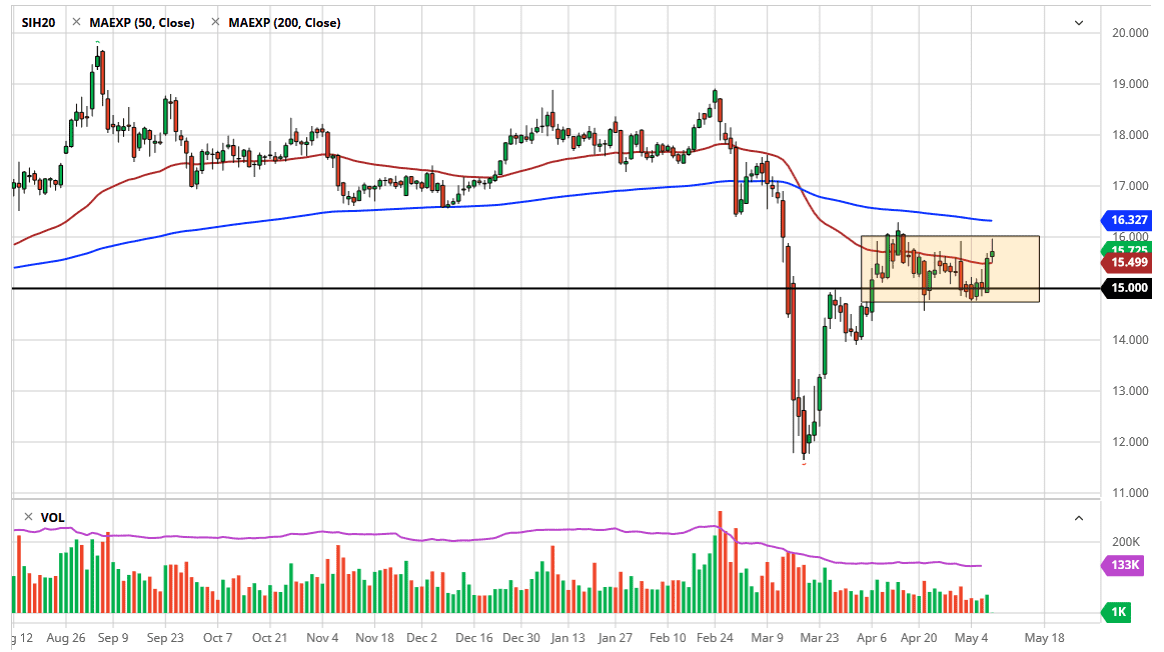

The silver market has rallied a bit during the trading session on Friday before given back some of the gains near the $16.00 level. This is a level that has been resistance more than once, so the fact that we pulled back from that level suggests that we are not quite ready to break out. In fact, the candlestick for the trading session on Friday ended up being a bit of a shooting star and therefore I think we might get a little bit of a pullback. At this point, the market is highly likely to go looking towards the $15.00 level underneath, and then perhaps the $14.80 level after that. Ultimately, this is a market that has been range bound for a couple of months, and I do not know we are ready to take off quite yet.

Adding a little bit more negativity to the situation is the fact that the 200 day EMA sits just above the top of the range, and as a result it is highly likely that we will see that pressure the market as well. Keep in mind that silver also has to deal with the fact that it is not only a precious metal, but it is also an industrial metal. What this means is that unless there is significant demand out there for manufacturing, silver is probably going to struggle. To the downside, I believe that the $14.80 level underneath is a lot of support, and at this point I think that the buyers will continue to jump back into the marketplace. If we were to break down below that level, then the $14.00 level would be targeted.

It should be noted that the 50 day moving average is sitting right in the middle of the rectangle, and at this point it is likely that we will see a lot of back-and-forth trading as well. With that, keep in mind that if you can keep your leverage level, you can simply buy-and-hold because with the type of central bank liquidity that is being thrown into the market, hard money will continue to pick up value. However, if you are playing the precious metals trade based upon lose money, you need to be in gold and not in silver. Ultimately, the market looks as if it is trying to digest the gains from below, and now the market is trying to figure out where to go next.