The recent skirmishes between the two largest economies in the world will motivate investors once again to buy safe haven assets, and gold will have a large share of this turnout. For three consecutive trading sessions, gold prices stabilized around and above the $1700 psychological resistance. The Coronavirus consequences are still the strongest influence on global financial market trends and investor sentiment especially with increasing numbers of coronavirus infection above 3.54 million people until Monday, in contrast, US President Donald Trump and other members of his administration continued to criticize China, as the virus was announced on its soil for the first time last year.

In this context, US Secretary of State Mike Pompeo told ABC on Sunday that he saw "enormous evidence" that the virus originated in a laboratory in Wuhan, China, although he refused to provide any details. Last week, US intelligence agencies said the virus was not "manmade or genetically modified." For his part, US President Trump said, "I think they made a terrible mistake and did not want to admit it."

An intelligence report issued by the US Department of Homeland Security said that Chinese leaders "intentionally concealed" the severity of the epidemic from the world in early January. The report saw that they did this to stock up on the medical supplies they needed to respond to the epidemic. China reported the outbreak to the World Health Organization on December 31, 2019. It called the US Centers for Disease Control and Prevention on January 3, and publicly announced the disease as a new coronavirus on January 8. The growing tensions between the United States and China have affected US stocks recently, which has caused the major indices to drop sharply.

According to details of the numbers, over 3.54 million COVID-19 cases have been monitored worldwide and at least 248,816 people have died, according to data compiled by Johns Hopkins University. More than 1.14 million people have recovered. And the United States of America has the highest number of cases reaching 1.17 million infections, and the highest number of deaths with more than 68285 people. Spain has the largest number of cases in Europe, with 217,466 cases and 25264 deaths. In Italy, there are 211938 cases and 29079 deaths, the highest number of deaths in Europe.

Failure to reach a vaccine that ends the disease will continue to negatively affect investor sentiment for a longer period of time, even as governments want to reopen the global economy.

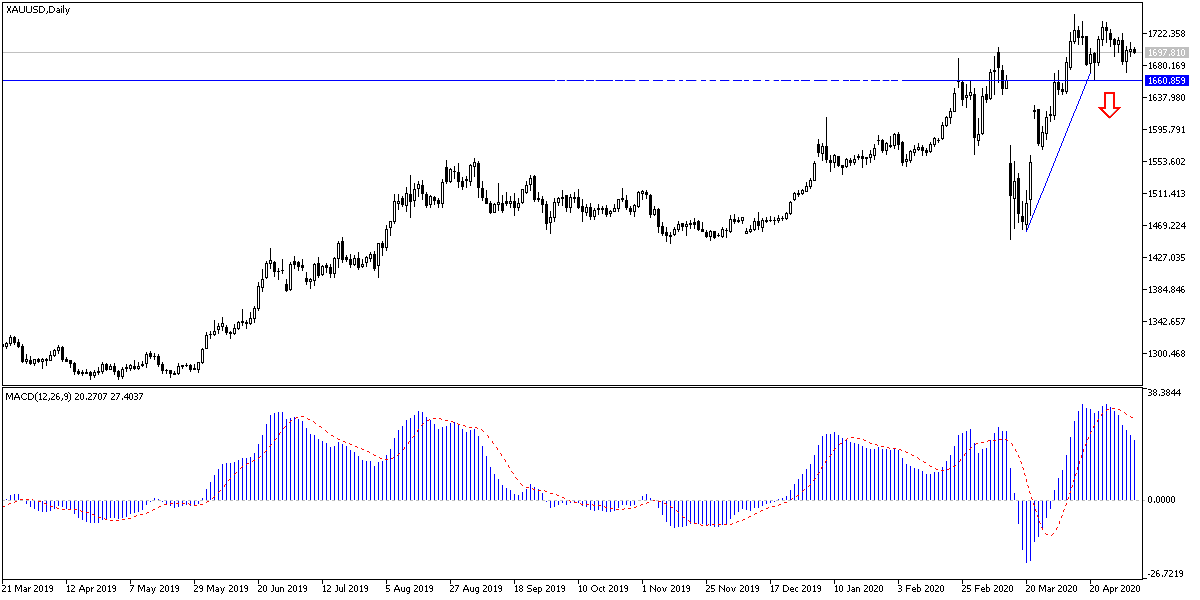

According to gold technical analysis: What has been mentioned above will continue to support gold investors in continuing to buy gold from any drop in prices, with the closest support levels are now 1685, 1670 and 1655, respectively. The $1700 psychological resistance is still a catalyst for the bulls control over the performance and the increasing global anxiety will support the move towards higher and closer peaks, at 1715, 1733 and 1765, respectively. Gold prices will react today with the announcement of the Reserve Bank of Australia monetary policy, US data, the trade balance and the ISM services PMI reading along with the reaction from the important German court decision towards stimulus plans approved by the European Central Bank.