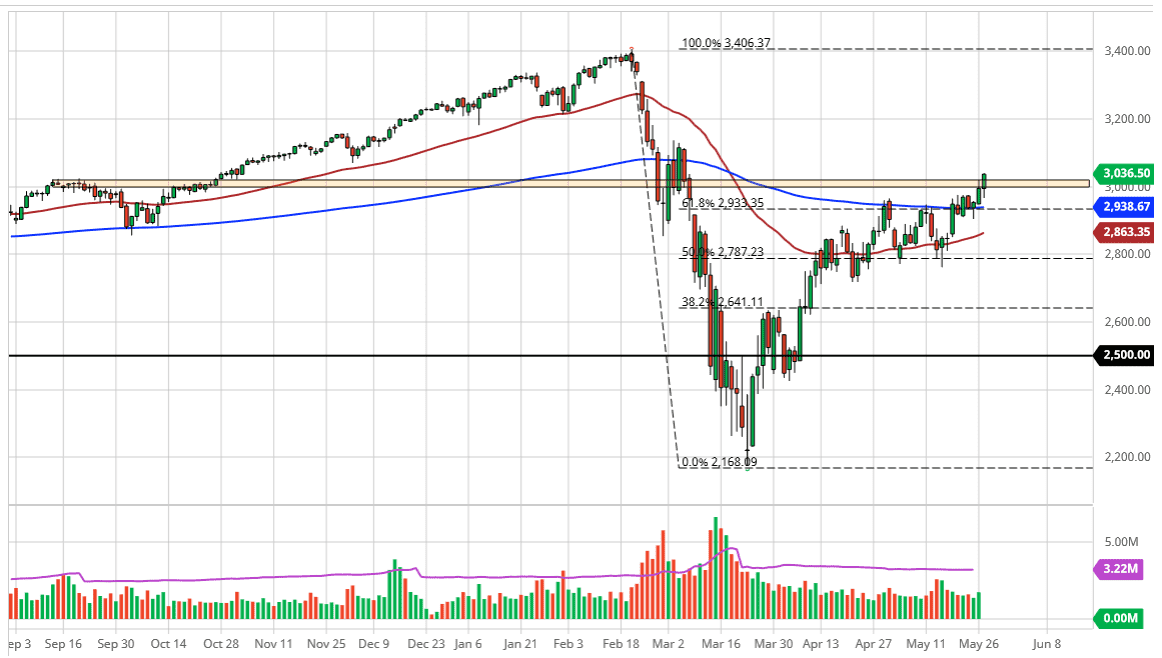

The S&P 500 initially broke down during the trading session on Wednesday but then turned around to rally significantly. Initially, it looks as if the S&P 500 was going to rollover drastically, but later in the day it turned around in a rush of buying. The form of trade continues in this market, and therefore it looks like we are probably going to continue to break out towards the 3100 level. Quite frankly, this is all about liquidity and has nothing to do with anything fundamental related, but that is something that could be said about the last 12 years to begin with. Unfortunately, far too many people worry about earnings and economic reality when they should simply look at how much liquidity the Fed is forcing into the market.

That is a proxy for what the S&P 500 has become. Furthermore, you should keep in mind that the S&P 500 is heavily slanted towards a handful of stocks, and therefore it comes down to what specific companies are doing. That being said, it looks as if the 200 day EMA has offered support, so at this point it is difficult to get bearish again, although I recognize it is going to be a significant fight to the 3100 level. If we break the 31 level, then it is almost impossible to imagine anything other than going back to the all-time highs. To the downside, if we were to break down below the 200 day EMA it could open up a move down to the 2800 level, but clearly something is amiss to the downside, as we simply cannot hang on to negativity. The rally was somewhat broad-based during the trading session, but volume is still rather thin. Overall, the market has only one direction and if you understand how indices are built, you should know that selling is an exceedingly difficult thing to do as the indices are weighted towards companies that typically do better anyway. It is not an ETF of 500 equal weighted stocks, rather some of the big names are up at the top and by the time you get to about 30 on the list, the effect of each dock becomes almost nonexistent. As a retail trader, you need to look into the waiting of the index and understand that you are trading in an ETF of some of the favored stocks by Wall Street.