The S&P 500 did pull back a bit during the trading session on Thursday, as we cannot seem to be able to break above the 3000 handle. At this point in time, it makes quite a bit of sense that the large, round, psychologically significant figure causes some issues. What will be interesting is that the Friday session will be somewhat quiet in general due to the fact that Memorial Day is Monday, so markets will be closed. In other words, it is likely that the market will probably be heavily slanted towards the beginning of the session, the question now is whether or not people are willing to take on a lot of risk at this point.

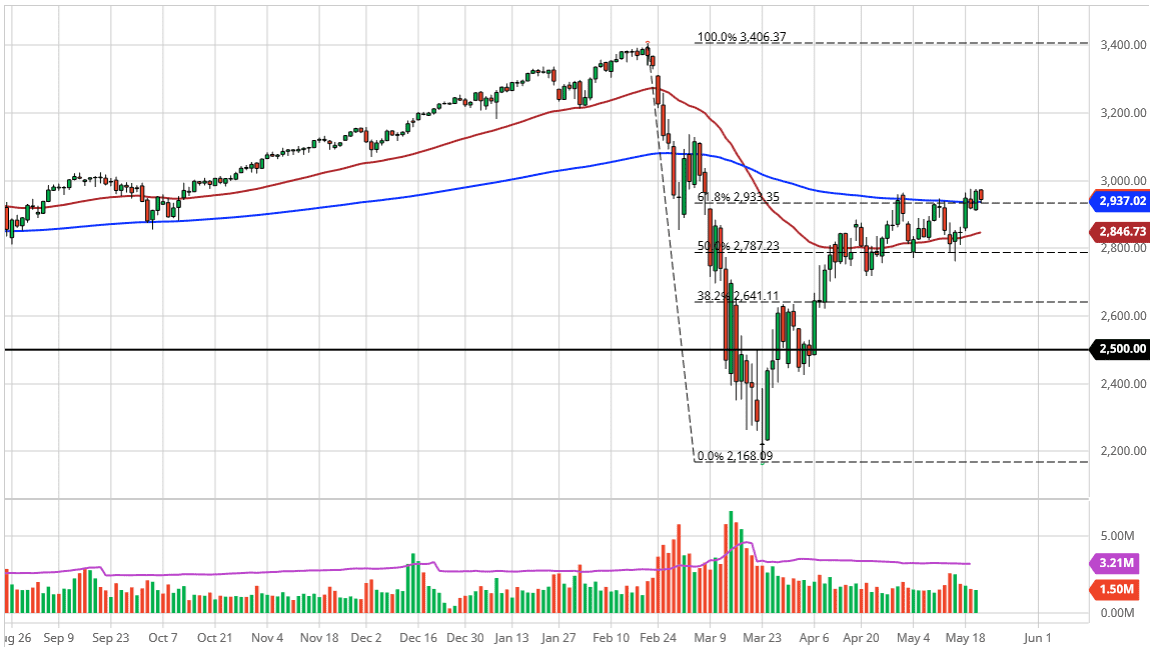

The candlestick from the Thursday session of course will show a significant amount of support at the bottom of it, so if we were to break down below that level it is likely that the S&P 500 would go looking towards the 50 day EMA underneath. Ultimately, this is a market that I think is a bit overdone, but it is very likely that the one thing that you can probably count on is going to be a lot of volatility as the market is weighing a lot of different concerns. The fact that we closed at the bottom of the round suggests that there is probably a bit of follow-through coming.

The 200 day EMA sits right in this area, so at this point it makes quite a bit of sense that we are going to see longer-term traders looking at this region. The 61.8% Fibonacci retracement level is also in this area, so that is yet another reason to think that the sellers may return. If we were to break above the 3000 level though, I think that will get a lot of the “FOMO” crowd coming back in and trying to push the market even higher. At this point, I think we are simply trying to go back and forth, perhaps trying to find some type of longer-term resolution to all of the economic questions. The economy has a lot to think about, not the least of which will be the jobs losses which continue to pile up and be horrific. At this point, I suspect that we will have a negative session on Friday, but only to a certain point.