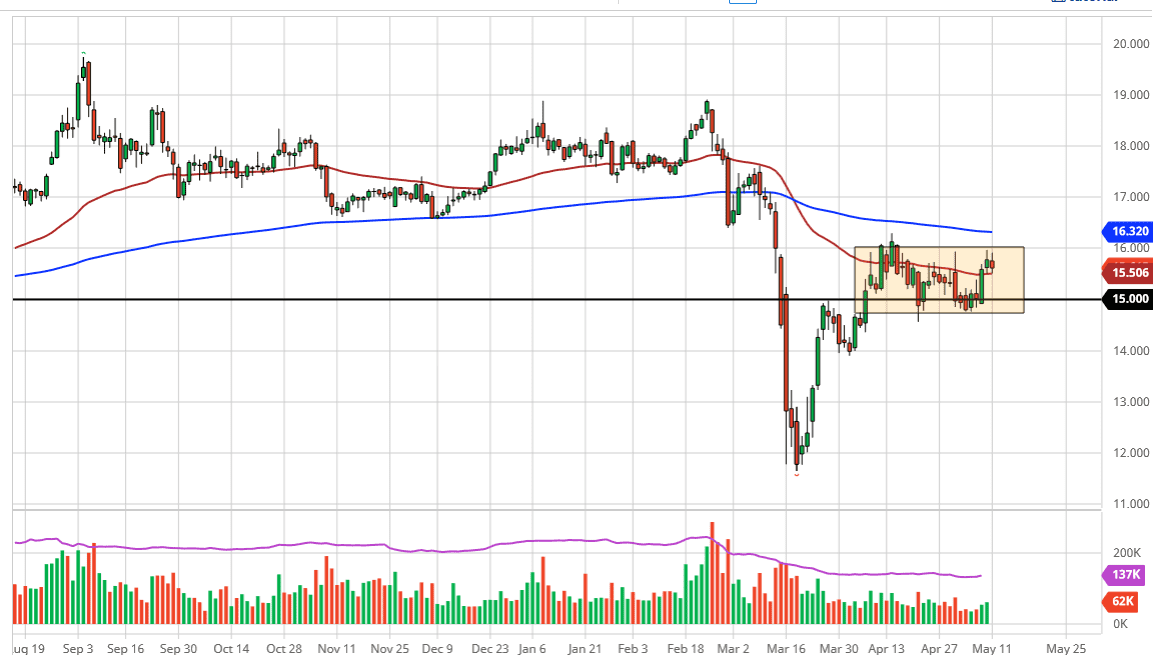

Silver markets have gone back and forth during the trading session on Monday, testing the $16.00 level, an area that of course is a major barrier. If we can break above there, then the market could really start to take off as we attempt to break above the 200 day EMA. If we can break above that level, then it is likely that the market will go looking towards the $17.00 level, and then perhaps even the $17.50 level. On the other hand, the market could very well pull back from here and quite frankly that is what I am expecting to see.

The market pulling back from this area makes quite a bit of sense as it is the top of consolidation that we have been in for some time, which extends down to the $14.80 level, in a bit of a “buffer zone” that extends to the $15.00 level. That is an entire area that could offer plenty of buying pressure, and as the silver market tends to be a bit of a short-term market more than anything else, it would not surprise me at all to see that level tested.

Although I do expect a pullback from the top of the range, I would not be the looking to short silver, because there are far too many things working against silver at the moment. For example, there is the central banks around the world flooding the market with monetary policy, meaning that they are trying to debase fiat currencies. This typically works in the favor precious metals, although silver is a bit of a laggard due to the fact that it has a lot of industrial uses as well. Because of this, I think that silver will have some issues due to the fact that industry is shutting down and does not look ready to suddenly take off again. Yes, there is a little bit of hope out there for some sense of normalcy, but at the end of the day we are light years away from anything close to normalcy. The next couple of days will probably be somewhat bearish for silver, but I am looking to pick up closer to the $15 level than anything else. I would keep my leverage exceptionally low, or perhaps even look at physical silver from a longer-term trend more than anything else. Regardless, I have no interest in fighting the recent gains in silver.