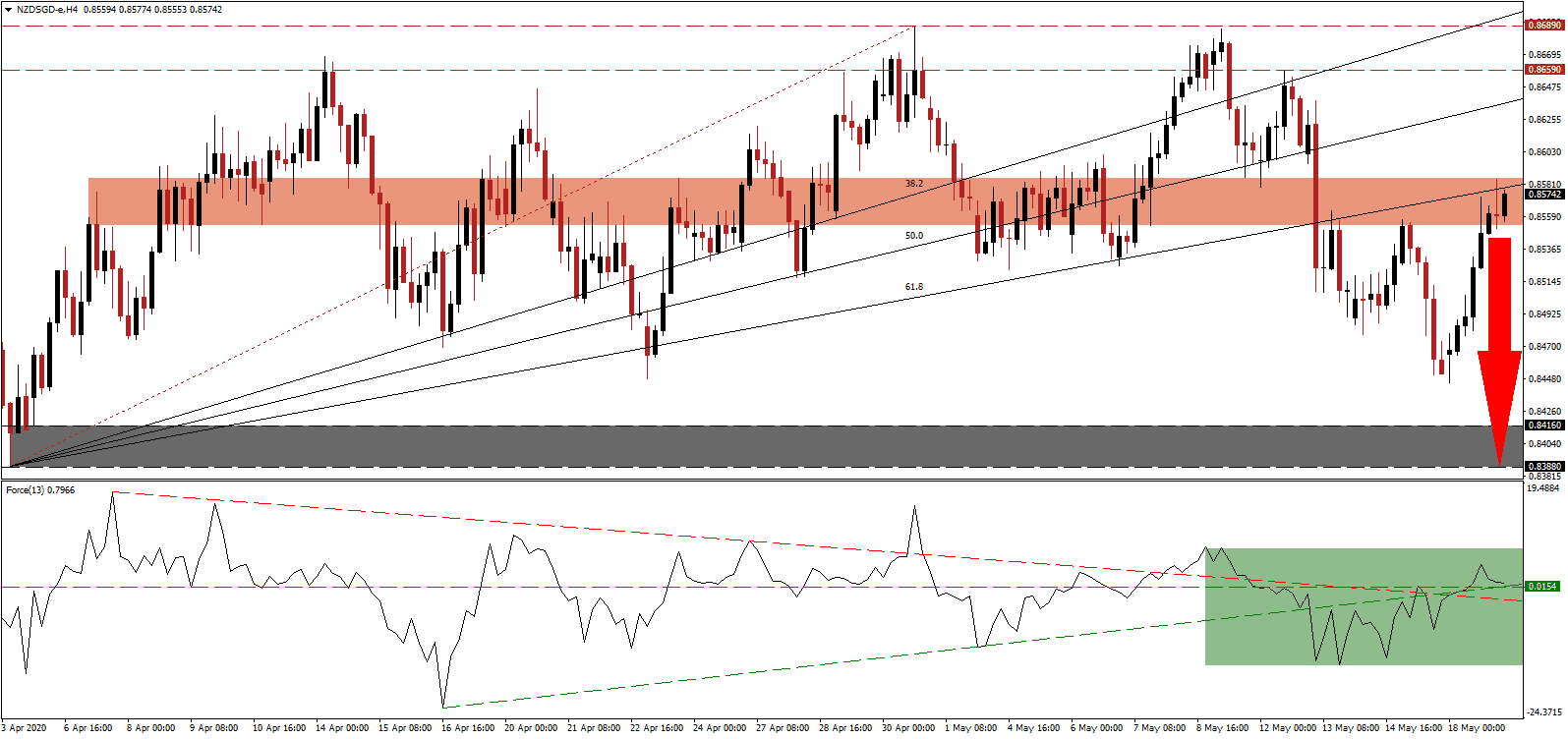

Singapore reported a smaller trade surplus in April as compared to March, on the back of a monthly decrease in non-oil exports while posting an annualized increase. A gradual easing of the partial nationwide lockdown will be implemented this week. The country has a functioning test, trace, and isolate (TTI) infrastructure in place, allowing it to return to a modified social and economic life ahead of the curve. It makes the NZD/SGD vulnerable to a correction after advancing into its short-term resistance zone, where it faces rejection by its ascending 61.8 Fibonacci Retracement Fan Resistance Level.

The Force Index, a next-generation technical indicator, recorded a lower high before retreating from its current peak. It is now challenging its ascending support level from where a breakdown will additionally take it below its horizontal support level due to the proximity of both, as marked by the green rectangle. A collapse in the Force Index below its descending resistance level will take this technical indicator into negative territory, ceding control of the NZD/SGD to bears.

New Zealand’s new budget includes a NZ$50 billion rescue fund for the labor market, hoping to return the unemployment rate to pre-Covid-19 levels of 4.2% within two years. It heightens total crisis-related spending to NZ$62 billion or approximately 21% of GDP. It boosted the New Zealand Dollar temporarily, but the risk of disappointment for the duration and extent of any recovery following the deep recession limits upside potential. New Zealand’s tourism sector remains shut, placing hopes on global food exports. The NZD/SGD is positioned for a profit-taking sell-off after a breakdown below its short-term resistance zone located between 0.8553 and 0.8585, as marked by the red rectangle.

Expectations of New Zealand Prime Minister Ardern to attract foreign companies, after Microsoft announced the opening of a data center, are likely to materialize in wishful thinking. She hopes to promote the island nation as a virus-free haven, which will not suffice a significant inflow of companies. Forex traders should monitor the intra-day low of 0.8525, the last instance price action recovered off of its 61.8 Fibonacci Retracement Fan Resistance Level. A breakdown will allow the NZD/SGD to accelerate down into its support zone located between 0.8388 and 0.8416, as identified by the grey rectangle.

NZD/SGD Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 0.8575

Take Profit @ 0.8400

Stop Loss @ 0.8630

Downside Potential: 175 pips

Upside Risk: 55 pips

Risk/Reward Ratio: 3.18

In the event the Force Index bounces off of its ascending support level and pushes to the upside, the NZD/SGD can attempt a breakout. The absence of a plan for a sustained economic recovery in New Zealand, which was substituted with a social agenda ahead of late summer elections, reduces the upside potential. Forex traders are advised to view any advance as a secondary short-selling opportunity. The next resistance zone is located between 0.8659 and 0.8689.

NZD/SGD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 0.8650

Take Profit @ 0.8690

Stop Loss @ 0.8630

Upside Potential: 40 pips

Downside Risk: 20 pips

Risk/Reward Ratio: 2.00