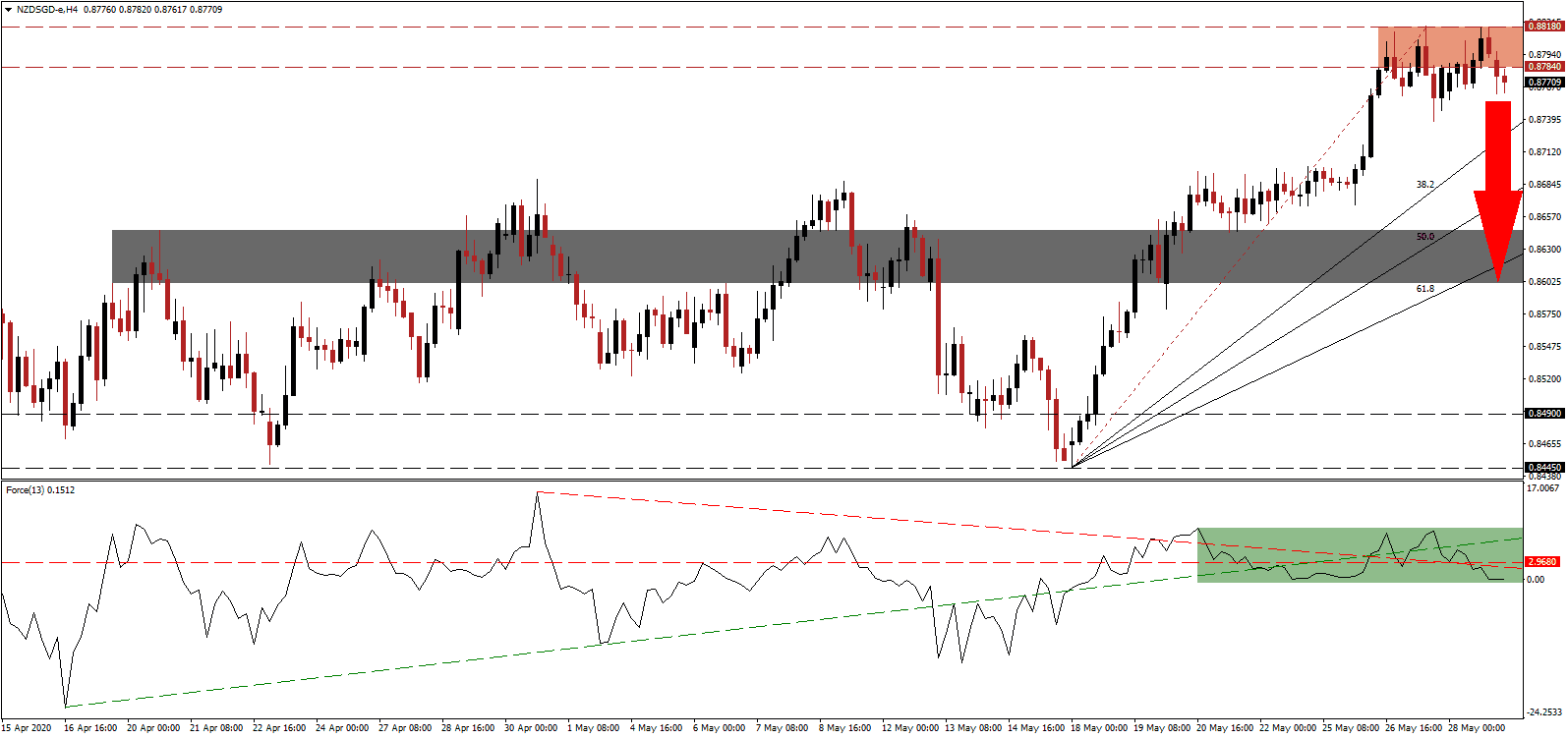

New Zealand could be declared Covid-19 free in as little as 21 days. Only eight active cases remain, and researchers published a study with a 95% probability to achieve epidemic extinction, in that period. It would allow the government to lift all remaining restrictive measures, but borders will remain closed. While it will be great for the domestic economy, key GDP contributors like tourism and education are not scheduled to resume full activity. New cases are surging globally, as governments initiated premature easing of restrictions. The NZD/SGD overextended its advance and completed a breakdown below its resistance zone, supported by a collapse in bullish momentum.

The Force Index, a next-generation technical indicator, provided an initial warning sign, as it was unable to confirm the most recent advance and failed to record a higher high. It swiftly collapsed below its ascending support level, as marked by the green rectangle. It then converted its horizontal support level into resistance before moving below its descending resistance level. This technical indicator is now expected to cross below the 0 center-line and cede control of the NZD/SGD to bears.

One sector hoped to contribute to New Zealand’s post-Covid-19 recovery is culture and creative arts. An additional NZ$25 million in support was pledged by the government. With borders anticipated to remain closed, Prime Minister Ardern banks on domestic tourism and government infrastructure programs. The absence of a viable plan forward added to the breakdown in the NZD/SGD below its resistance zone located between 0.8784 and 0.8818, as marked by the red rectangle.

Singapore and New Zealand did sign the New Zealand-Singapore Closer Economic Partnership (ANZSCEP) upgrade, in a positive development for both island nations. It additionally includes the Digital Economy Partnership Agreement (DEPA), where Chile is a signatory. The outlook for the Singapore economy is considerably more bullish than for New Zealand, and the NZD/SGD is favored to extend its breakdown below the ascending 38.2 Fibonacci Retracement Fan Support Level. A likely increase in volume can then prolong the correction into its short-term support zone located between 0.8601 and 0.8646, as identified by the grey rectangle.

NZD/SGD Technical Trading Set-Up - Breakdown Extension Scenario

- Short Entry @ 0.8770

- Take Profit @ 0.8600

- Stop Loss @ 0.8820

- Downside Potential: 170 pips

- Upside Risk: 50 pips

- Risk/Reward Ratio: 3.40

In the event the Force Index pushes above its descending resistance level, the NZD/SGD could attempt a breakout. With Singapore relying on precision manufacturing, healthcare, and biotechnology, while New Zealand places its hopes on culture, creative arts, and domestic tourism, the outlook for this currency pair carries a distinct bearish bias. Forex traders are advised to consider any advance as an excellent selling opportunity. The net resistance zone is located between 0.8888 and 0.8909.

NZD/SGD Technical Trading Set-Up - Reduced Breakout Scenario

- Long Entry @ 0.8845

- Take Profit @ 0.8900

- Stop Loss @ 0.8820

- Upside Potential: 55 pips

- Downside Risk: 25 pips

- Risk/Reward Ratio: 2.20