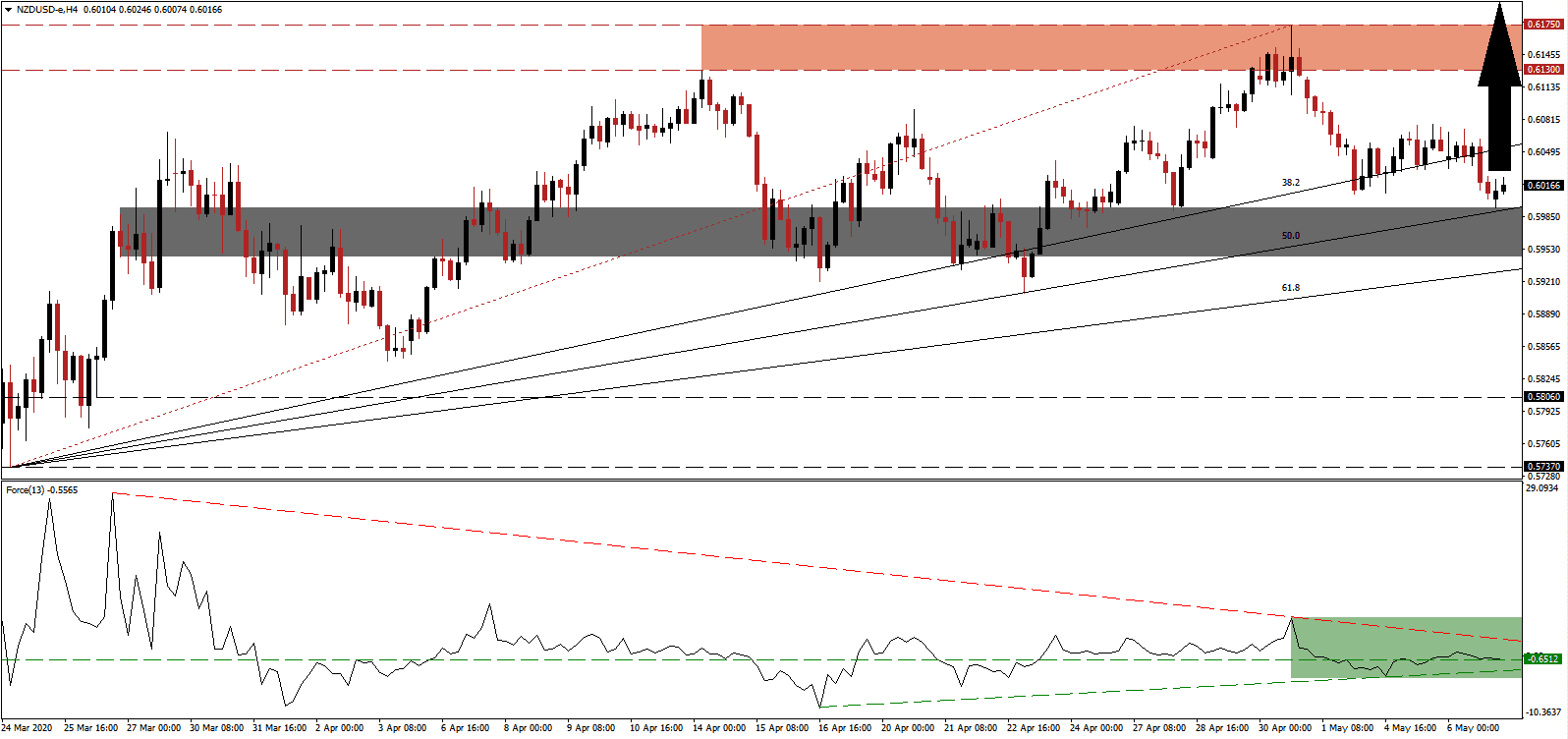

New Zealand’s economy is intertwined with the one of Australia, and both are heavily dependent on China. Australia reported a surprise increase in exports for March, up 15%, together with a 4% decrease in imports. China followed the same pattern for April, where exports unexpectedly increased by 3.5%, but imports slumped a more notable than forecast 14.2%. The data sufficed to allow the NZD/USD to bounce off of its ascending 50.0 Fibonacci Retracement Fan Support Level. Inflation expectations in New Zealand slowed to 1.2% while markets await today’s US initial jobless claims.

The Force Index, a next-generation technical indicator, confirms the build-up in bullish momentum after recovering with the assistance of its ascending support level. It allowed for a conversion of the horizontal resistance level into support, as marked by the green rectangle. The Force Index is now faced with its descending resistance level from where a breakout is likely. This technical indicator is additionally on course to cross above the 0 center-line, placing bulls in control of the NZD/USD.

Per the Reserve Bank of New Zealand, the Covid-19 related lockdown eradicated NZ$10 billion and 37% of economic output during level four measures. The alert level was reduced to three, with the central bank forecasting another NZ$5 billion loss. Criticism over the length and toughness of the lockdown is emerging, only trumped by the US, where over thirty million jobs are lost, and more are anticipated. The NZD/USD maintains its bullish chart pattern after a brief dip into its short-term support zone located between 0.5945 and 0.5994, as marked by the grey rectangle.

Forex traders are recommended to monitor the intra-day high of 0.6076, the peak of the reversal off of the 38.2 Fibonacci Retracement Fan Support Level before extending farther to the downside. A breakout is favored to provide the volume for the NZD/USD to challenge its resistance zone located between 0.6130 and 0.6175, as identified by the red rectangle. Persistent US weakness, as evident by economic disappointments, enables an extension of the advance into the next resistance zone, located between 0.6341 and 0.6378.

NZD/USD Technical Trading Set-Up - Reversal and Breakout Scenario

Long Entry @ 0.6015

Take Profit @ 0.6375

Stop Loss @ 0.5915

Upside Potential: 360 pips

Downside Risk: 100 pips

Risk/Reward Ratio: 3.60

In case the descending resistance level pressures the Force Index to the downside, the NZD/USD is expected to enter a corrective phase if this currency pair corrects below the 61.8 Fibonacci Retracement Fan Support Level. Forex traders are advised to consider any sell-off as a second buying opportunity with the next support zone located between 0.5737 and 0.5806. While New Zealand presently lacks a clear plan for sustained economic recovery, it remains in a more favorable position than the US.

NZD/USD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 0.5875

Take Profit @ 0.5775

Stop Loss @ 0.5915

Downside Potential: 100 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 2.50