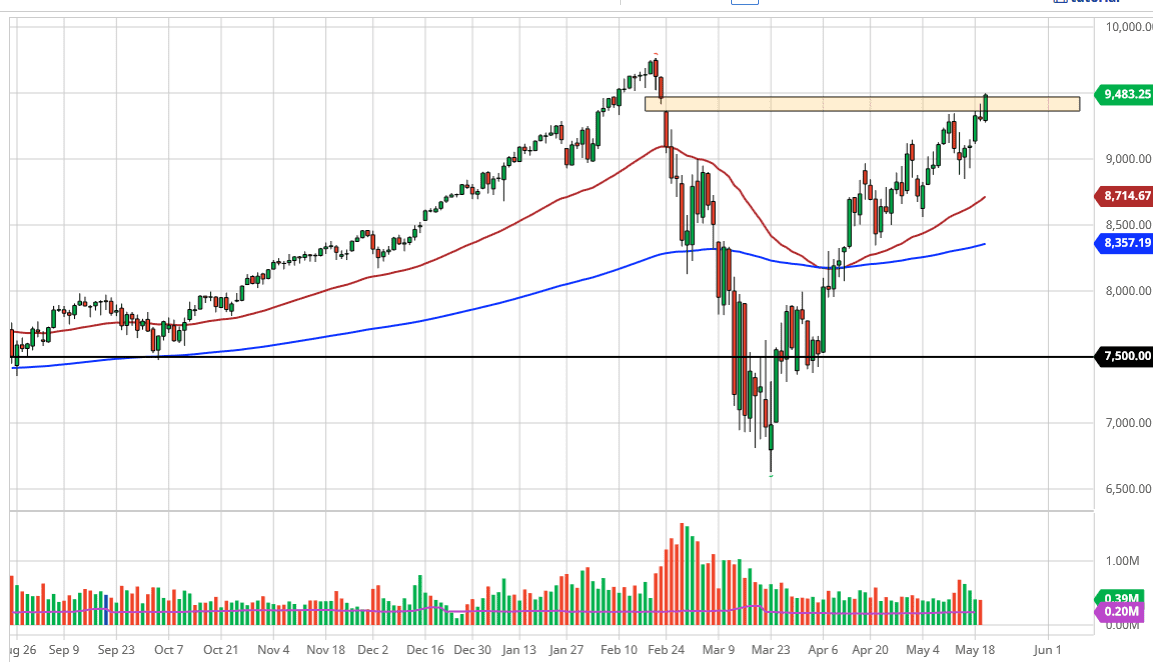

The NASDAQ 100 has exploded to the upside during the trading session yet again on Wednesday, slicing through the top of the gap. If that is going to be the case, it is likely that we will continue to go higher, perhaps even as high as 10,000. Ultimately, this is a market that should continue to see buyers on dips, and am a bit surprised how it simply will not keel over.

That being said, the extensive candlestick swallowing the previous shooting star is a very bullish sign and I think we continue to go further. After all, the NASDAQ 100 is made up of all of the “Wall Street darlings”, as Facebook, Amazon, Tesla, Alphabet, Microsoft, and Netflix are a huge portion of what makes up the index. When you think of all of the people being stuck indoors, it makes sense that these companies should continue to gain. The fact that they are almost 35% of the index suggests that as long as they are going to benefit from the conditions, the NASDAQ 100 will almost have to break higher based upon the ill weighted math that makes up this index.

If we do pull back from here, I think that there is plenty of support extending all the way down to the 9000 level, so I think at this point it is very likely that the buyers would come in based upon value, but I would also point out that perhaps we are at the top of a major channel, so a pullback from here does make quite a bit of sense, as the market has gone back and forth in this pattern for some time. Having said that, if we do break out to the upside it is likely that the move will be somewhat rapid.

The size of the candlestick is impressive, especially considering that the market closed at the very top, it suggests that there is probably more follow-through coming. In other words, if we do pull back, I would be overly cautious about shorting, but I would be much more interested in buying value. Also, if we broke above the top of the range then it is likely that we go higher as well. We are in an uptrend, and we cannot fight it anytime soon. If the stock market was to break down, then it is highly likely that it is easier to short the S&P 500.