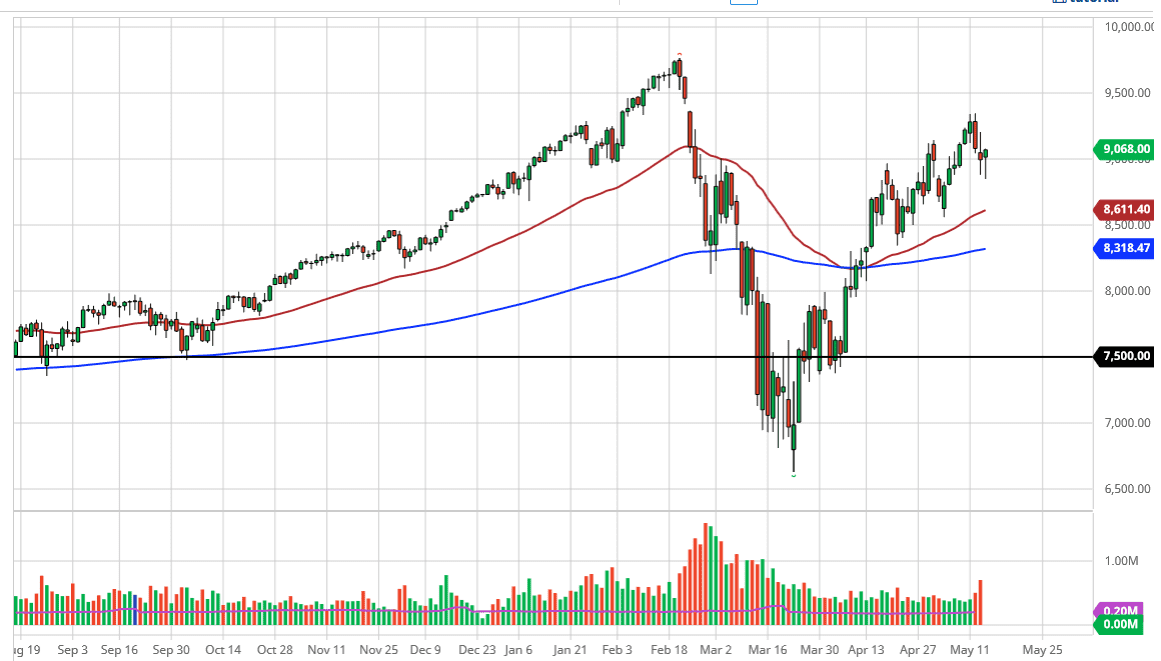

The NASDAQ 100 has pulled back a bit during the trading session on Thursday but shown an extreme amount of resilience to break above the 9000 handle. At this point in time, the fact that the market has formed a bit of a hammer for the trading session right at the 9000 level tells me that there are still buyers underneath willing to step in and pick up the NASDAQ 100 when they can. Furthermore, you should keep in mind that the same stock that everybody else plows into on Wall Street are the main components of this index, meaning Alphabet, Netflix, Microsoft, and Facebook. At this point, the market is likely to see those stock still bought into so I believe that when it comes to the two major indices that I follow here at Daily Forex, the NASDAQ 100 will be a major leader.

That being said, if we were to break down below the hammer that formed for the session on Thursday, then it is likely that we could go even lower. When you look at the chart from a longer-term standpoint though, it looks like we are in an up trending channel, so that should continue to cause a bit of a bullish pressure as well. Ultimately, I think that the NASDAQ 100 is most certainly favored but at this point it is probably only a matter of time before economic gravity has to come back into play. In the short term though, I think we are going to go a little bit higher, but it is not going to be easy anymore. The “easy money” has already been made. What is interesting is that the channel is supported by the 50 day EMA.

Having said that, if this market rolls over, it is highly likely that the market will be a signal that people will start dumping anything related to risk. At this point, it is likely that the market will look to the NASDAQ 100 as a great signal, so if should be paid attention to regardless of what you are looking to trade in general. That being said, it looks like there is still plenty of “fear of missing out” on Wall Street, as we grind higher in a market that is clearly divorcing itself from reality. Regardless, you cannot fight the tape, it is a great way to lose money.