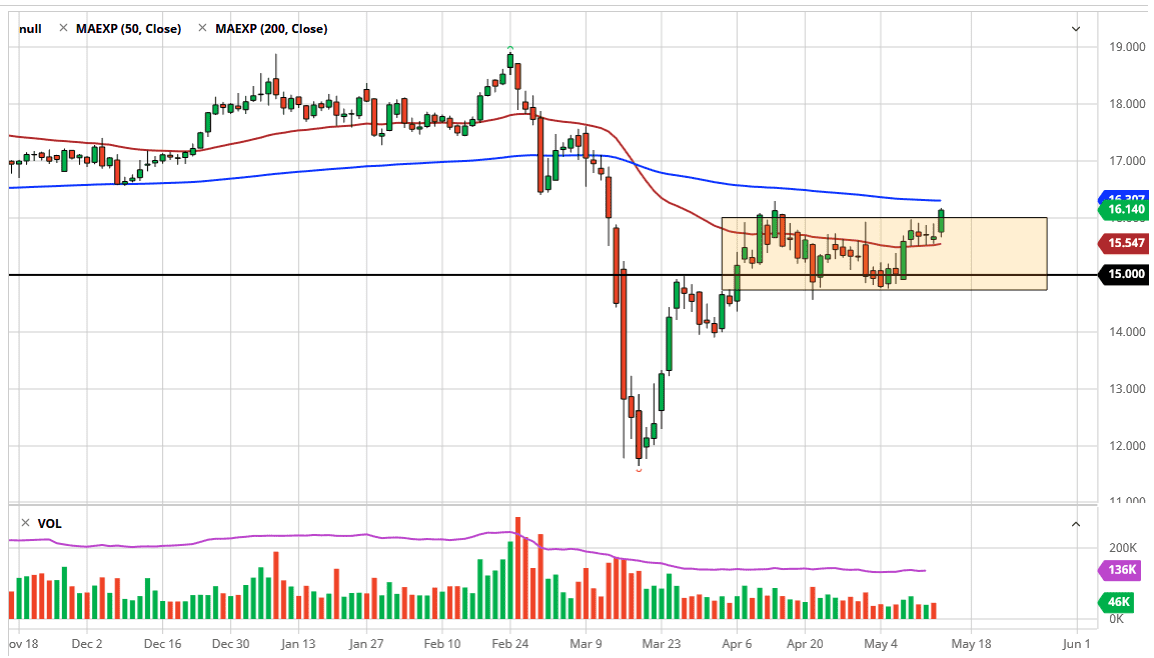

Silver markets have broken above the $16 level during the trading session on Thursday, clearing the top of the rectangle that I have marked on the chart. This is a market that has gone back and forth during the last couple of months and breaking above that level opens up the door towards the 200 day EMA. At this point in time, the market should continue to find buyers underneath, and therefore I think that short-term selling is likely to find plenty of buyers. The 50 day EMA underneath is likely to offer support, as it has over the last couple of days. However, we could even break down below there it still remains well within the usual tolerances.

Looking at the candlestick for the session on Thursday, it is quite strong, and it is closing towards the top of the range, but I think the 200 day EMA will probably attract enough attention to get people to either take profit or selloff. I find it difficult to think that people will be looking to take on a lot of risk going into the weekend, but the one thing that could lift the silver market is perhaps the gold market. Ultimately, if the gold markets get picked up into the weekend as a safety play then there could be a little bit of a knock on effect over here, but the biggest problem that the silver market is going to have is that there is a lot of industrial demand attached to it. That is a major problem of course, and as a result I think that silver will continue to be a major laggard. If we do break above the 200 day EMA, then the market is likely to go looking towards the $17 level. Above there, the market then has to worry about the $17.50 support level.

More likely, we will get a pullback in order to pick up a bit of value, near the 50 day EMA or even as low as the $15.00 level. Ultimately, this is a market that will continue to be very volatile, so I think that if you wait for dips to pick up little bits and pieces, that is probably the best way going forward. As far as an investment is concerned, you could be looking to buy silver in the physical form, as it makes a nice longer-term investment.