Although gold price stopped achieving stronger gains during yesterday's trading, despite the USD drop, reaching the $1754 resistance an ounce and stability around $1743 at the time of writing. However, the general trend is still bullish and ready to move towards new highs. There is optimism in the markets about the increased demand for the metal as many countries are planning to reopen after a long closure due to the Coronavirus epidemic. Although the US Federal Reserve Board has excluded the possibility of negative interest rates, the interest rate is still near 0 to 0.25%, and the US central bank has pledged to come up with other options available in its toolkit to boost the economy which may prompt investors to search for the precious metal .

According to the minutes of the last US Federal Reserve meeting. Several participants in this meeting believed that there is a high probability of additional waves of coronavirus outbreaks, which could lead to further economic turmoil. At the same time, economic activity can recover more quickly if the epidemic subsides enough for families and businesses to have enough confidence to relax or modify social distancing behaviors over the next several months.

Silver futures for July rose to $18.031 an ounce, while copper futures for July rose 1.7% to $2.4600 a pound.

On the European side. The objection is becoming apparent to the European economic stimulus plan, which was promised by Germany and France. As Dutch Prime Minister Mark Rutte said on Wednesday that he did not clearly endorse - the Franco-German proposal for a 500 billion Euro ($550 billion) fund that would support countries to borrow together and provide explicit grants to help countries during a recession. This plan, developed by two leaders, Emmanuel Macron and Angela Merkel, goes beyond the previous loan-based bailout package that had to be paid off one day.

Economic stimulus measures around the world have boosted demand for the yellow metal on the back of global economies' desire to reopen from the COVID-19 closures. At a briefing before the Senate Banking Committee on Tuesday, Jerome Powell said, "We must be ready to do more, and I would say we're ready to do more if there is a need for that."

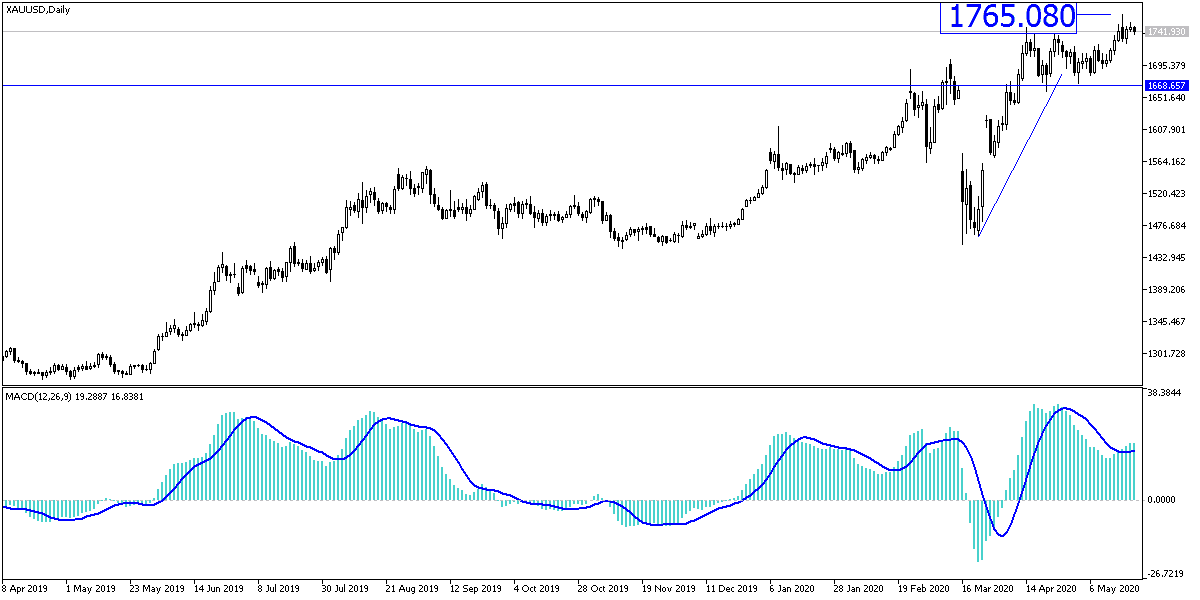

According to gold technical analysis: bulls' control of the gold path is still in place, and as I mentioned before, the $1700 psychological resistance will remain supportive of the bullish trend for a longer period. Investors may prepare to take the price to lower levels to return to buying and the nearest support levels are now 1738, 1725 and 1710, respectively. A return to the recent 1765 resistance barrier could quickly set the stage for the next psychological resistance level at $1,800 an ounce.

Gold prices will react to the announcement of industrial and services sectors PMI readings, for the Eurozone Britain and the United States of America. In addition to unemployed claims and remarks by Federal Reserve Governor Jerome Powell.