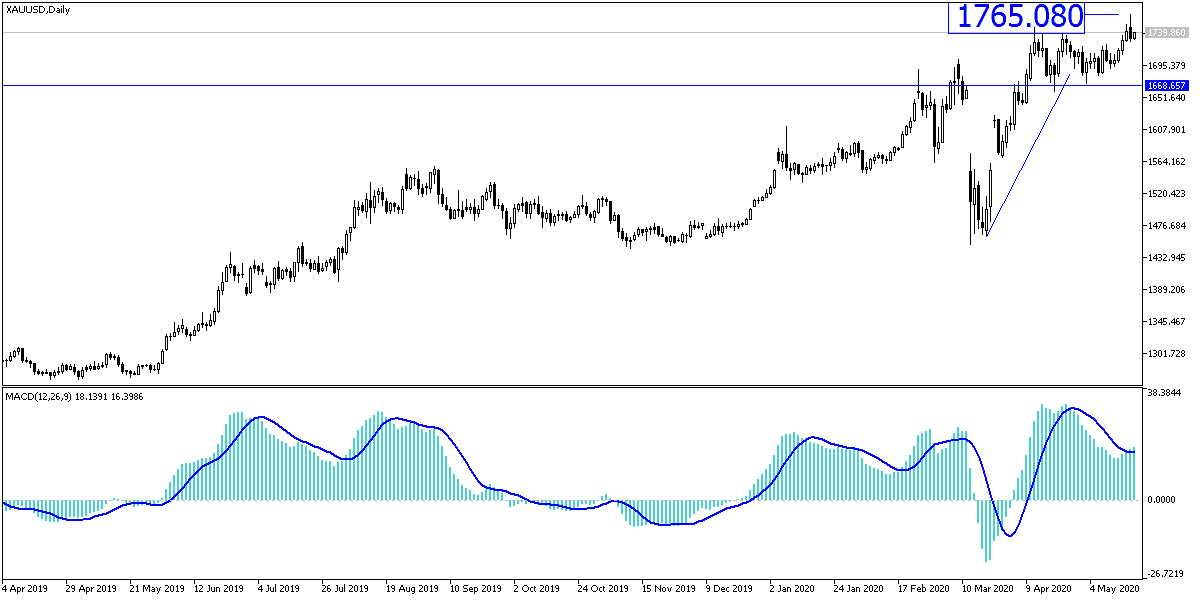

With the highest gains since 2012, the price of gold began to move this week to the $1765 resistance. With optimism in financial markets led by global stocks, investors abandoned the yellow metal, a safe haven of choice in times of crisis. Profit taking pushed gold prices to the $1727 support. It will start trading on Tuesday with stability around the $1732 level. The yellow metal is still in a strong bullish path. After yesterday's gains, expectations increased for the next psychological resistance at $1800 an ounce. Will this happen soon?

In the Corona epidemic, everything can happen and even more. Gold will need the worries to come back to the markets and to investor sentiment to increase the purchase of gold again. Hopes evaporated from Powell's optimistic remarks, which was a good reason to stop record gains, will give gold the impetus to start again. But it must be taken into account that all technical indicators have reached overbought areas, and accordingly, with buying again, we warn against risking big deals.

Jerome Powell, governor of the US central bank, reiterated his confidence in the possibility of an economic recovery for the United States soon, and everything will return to normal again, in particular, with a vaccine that kills the Coronavirus. Powell added that he and other central bank officials, in talks with companies, business leaders, universities and hospitals, have come to "a growing feeling that recovery may take some time to gain momentum." He added: "This will mean that we will start our recovery and take this path. It will be a good thing, but it will take some time to regain its strength."

Powell reiterated his view that both the Congress and the Federal Reserve should be prepared to provide additional financial support to prevent the permanent damage to the economy from widespread bankruptcy between small businesses or long-term unemployment, which usually erodes workers' skills and social networks. Congress has already approved nearly $3 trillion in rescue assistance for individuals and companies. But states and localities need federal funds to avoid having to cut jobs and services.

If necessary, Powell said, the Federal Reserve can expand any of the nine lending programs it has initiated since the virus's spread began harming the economy - or create new ones. In March, the central bank cut its benchmark interest rate to close to zero as stock markets fell and bond markets froze. The Fed also intervened by buying $2.1 trillion in Treasury and other bonds in an attempt to keep interest rates low and facilitate the flow of credit.

Powell said that the Fed could also provide clearer guidance on how long the interest rate will remain pegged at almost zero and the extent of bond-buying programs. Doing so will give banks and other companies more confidence that borrowing rates will remain low for a longer period. But the chairman reiterated that the Fed is not thinking of lowering interest rates to negative territory, something that US President Donald Trump has repeatedly urged.

Expectations of negative interest rates have increased in recent weeks, when the futures markets basically bet that the Federal Reserve will take this step early next year, as some other central banks have done.

According to the technical analysis of gold: The general trend of gold is still bullish as long as it is stable above the $1700 psychological resistance, and preparing now for the $1800 psychological resistance, which will require what we have mentioned above. Technical indicators have reached overbought areas, and accordingly, when wanting to buy, there should be no risk. The closest support levels for gold are currently 1723, 1705 and 1690, respectively. A break above the $1765 resistance will inevitably lead to $1800.

Gold price will react today to the British wages and job numbers announcement, German ZEW index reading. The US data will be the housing market, then the testimony of Federal Reserve Governor Jerome Powell.