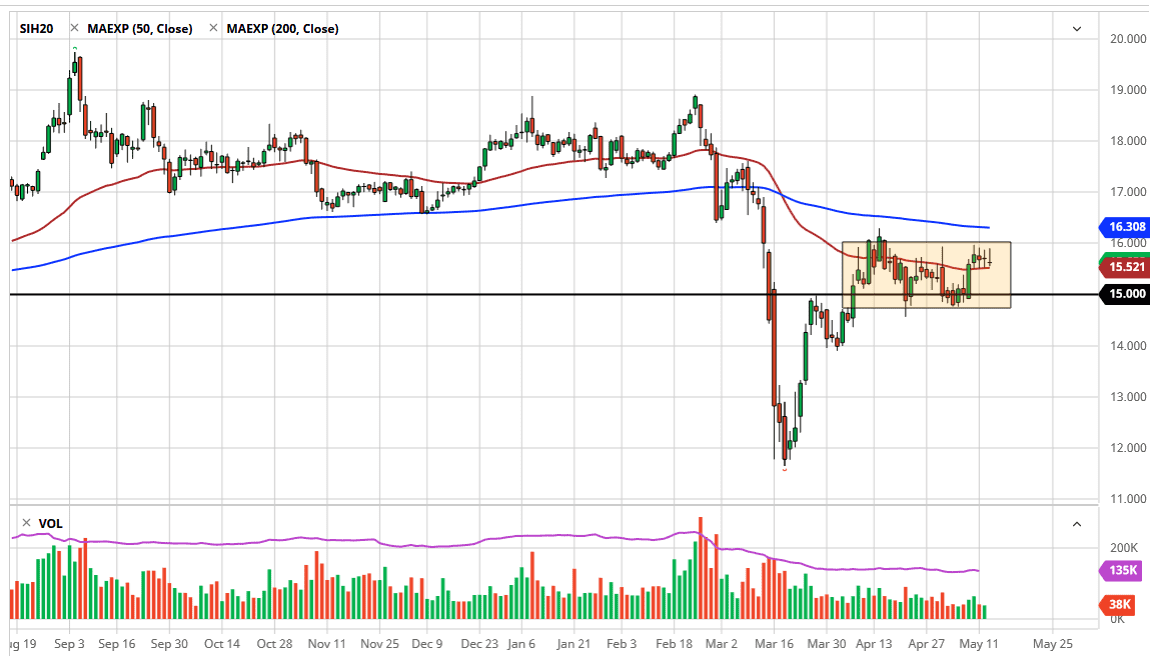

The silver markets initially tried to rally during the trading session on Wednesday but have found sellers in the same area we had previously. Ultimately, this is a market that seems to be looking at the $16 level as a potential barrier that cannot be overcome. The fact that the market has formed a shooting star during the trading session after forming a couple of neutral candlesticks shows just how difficult it is going to be to go higher.

Having said that, to the downside I think there is plenty of support down to the $14.80 level so it is only a matter of time before the market will find buyers on pullbacks, which I do think we are going to get relatively soon. After all, the US dollar has strengthened a bit during the trading session on Wednesday, and that works against the value of silver. Beyond that, one has to wonder whether or not there is going to be any industrial demand for silver anytime soon? Remember, even though it is a precious metal, it is highly regarded as an industrial metal and therefore it trade somewhat like a base metal.

The 50 day EMA underneath continues to offer support, so a breakdown below that level will clearly open up the door lower. Having said that though, if the market was to break above the $16.00 level, and then of course the 200 day EMA above will offer resistance. Ultimately, a break above there would be an extraordinarily strong sign but I do not anticipate seeing that anytime soon. Ultimately, this is a market that continues to be very noisy, so keeping a small position size on is probably about as good as it gets. If you have the ability to trade silver in CFD markets, then you can cut your position size accordingly and therefore ride out the volatility. Otherwise, you are going to need to see that the 50 day EMA broken to the downside in order to take a short-term selling opportunity or break out to the upside. Either way, this is a market that is going to be exceedingly difficult to handle at times, as it has not only the precious metals aspect, but the industrial metals aspect is perhaps even more important. Ultimately, this market continues to underperform the gold market in general, as we have seen gold do quite well over the last several days.