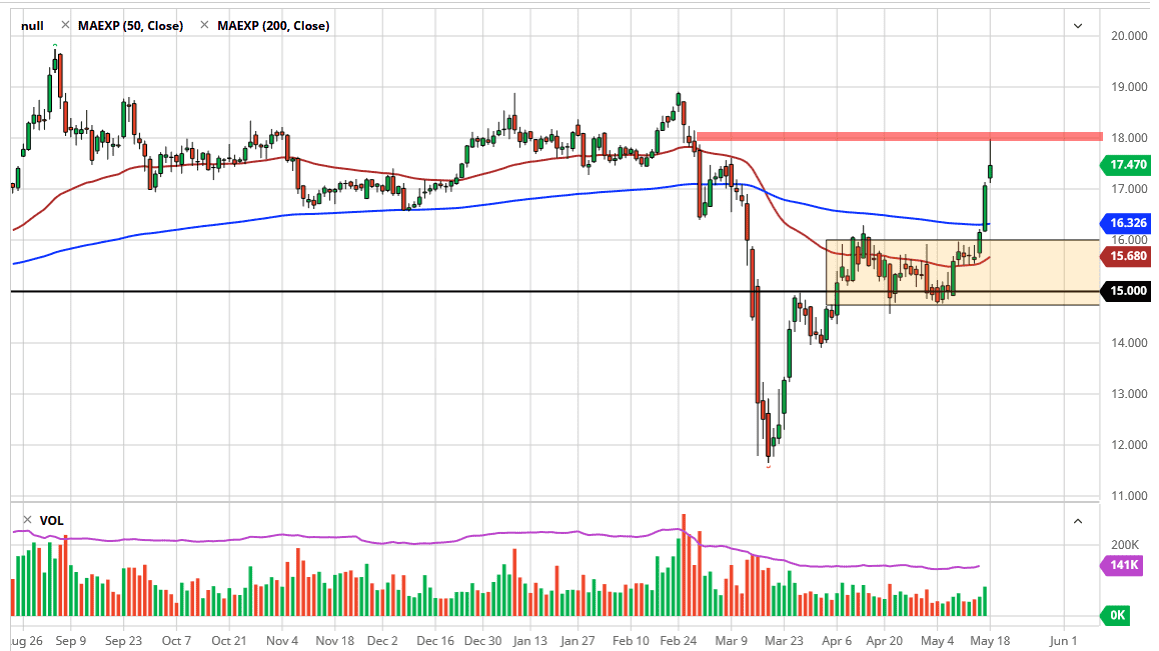

Silver markets rallied significantly during the trading session on Monday, but quite frankly they have stretched far too much to continue the momentum. Yes, there has been a significant amount of volume during the day, but not something that is completely out of sorts, and the fact that the market pulled back so rapidly from the $18 level tells me that it has gotten ahead of itself. The question now is, would I be a seller? Of course not, but I do recognize when a market is overbought, and this is most certainly one of those situations.

Looking at the candlestick, I think that if we break down below the $17 level it is likely that we could go down to the 200 day EMA, perhaps even the $16 level after that. Ultimately, that is an area that should offer support based upon the rectangle underneath, and of course the fact that it is a large, round, psychologically significant number that also features not only the 200 day EMA just above it, but also the 50 day EMA just below it and at the same time turning higher.

The alternate scenario of course is that we break above the top of the candlestick for the trading session on Monday, this would be breaking the back of a shooting star, it could open up a move towards the $19 level. All things being equal, silver markets are overdone due to the fact that the markets got a bit ahead themselves due to the fact that the Federal Reserve Chairman suggested that he was willing to bail out Wall Street yet again over the weekend. Furthermore, the release of potentially positive test when it comes to the coronavirus also had more of a “risk on” feel. Having said that, we are light years away from having a vaccine so it is very unlikely that this bullish pressure will continue. Remember, silver not only acts as a precious metal, but it also acts as an industrial metal, and therefore it has struggled a bit due to the fact that there is going to be a lack of demand in general. With that being the case, silver most clearly needs to pull back at the very least, perhaps reaching towards the $17 level, before breaking down closer to the 200 day EMA as mentioned previously. I do not like the idea of going long of silver up here, but I would be willing to buy on a pullback as it gives us an opportunity to pick up a bit of value.