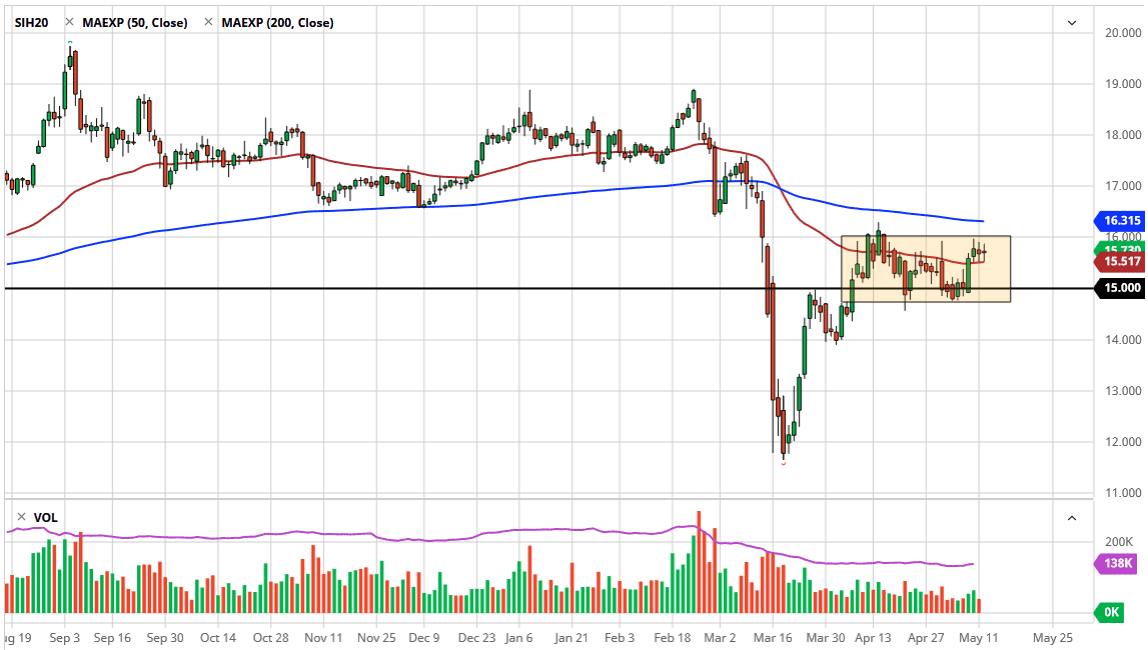

Silver markets went back and forth during the trading session on Tuesday as we continue to see a lot of hesitation in the market. The $16 level just above is significant resistance, as we have seen it repel price more than once. That being said, it is highly likely that we will continue to see a lot of choppy behavior. After all, there are a host of different things affecting the silver market right now, not the least of which will be the lack of industrial demand. After all, the global economy has essentially stopped, and that means that there will be a lot less demand for silver going forward.

If there is no industrial demand, that only leads the question as to whether or not there is going to be another precious metal demand. There does seem to be in general, but silver is second-place when it comes to that argument, when you can simply by gold which of course is much more desirable as a hedge against inflation and as a source of “hard money.” The $16 level above has been an extraordinarily rough resistance barrier and breaking above there will take a certain amount of momentum. Furthermore, the 200 day EMA sits just above that level so it is highly likely we will continue to see resistance in that same region.

To the downside, the $15.00 level underneath will offer a significant amount of support that extends down to the $14.80 level. At this point I think that plenty of buyers will come back in and you can play the range going forward. Ultimately, this is a market that is struggling to decide whether or not it is going to continue the uptrend that we have seen recently or if this is just simply a distribution pattern. To the downside, if we were to break down the $14 level will offer a certain amount of support, and then down to the $13 level. All things being equal, this is a market that I like the idea of buying for longer-term moves, but you cannot do so with a large amount of money. You have to “scale into” a position. Simply jumping in with a large position is a great way to lose money in the silver market which can be quite expensive when it comes to futures contracts. If you have the ability to trade the CFD market, that is probably the best route to go as you can customize your position size.