Increasing global geopolitical and commercial tensions contributed to more interest by investors to buy more gold bars, which pushed the price of gold to the $1752 level, the highest for eight years. The factors driving the metal gain included the widening scope of the dispute between the United States of America and China, which reached Trump's desire to suspend all relations with China, as well as the tension between the two sides of the Brexit, the European Union and Britain, over the future of trade and political relations between them in the post-Brexit era. The global human and economic losses from the rapid spread of the Coronavirus continue to overshadow optimism that the global economy will be re-opened amid coexistence with the epidemic until a vaccine is reached. Gold closed trading last week around the $1741 level. With the beginning of trading this week, its record gains continued, reaching the $1764 resistance.

Globally, the coronavirus epidemic continues to increase demand for safe-haven investments. There are near-certain expectations that a global financial crisis after COVID-19 cannot be avoided amid the closures by the global economies that are hardest hit by it, which has stopped business. As such, the price of gold has gained more demand from investors looking to protect their investments in high-risk assets by taking advantage of gold investments, as the US-led world economic activity appears to be slowing sharply.

On the economic side. US inflation levels fell stronger than expected, as the core US consumer price index, which excludes food and energy, was at -0.4%, while expectations were for a decline of -0.2%, and on an annual basis it recorded a reading of 1.4%, less than expectations at 1.7%. Likewise, the weekly US jobless claims recorded 2.981 million claims, and expectations were for only 2 and a half million claims. And by the end of last week, the data results showed a sharp decline in US retail sales down to a reading of -15.3%, which is significantly worse than the market expectations at -4.6%.

According to the technical analysis of gold: On the short term, after the recent gold gains, it has reached the overbought levels of the 14 hour RSI in the 60 minute chart. This could push the XAU/USD pair down in the coming days amidst profit-selling. Therefore, bears may target retreat earnings at around $1732 or less at $1720. On the other hand, bulls will target profits at around $1752 or higher at $1770.

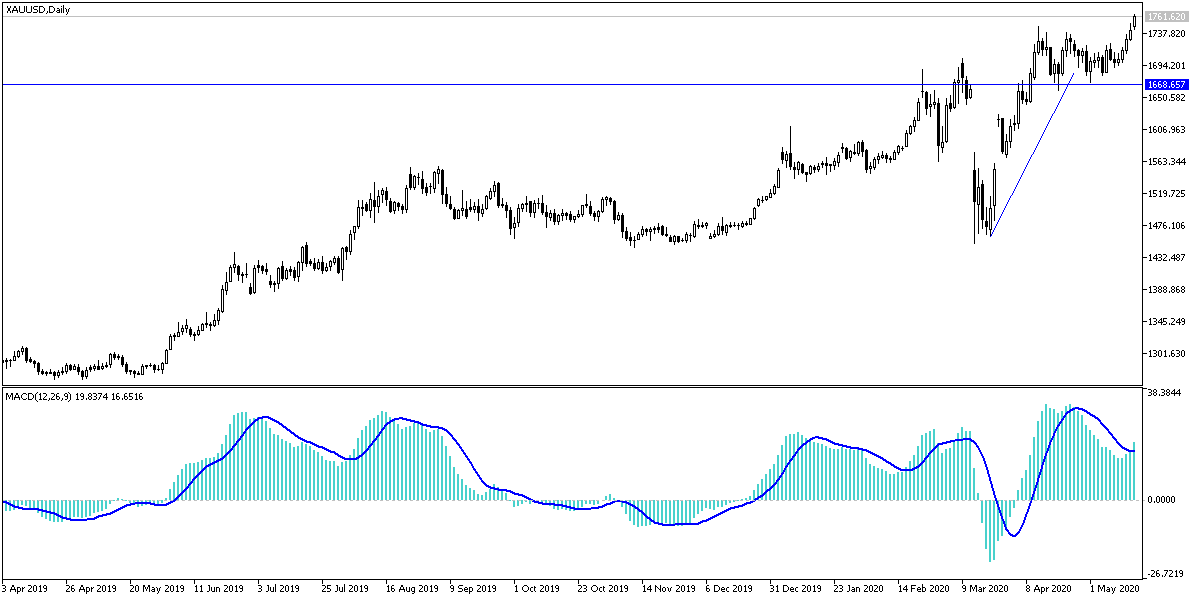

On the long run, according to the performance on the daily chart, it appears that the gold price is trading inside a sharp bullish channel. This indicates a long-term bullish bias in market sentiment. Thus, it appears that the price of gold is also approaching the overbought levels of the 14-day RSI on the daily chart. Speculators will look for the rally to extend long-term gains towards $1777 or higher at $1821. On the other hand, bears will target declining profits at around $1708 or less at $1665.

A calm move in the price of gold is expected at the beginning of the week’s trading, as the economic calendar is free of important and influencing economic issues.