For the sixth consecutive day, the gold price is moving in a downward correction range, amid profit-taking operations, supported by optimism that has prevailed in the global financial markets recently, with the re-opening of global economies and the abandonment of some of the closures used to contain the rapid spread of the deadly Coronavirus. The risk appetite pushed the safe haven yellow metal to the $1693 support, the lowest in two weeks, before settling around the $1710 level in the beginning of today’s trading, the most important trading session for this week, during which important U.S economic figures will be released in the shadow of the Corona era, and with the United States moving beyond 100,000 dead from the epidemic.

The bearish correction was not as violent as the strength rebound higher because the ongoing dispute between the United States of America and China still supports the ability to buy at any time, as the developments are many and successive and will not end soon.

Despite the disastrous numbers of US infections and deaths due to the Coronavirus, which topped the global figures, the Trump administration is still eager to reopen the economy. According to the most recent survey of economic conditions, known as the Beige Book, issued by the Federal Reserve, the US economic downturn caused by the coronavirus pandemic remained in full force in mid-May, with activity declining sharply and sharp job losses, the report found that the majority were pessimistic about the possible pace of recovery.

According to the report’s narration, some sectors, such as entertainment and hospitality, have been affected the most by staying at home. Factory activity decreased sharply and agricultural conditions were in decline. One of the highlights of the report was the rise in car sales in mid-May. Wage pressure was mixed.

According to expectations. The US economic growth will shrink in the April-June quarter at a sharp rate, and as policymakers began to turn their attention to what would happen next with New York Federal Reserve Chairman John Williams and St. Louis Fed President James Pollard said on Wednesday that the US economy is either on or near the bottom and that there will be a recovery in the second half of the year.

In light of Trump's agitation at a very sensitive time which threatens the future of his second presidency of the United States. The US president has threatened to impose new regulations on social media companies or even "shut them down". And this is amid Trump's anger at Twitter after his recent tweets.

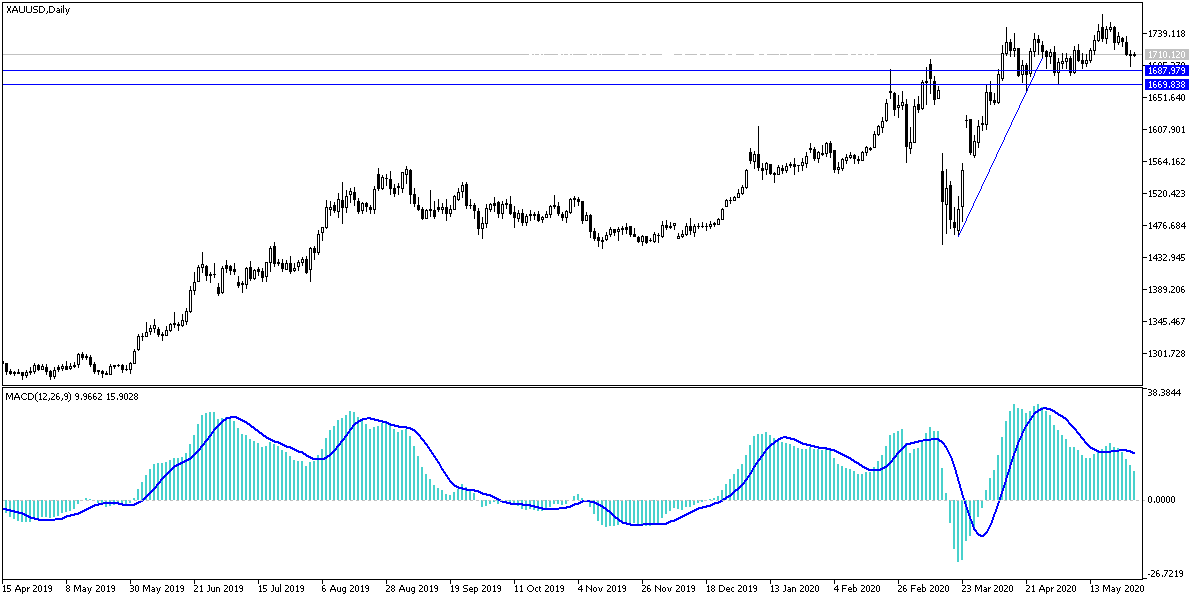

According to gold technical analysis: the opportunity for gold prices to go higher still exists despite the recent correction moves. As long as prices are stable around and above the $1700 psychological resistance. The recent correction due to profit-taking sales may push prices, as I mentioned recently, to new buying levels, and the closest ones are currently at 1688, 1675 and 1660, respectively. On the other hand, the $1735 resistance level will continue to support a stronger movement of bulls towards new highs. The US/China conflict and the continuing global economic bleeding from the Corona epidemic will always be a catalyst for gold investors to buy.

Gold will react today with the announcement of the US economic data, which is includes the US GDP growth rate, jobless claims, durable goods orders and pending home sales.