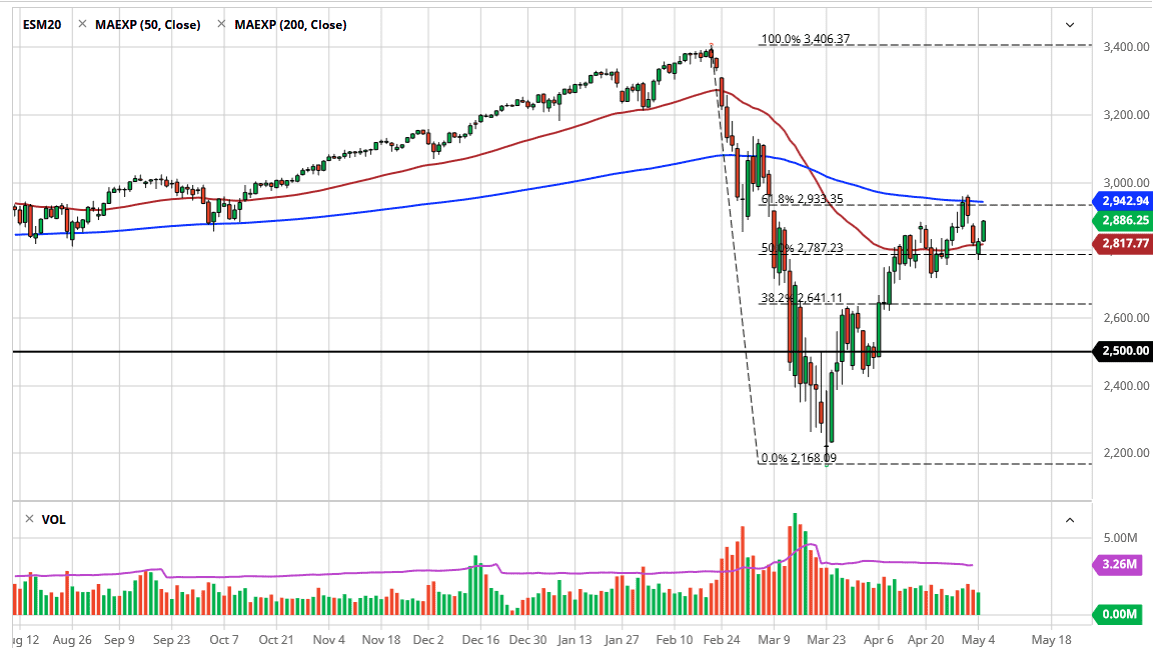

The S&P 500 rallied a bit during the trading session on Tuesday but is still struggling to get to the top of the gap. If we can break above the top of the gap, then it is likely that we will go looking towards the 200 day EMA. The 61.8% Fibonacci retracement level is in that same scenario as well, so at this point in time it is likely that we will see sellers in this general vicinity, right around the 2940 handle.

That being said, stock market seems to be ignoring the overall economic situation in the global economy, as the S&P 500 simply continues to rally no matter what. This is about the Federal Reserve liquefying the marketplace, and therefore it is likely that the liquidity becomes without a doubt the most important thing to pay attention to. If the Federal Reserve is in fact going to step into the marketplace and start buying particular ETF markets, it is likely that the stock market will rally due to the fact that the “Federal Reserve put” is in play. Macro traders are getting crushed these days, because the fundamentals are completely missing.

We are in the midst of earnings season, so we may get the occasional jolt, but it is not until we break down below the 2800 level that I would have a lot of confidence shorting at this point. That being said I would take quite a bit of notice to any type of exhaustive candlestick near the 200 day EMA, as it could be another opportunity to start shorting again. However, if we close above the 3000 level on a daily close, that could send this market looking towards the top of the consolidation phase near the 3150 level. Above there, then the market goes looking towards the 3400 level which was the most recent high. As ridiculous as it seems, it does look as if there is a real argument for the market to get back to those all-time highs as Wall Street has completely ignored economic reality. Having said that, we should simply follow price, because other types of analysis have been thrown out the window. If we do break down though, it will probably be due to some type of headline that shocks the world, and therefore would be rather brutal as we had seen in the past. We are simply consolidating back and forth after having a nice bounce from a breakdown.