New Zealand Prime Minister Ardern suggested a four-day workweek as part of a post-Covid-19 economic recovery plan. She also hinted at more public holidays to spur domestic tourism while borders remain closed. With the economy in shatters, consumers are now faced with a likely bursting of the housing bubble, eradicating the primary wealth effect driving spending patterns. While the government has ambitious goals, the lack of a plan to achieve them is notably absent. The NZD/USD exhausted its advance temporarily and was rejected by its resistance zone for the third time.

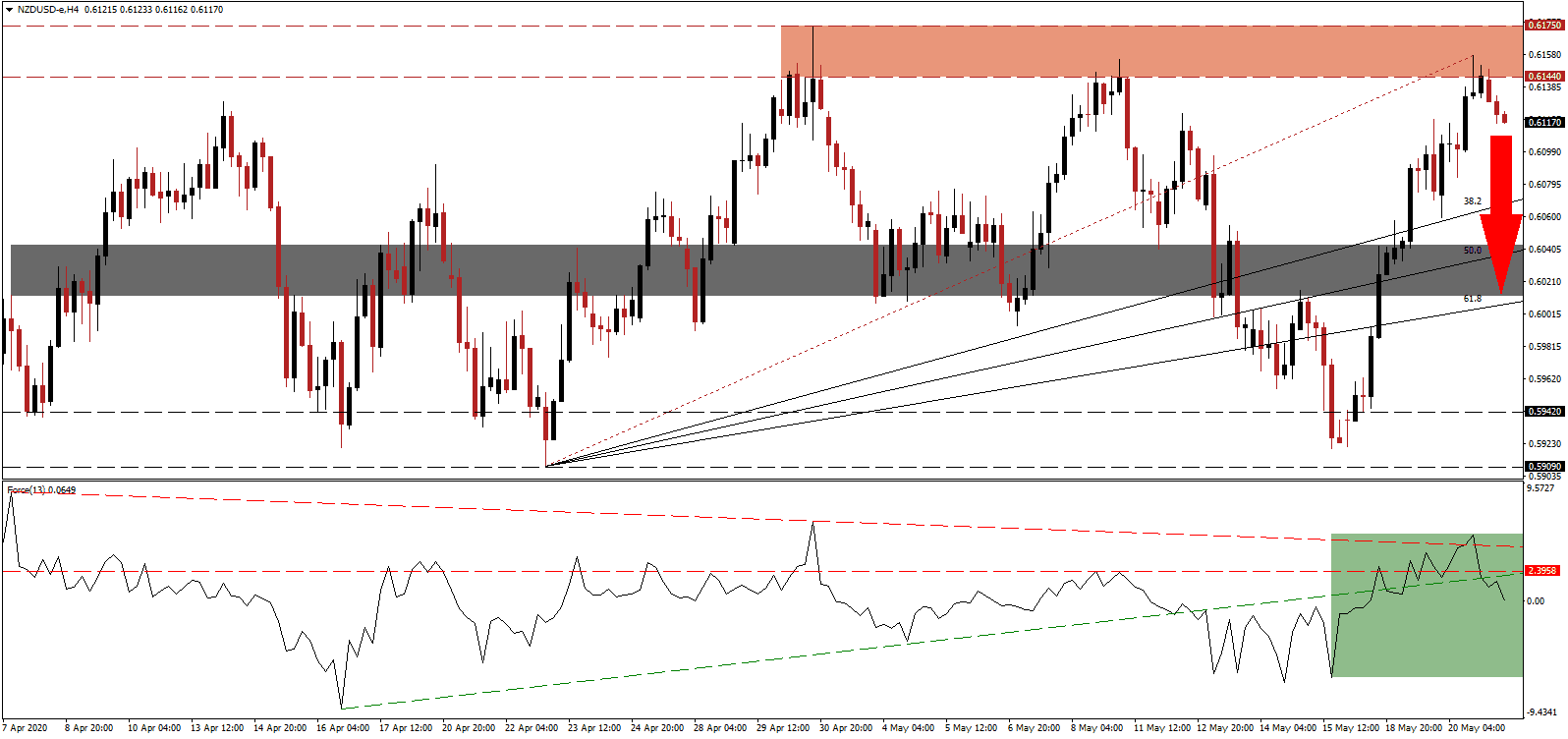

The Force Index, a next-generation technical indicator, briefly pierced its descending resistance level to the upside before converting its horizontal support level into resistance. It was followed by a breakdown below its ascending support level, as marked by the green rectangle. This technical indicator is now on track to cross below the 0 center-line and accelerate into negative territory, granting bears complete control over the NZD/USD.

With tourism, one of the essential pillars of the New Zealand economy, crippled, food exports remain at the core of any non-domestic contributors to the slow recovery process. It may be boosted by the looming trade war between Australia and China, which could benefit New Zealand. Microsoft announced the opening of a new data center but hopes to attract an inflow of foreign companies, to what Prime Minister Ardern promotes as a virus-free zone, are anticipated to fade. The NZD/USD is expected to close the gap to its ascending 38.2 Fibonacci Retracement Fan Support Level after the breakdown below its resistance zone located between 0.6144 and 0.6175, as marked by the red rectangle.

Today’s US initial jobless claims data may offer a short-term catalyst, as the US Dollar strengthened after each report that showed a worse than forecast increase in new claims. Negative data is being ignored by markets, resulting in a long-term bullish outlook for this currency pair. A correction in the NZD/USD is a healthy development and ensures the bullish trend remains intact. Due to the increasingly bearish conditions out of the US, the downside potential is limited to its short-term support zone located between 0.6012 and 0.6043, as identified by the grey rectangle. The 61.8 Fibonacci Retracement Fan Support Level is favored to enforce the long-term bullish chart pattern.

NZD/USD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 0.6115

Take Profit @ 0.6015

Stop Loss @ 0.6145

Downside Potential: 100 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 3.33

In case of a breakout in the Force Index above its descending resistance level, the NZD/USD could challenge the top range of its resistance zone. While the long-term outlook for this currency pair is bullish, failure to correct now will position price action for a more violent sell-off in the future. Volatility is expected to increase, and the next resistance zone is located between 0.6242 and 0.6278.

NZD/USD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 0.6180

Take Profit @ 0.6275

Stop Loss @ 0.6145

Upside Potential: 95 pips

Downside Risk: 35 pips

Risk/Reward Ratio: 2.71