The profit-taking operations after the recent record gains for the gold pushed performance towards the $1725 support. Gains at the beginning of this week's trading were around the $1765 resistance, the highest level since 2012. In the midst of the sales operations, we expected that gold may bounce higher, especially with the evaporation of recent optimism in the financial markets, from the announcement of the first vaccine experiments success that might eliminate the Coronavirus, and with hints of optimism by the Governor of the Federal Reserve Bank Jerome Powell regarding the timing of American economy’s recovery from the devastating coronavirus effects, amid a strict policy of closure to contain the rapid spread, with the United States leading the world figures of cases and deaths due to this deadly epidemic. The rebound gains for gold pushed it back to stability around the $1746 resistance in the beginning of Wednesday’s trading.

The metal progress was stalled by the statements of Federal Reserve Chairman Jerome Powell, which confirmed that the US central bank is ready to provide more support to the local economy. Speaking to the Senate Banking Committee yesterday, Powell said, "We must be prepared to do more, and I would say we are ready if there is a need." On the other hand, although reports indicate that the pharmaceutical company Moderna Inc. has made some early progress toward producing a vaccine for the virus, but some gold bulls believe that the massive fiscal and monetary stimulus measures of governments around the world will support buying gold on the long run.

Gold prices have skyrocketed recently, amid concerns about the economic impact of the COVID-19 pandemic, which is likely to push the world into recession, boosting the appeal of the yellow metal as a safe haven.

At the annual meeting of the United Nations' World Health Organization and this week, Chinese President Xi Jinping joined by video to provide more money and support. Meanwhile, US President Donald Trump has criticized the World Health Organization in a letter accusing it of covering up the coronavirus outbreak with China, and has threatened to permanently cut US funding that has been the main financial lifeline for years. The confrontation between the two largest economies in the world increased, with the epidemic killing more than 300,000 people around the world, and nearly a third of that number came from the United States of America alone.

In this regard, Lawrence Justin, director of the WHO Collaborating Center for Health and Human Rights at Georgetown University, said the US withdrawal from the WHO would be a seismic political transformation. Justin added that the US exit is likely to weaken the World Health Organization and leave the United States and China to each of them to fund their own projects.

At the meeting that ended yesterday, European Union leaders tried to compromise between the two opponents, and the agency's director general simply attempted to focus on fighting the disease. The Assembly's opening day ended on Monday with two very different messages. On the one hand, Chinese President Xi has called for China to provide two billion dollars over two years to help cope with the COVID-19 epidemic and its economic repercussions. He pledged that any vaccine against the disease developed in his country would become a "global public good."

On the other hand, Trump threatened to cut US funding to the World Health Organization forever unless the agency committed to "substantial improvements" in the next thirty days, in a letter to the agency's director general, Tedros Adhanum Gebresus. But it is not clear what improvements Trump expect.

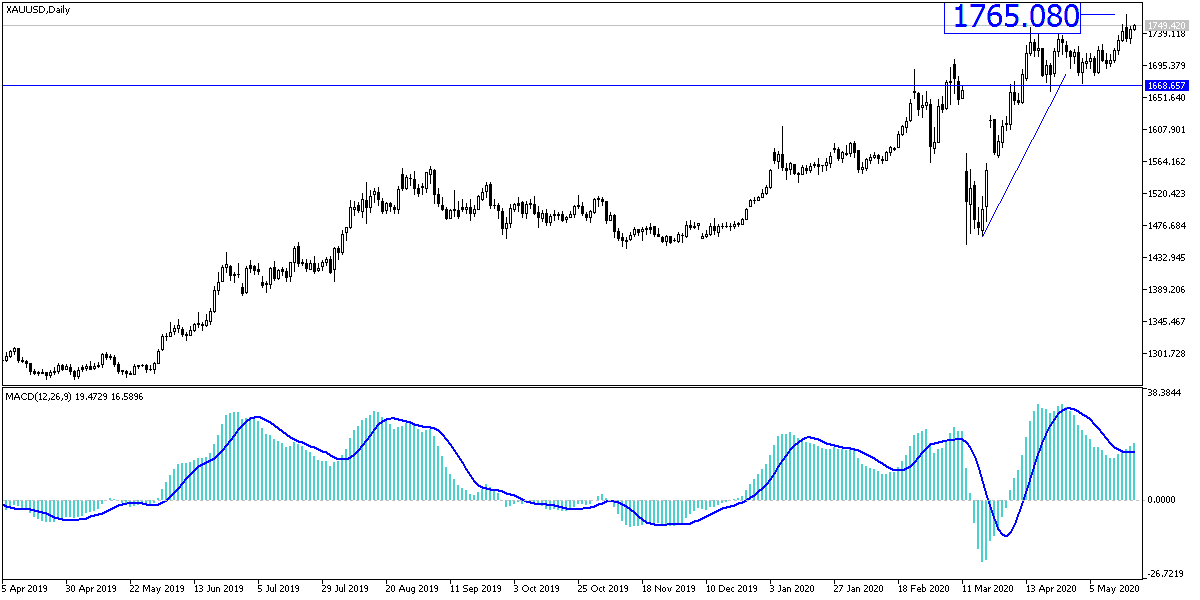

According to gold technical analysis: On the daily chart, the price of gold still has the opportunity to achieve its record and historical gains again, especially with the weakening of the US dollar. The closest resistance levels for gold are currently 1755, 1770 and 1800, respectively. Without a move below the $1700 resistance, there will be no bearish correction nor a reversal of the trend. Until a vaccine eradicates the epidemic and the US-China relations return to the pre-epidemic status, I will continue to recommend the purchase of gold from every downturn.

Gold will react today with the announcement of British and Canadian inflation figures and to the announcement of the minutes of the latest Fed meeting.