Fear of weak demand for the yellow metal in the event of a worsening trade dispute between the United States and China stopped gold gains, which did not exceed $1712 resistance since the beginning of the week's trading, and settled around the $1703 level at the beginning of today’s trading and the time of writing. The announcement by the German court on the constitutionality of stimulus plans from the European Central Bank has provided little support for gold, with the stronger influence of monitoring developments in economic and human losses due to the coronavirus outbreak, especially with the return of global economies to business to prevent further collapse of the global economy. Despite the huge economic stimulus plans approved by the global central banks and governments, they could vanish quickly unless the global economy opened-up and able to coexist with the virus until a vaccine is eliminated.

Closings and travel restrictions aimed at containing the virus are hurting the US economy. Therefore, the United States' GDP is expected to decrease by an annual rate of 40% from April to June. This will be the worst quarter ever going back to 1947. Because of Corona, thirty million Americans have sought unemployment benefits.

Before the grinding health crisis, U.S. government debt hit record levels, due to President Donald Trump's tax cuts in 2017, of more than 80% of gross domestic product, the highest level since 1950. In 1946, a year after the end of World War II, federal debt reached peaked at around 109% of GDP. By 1962, the US debt burden had fallen below the 1940 level of 44% of GDP.

Economists have long been concerned about the consequences of large government debt. The argument says that when the government deals with debt, it competes with private borrowers for loans. This "crowds out" private investment, increases borrowing rates and threatens growth. But after the financial crisis, economists began to rethink their approach to debt. Recovering from the Great Recession, in the United States and especially in Europe, was partly slow because policymakers have held back from boosting growth with more debt. The Eurozone slid into recession in 2011, as its economies declined, their debt problems worsened.

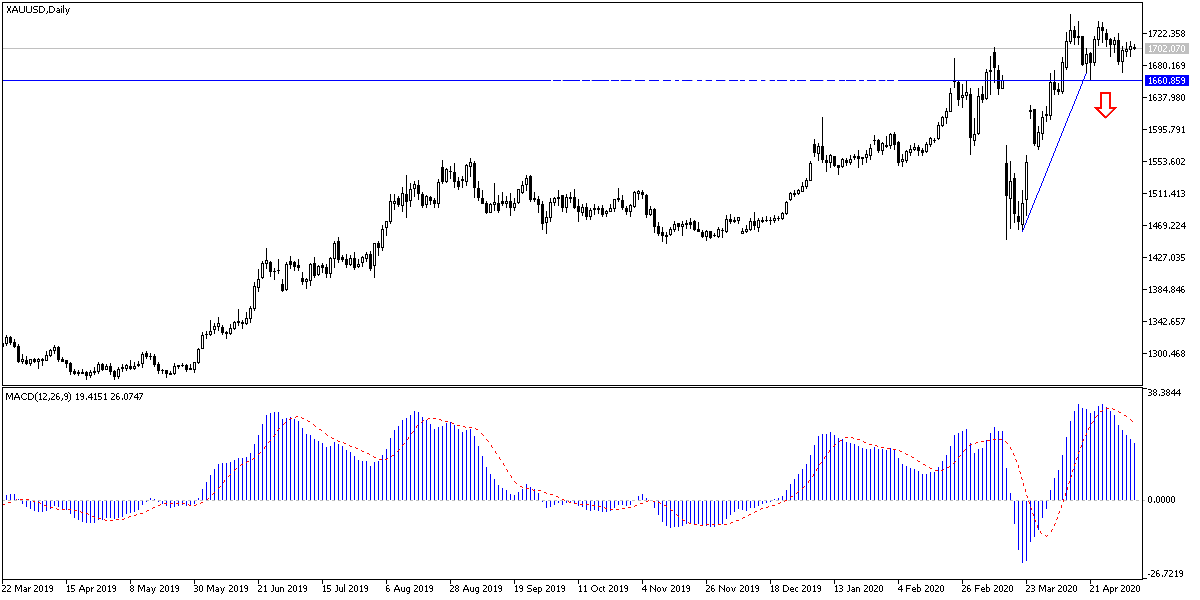

According to gold technical analysis: Despite halting gains, gold prices are still in the range of a bullish channel supported by stability around the $1700 resistance. Resistance levels at 1716, 1732 and 1760 dollars, respectively, may be legitimate targets for bulls in the event that global anxiety increases due to fears of a second wave of coronavirus outbreak with the re-opening of the global economy. On the downside, in the event of a breach of the 1685 support, sales may increase pushing gold towards the next support at $1660. I still prefer to buy gold from every bearish level.

Gold may react today to the announcement of the ADP reading to measure the change in the US non-farm jobs, because it may give a clearer picture of US job numbers in the official report on Friday.