The gold price is still benefiting a lot from the historical and record negative results of the global economic releases due to the strict closures policies approved by countries to contain the rapid spread of Coronavirus. This is in addition to the renewed global geopolitical and trade tensions at a time when the global economy is suffering from a free slide. Gold prices rose to the $1710 resistance during yesterday's session and was stable around the $1703 level in the beginning of Wednesday’s trading. The yellow metal recently gained momentum from the weakening of the USD, as investors are betting on a slow economic recovery, despite ongoing efforts to reopen the economies that were closed to contain COVID-19.

Economists believe that investors’ resort to gold as a safe haven came amid changing market perceptions about the pace of economic recovery after the Covid-19 epidemic subsided. Investors are currently focusing on assessing the market implications of the highly potential "second wave" of Covid-19 as major global economies begin to reopen their businesses and revitalize transport infrastructure. There is a growing feeling that the economic recovery, which has been calculated at current market prices despite the strong gains in several global stock indices, will be "slower than initially expected."

As for the prices of other metals. The price of an ounce of silver increased to $15.70. In contrast, the price of copper fell to $2.359 a pound. The price of platinum fell to $777.40 an ounce and the price of palladium fell to $1835 an ounce.

Some economists argue that even as economies recover, gold prices will be supported by more purchases as a safe haven due to the fear of COVID-19, along with fear of inflation and the uncertainty surrounding the vast sums of liquidity created by global central banks to cope with the crisis.

For economic news. Consumer prices in the United States fell more than expected, according to a report published by the Ministry of Labor yesterday, the index fell -0.8% in April from a decline of -0.4% in March. The decline, according to the index, which meets economists' estimates, reflects the biggest monthly decline since December 2008.

Gasoline prices led prices lower, dropping - 20.6% in April after falling - 10.5% in the previous month. The drop in gasoline prices contributed to another sharp drop in energy prices, which fell - 10.1 percent in April after falling - 5.8 percent in March. Energy prices experienced their biggest monthly drop since November 2008.

However, the collapse in energy prices was partly offset by a 1.5 percent rise in food prices, as food prices at home rose by 2.6 percent, marking the largest monthly increase since February 1974.

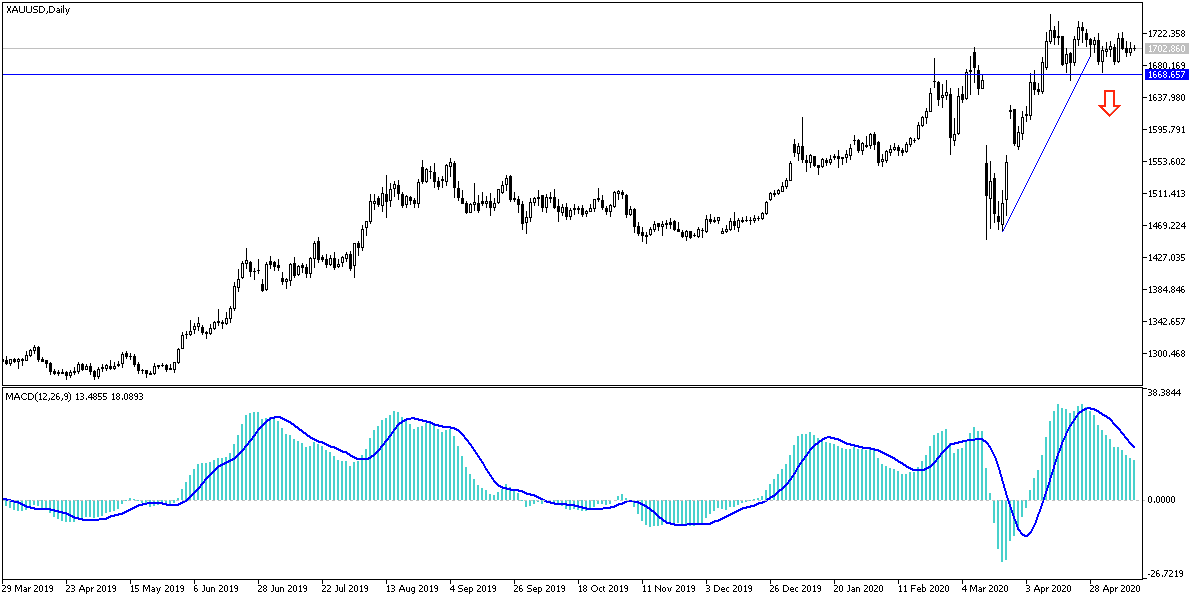

According to gold technical analysis: The gold price path is still bullish as long as it adheres to the $1700 psychological resistance, taking into account technical indicators reaching overbought areas, and profit-taking sales can be activated at any time, especially if calm returns to the markets and the investor confidence increases from the pessimism that prevails in the markets now. The closest support levels for gold are now 1695, 1682 and 1660 dollars, respectively.

The gold price will react to the announcement of the growth rate in the British economy and producer prices in the United States and with the statements of the Governor of the US Federal Reserve.