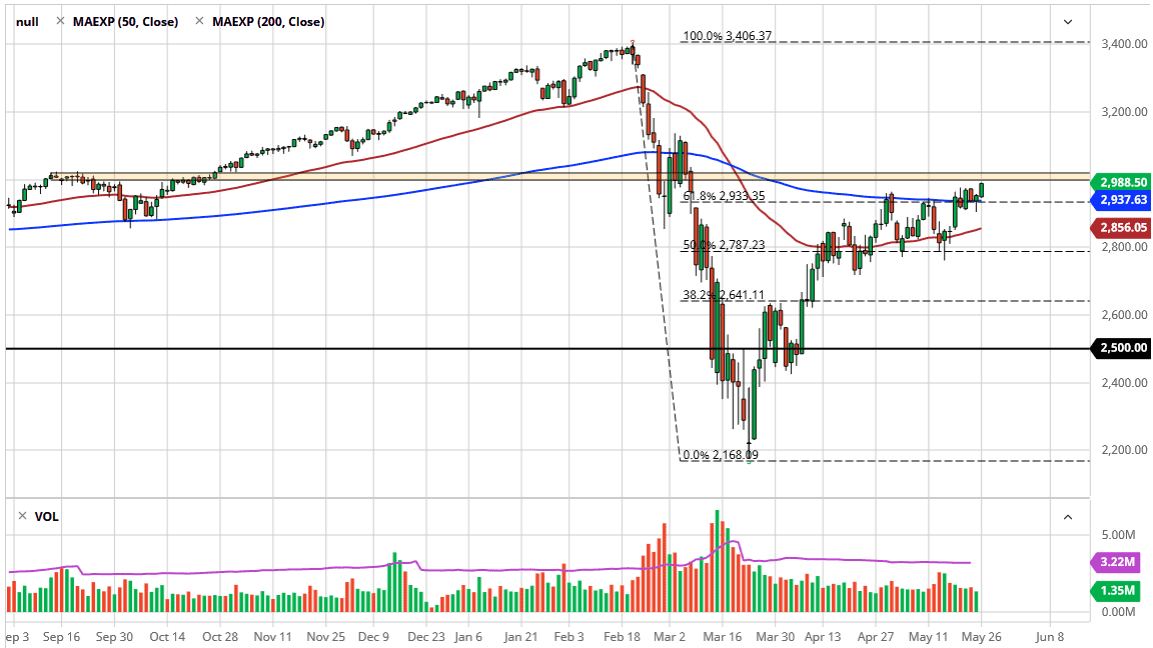

The S&P 500 looks as if it is trying to get to the 3000 handle, which is a major round figure that will attract a lot of attention. Ultimately, the candlestick for the Monday session was rather interesting, and of course bullish but at the same time we have to keep in mind that the day was a major holiday, so a lot of the larger traders were not online. The question now is what they do with the Tuesday session? As far as trading is concerned, it is best to wait for the daily close on Tuesday to see where we go next.

If we can break above the 3000 handle, then it is highly likely that the market will continue to try to break out. However, there is a significant amount of resistance that extends all the way to the 3100 level, so it does not necessarily mean that it is going to be easy to go higher. Nonetheless, a break above the 3000 level is a psychological victory, so course a lot of people are going to pay attention. The 200 day EMA currently sits just below trading action so it certainly looks as if the buyers have the upper hand, at least in the short term.

That being said, there are a whole list of things out there that could cause major issues. Not the least of which will of course be the slowing down of the economy as it is not going to recover the way that a lot of people seem to be banking on. Furthermore, there is a lot of tension between the United States and China, China, and Australia, and just about everybody else on the planet right now. Ultimately, I think that we are still essentially in a range between the 3000 and the 2800 level, but clearly it looks as if the buyers are starting to press the issue. It will be interesting to see what Wall Street does with this on Tuesday, but in the meantime, it is probably best to wait till the daily close before putting money to work as there could be a sudden snapback once the professionals come back online. If we were to turn around a break down below the candlestick from the previous session, that would break the back of a hammer. That of course would be an extremely negative sign and or than likely send this market looking towards the 2800 level.