls in a holding pattern for this technical indicator to move into positive territory, handing control of the USD/CAD to them.

Today’s Canadian GDP data is expected to confirm a dismal March, where over one million jobs were eliminated. April’s job losses totaled nearly two million, while several million employees are faced with a significant reduction in hours worked. The collapse of the housing market takes away the primary wealth effect driving consumer spending, raising questions about demand moving forward, aside from essentials. A brief short-covering rally in the USD/CAD is pending, marking a healthy development in a broader corrective phase. The support zone located between 1.3727 and 1.3789, as identified by the grey rectangle, is favored to provide the platform for a breakout and confined counter-trend advance.

US data has been consistently weaker and calls for a second direct payment to consumers, as proposed in the Democrat's new $3 trillion stimuli, are on the rise. It confirms the economic condition is more severe than consensus realizes. The pending addition to the unsustainable debt load limits the upside potential in the USD/CAD to its downward adjusted short-term resistance zone located between 1.3892 and 1.3938, as marked by the red rectangle. It is enforced by the descending 38.2 Fibonacci Retracement Fan Resistance Level. An advance into this level will keep the long-term bearish trend intact.

USD/CAD Technical Trading Set-Up - Brief Short-Covering Scenario

- Long Entry @ 1.3765

- Take Profit @ 1.3905

- Stop Loss @ 1.3720

- Upside Potential: 140 pips

- Downside Risk: 45 pips

- Risk/Reward Ratio: 3.11

In case the Force Index collapses below its descending resistance level, serving as temporary support, the USD/CAD may resume its corrective phase without a counter-trend advance. It will position this currency pair for one in the future. Due to a toxic combination of US monetary and foreign policy, the outlook for price action is increasingly bearish. The next support zone is located between 1.3378 and 1.3464, which includes a price gap to the upside.

USD/CAD Technical Trading Set-Up - Breakdown Extension Scenario

- Short Entry @ 1.3660

- Take Profit @ 1.3380

- Stop Loss @ 1.3750

- Downside Potential: 280 pips

- Upside Risk: 90 pips

- Risk/Reward Ratio: 3.11