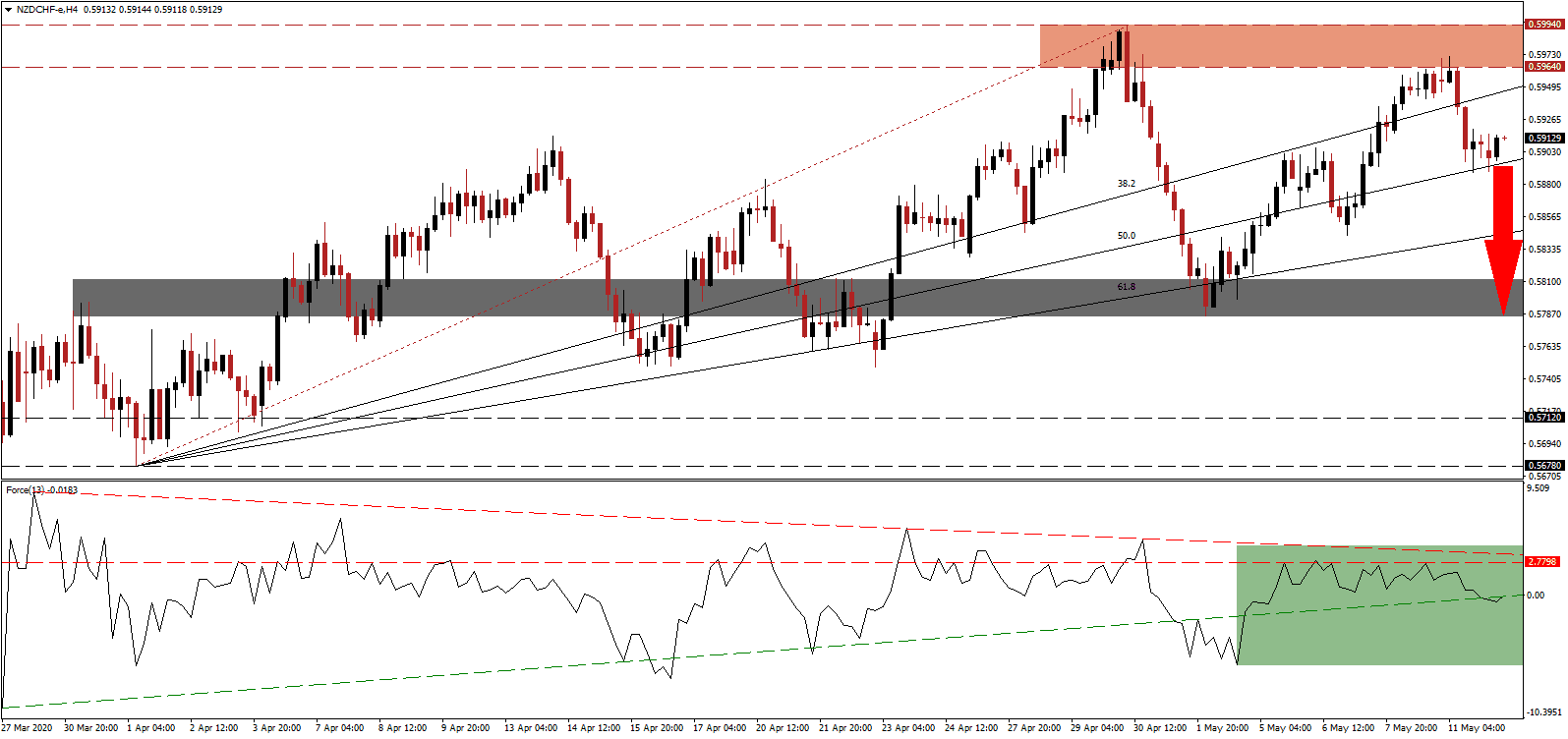

New Zealand’s 2020 budget will fulfill a critical role as it is likely to shape the future of the country for decades to come. Over the past thirty years, New Zealanders ignored the budget and forgotten the significance it has on their livelihoods. With the eight-week nationwide lockdown to contain the spread of the Covid-19 pandemic and a gradual return to an adjusted economic and social life, the 2020 budget resembles those in 1938 and 1991, both laying cornerstones for today’s New Zealand. Uncertainty over what the May 14th budget will contain added to breakdown pressures in the NZD/CHF, which created a lower high inside of its resistance zone.

The Force Index, a next-generation technical indicator, was rejected by its horizontal resistance level, as marked by the green rectangle, with the descending resistance level adding to bearish momentum. It contracted below its ascending support level, and the 0 center-line, granting bears control of the NZD/CHF. This technical indicator is favored to extend its move deeper into negative territory, pressuring price action into a more significant sell-off.

Grant Robertson, the finance minister of New Zealand, is tasked with balancing two competing ideologies, the 1938 socialistic ones, and the 1991 market-driven policies. After the Covid-19 pandemic, any future system requires the need to adapt to permanent changes. Misplaced optimism over the impact of the virus is anticipated to fuel safe-haven demand, adding a bearish catalyst to the NZD/CHF. Price action was rejected by its resistance zone located between 0.5964 and 0.5994, as identified by the red rectangle, and a minor pause is expected to extend the breakdown sequence.

Switzerland announced the second phase of reopening the economy. Contact tracing is at the core of the adjustment process, but warnings over a new wave of infections by the President of the Conference of Health Directors were issued. The biggest threat to the global economy remains a rush to kickstart hibernating economies, adding to the demand for safe-haven assets like the Swiss Franc. The NZD/CHF is poised to convert its ascending 50.0 Fibonacci Retracement Fan Support Level into resistance, and accelerate down into its short-term support zone. This zone awaits price action between 0.5785 and 0.5812, as marked by the grey rectangle.

NZD/CHF Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 0.5915

Take Profit @ 0.5785

Stop Loss @ 0.5945

Downside Potential: 130 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 4.33

A breakout in the Force Index above its descending resistance level can inspire the NZD/CHF to retrace its current sell-off. Uncertainties over the economic future of New Zealand, which lacks a clear path forward, limit the upside potential. Any recovery from present levels remains confined to the top range of the resistance zone, with the 0.6000 level adding psychological resistance. Forex traders should consider it an excellent selling opportunity.

NZD/CHF Technical Trading Set-Up - Confined Reversal Scenario

Long Entry @ 0.5960

Take Profit @ 0.5990

Stop Loss @ 0.5945

Upside Potential: 30 pips

Downside Risk: 15 pips

Risk/Reward Ratio: 2.00