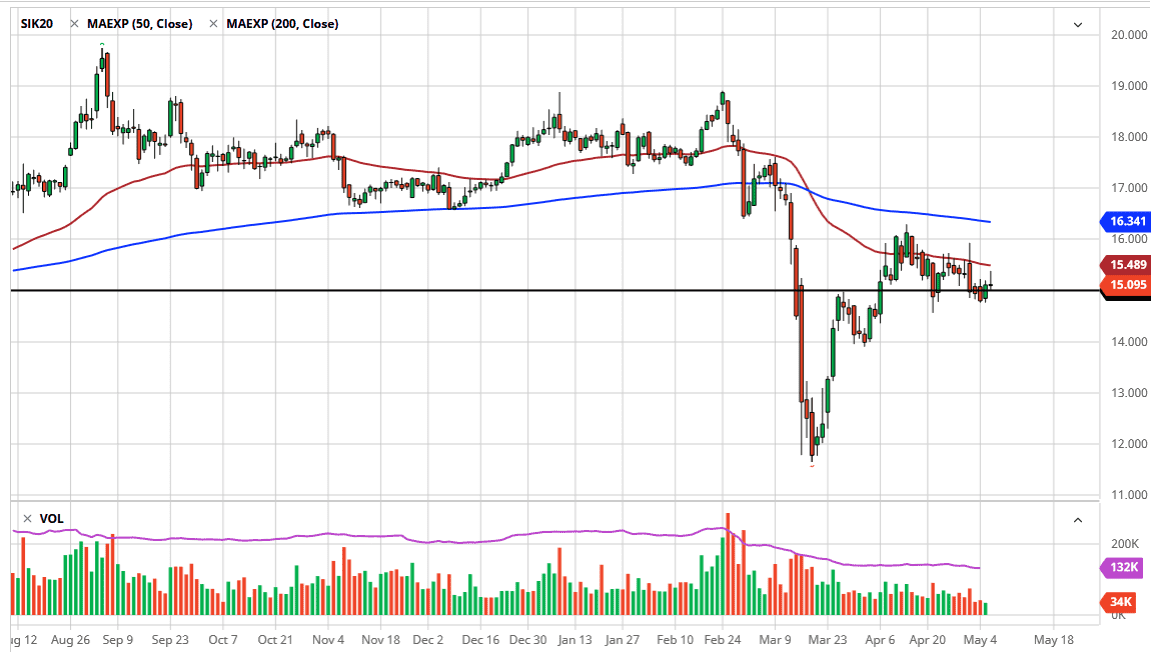

The silver markets initially tried to rally during the trading session on Wednesday but gave back the gains in order to form a bit of a shooting star. At this point, the market looks as if it simply cannot find enough strength to continue going higher. With that being the case, the market is likely to continue to see a lot of back and forth, and as we race towards the jobs figure on Friday, things will get even more tricky for those who are trying to bet on the economy.

Keep in mind that silver is overly sensitive to the economy, as there is a huge industrial demand component to the market, so therefore you need to pay attention to the idea of whether or not the economy is going to take off to the upside. If it does not, then it is very unlikely that silver will rally significantly due to the fact that the market is going to have to price in less industrial production of electronics and many other things that silver is used for.

Furthermore, in times of economic contraction, there is more of a safety trade than anything else. Safety tends to favor gold in general, and as a result silver is going to lag in that scenario. However, that does not mean that there will be some precious metal buying when it continues to silver, just that it will not be as a major of a driver as it will be in gold. Having said that, if we do get a good jobs number, or perhaps something that is more akin to “less bad” on Friday, then the market will more than likely take off and try to break above the 50 day EMA, perhaps even reaching towards the $16 level. Above there, the 200 day EMA sits at the $16.34 level, which could be the next target. All things being equal though, it looks as if the market is going to go back and forth right around the $15 level, and at this point time I do not see that changing anytime soon, although it certainly looks as if we have a significant amount of negativity just above the continues to grind away at silver in general. Longer-term, I like holding onto silver but beyond that I do not have much in the way of an opinion on what is essentially a relatively sideways market.