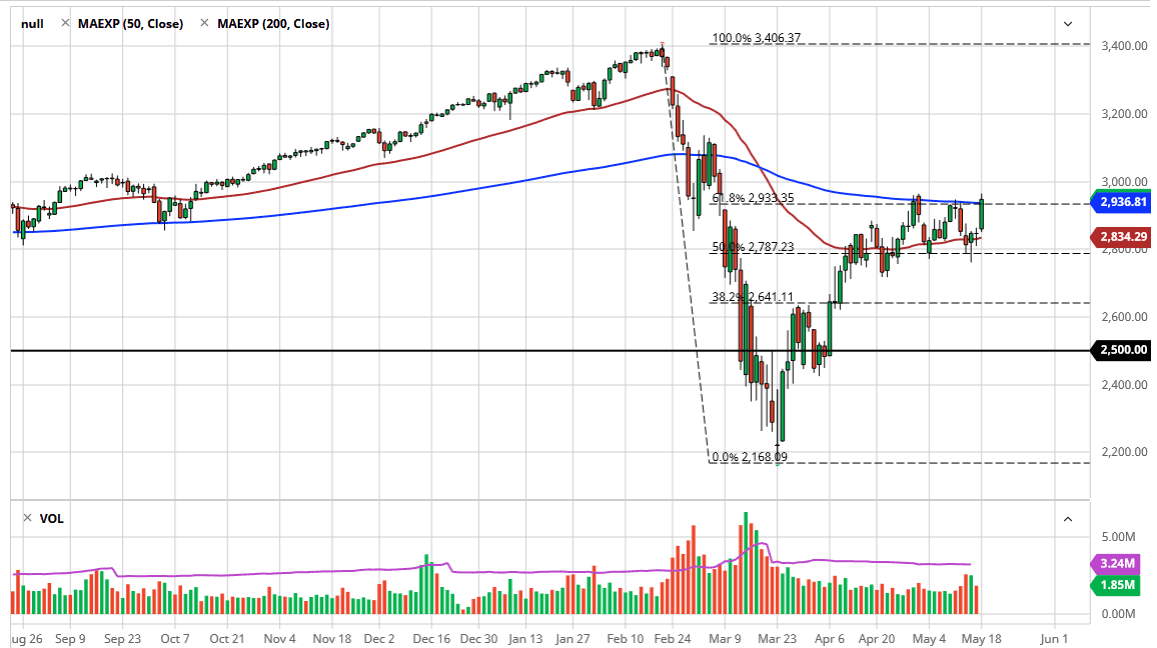

The S&P 500 has rallied with force during the trading session on Monday, as we continue to see a lot of noise out there. Ultimately, the market closed near the 200 day EMA, an area that has caused some issues over the last several weeks. The question now is whether or not we can continue to rally and breakout above here? So far, obviously we have not been able to, but it should be noted that this is probably the most impressive candlestick out of the last couple of weeks. However, the 61.8% Fibonacci retracement level, the 200 day EMA, and of course the 3000 level all in the same area does make for a significant barrier.

If we do pull back, then it is just going to be more of the same sideways back and forth trading that we have seen for so long, which of course makes quite a bit of sense as nobody knows what they are going next. It seems like the market is simply trading on the most recent headlines, and this time it was Jerome Powell suggesting that he was getting ready to bail out Wall Street again. In a scenario where you will not be able to take long term losses, then it makes a lot of sense that people will be buying assets. However, it should be noted that the stock market has completely divorced itself from reality, but this would be the first time. This has been a distortion that the Federal Reserve has put into the markets for the last 12 years or so, and therefore it is difficult to get overly bearish, lease for the longer term. Granted, we are at the top of the overall risk range, and the consolidation phase. Adding even more pressure in this area is the fact that there was a gap lower previously, so at this point it is simply a matter of fading this rally until we can break above 3000. If we break above 3000 then it is hard to tell what is going to stand in the way of the all-time highs. I do see the 3100 level as an area that could cause some issues, but you can say the same thing about several other levels that we have already blown through. With this, we should continue to see range bound trading and therefore I would not get too excited about anything at this point.