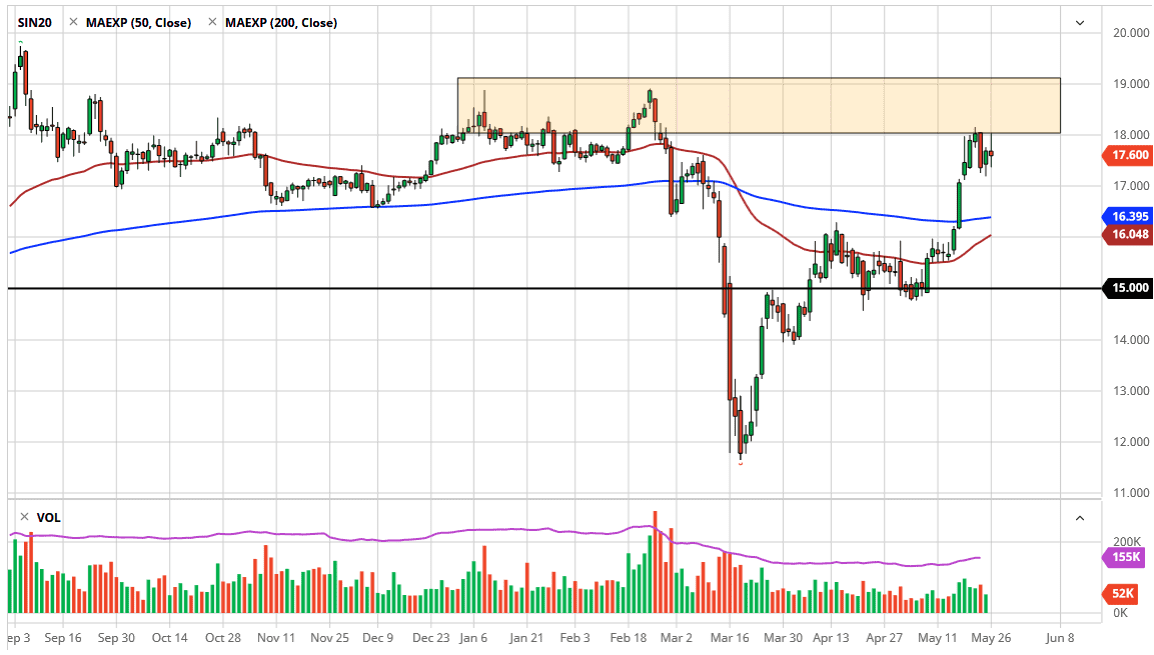

The silver markets have gone back and forth during the trading session on Tuesday as volumes increased instead of the holiday session that we had seen on Monday. That being said, one thing that you should pay attention to is that the $18 level has been massive resistance. With that in mind it makes a lot of sense that we continue to fail in this general vicinity. I think that the $17 level underneath is also supported, and as a result we are in a tight range of roughly $1.00, which is quite common for the silver market.

To the upside, if we were to break above the $18 level, then it is possible that we go all the way to the $19 level above. The $19 level is a major resistance barrier, and at this point it is more than likely a “hard ceiling.” The candlestick for the day is rather neutral, showing a bit of confusion. At this point, I think that short-term pullback should be buying opportunities, and therefore I think that you need to look for value. If the market were to break down a bit from here it is likely that we then go looking towards the 200 day EMA which is closer to the $16.40 level.

The silver markets have a couple of major inputs, including precious metals trades and the industrial component as well. Keep in mind that silver asked a little bit different than gold, to get to keep that in mind when trading it. As there are a lot of economic concerns out there, I think it is only a matter of time before people will worry about whether or not silver is being used to build products. At this point, one would have to wonder how much industrial use there will be, but there is also that precious metals trade that people are into at times. However, if you are looking for precious metals, gold tends to do much better.

Looking at this chart, a pullback makes quite a bit of sense, because we had gotten a bit ahead of ourselves. The $16 level underneath should offer as a bit of a floor given enough time, so at this point I think dips are probably going to be looked at as potential buying opportunities, and ways to build up a larger core position. However, keep in mind that silver is much more volatile than gold.