The call to open the world economy did not prevent the price of gold from maintaining its gains near its highest level in more than seven years. As fears remain, the urgency to open without a vaccine that eliminates the epidemic could increase coronavirus infections and deaths. During last week's trading and after a bearish corrections moves pushed gold price towards the $1681 support, gold got new support from the collapse of the American labor market and the decline of the US dollar as a result, and with expectations that the US Federal Reserve may have to adopt negative interest rates, and thus Gold reached $1723 an ounce at the end of last week’s trading, and started this week’s trading stable around the $1706 level.

The world is still under the pressure of severe economic shocks due to the rapid spread of the Coronavirus, which motivates investors to escape to gold as a safe haven. The continuing uncertainty will translate into higher gold prices at the present time. If plans to reopen the global economy succeed without additional spread of the virus, gold prices may lose their luster and begin to move down strongly due to sharp sell-offs.

The rapid spread of the COVID-19 has infected more than 3.97 million people, according to data compiled by Johns Hopkins University. The death toll rose to 275.527, and the recovered are more than 1.3 million people. The United States still has the highest number of cases at 1.29 million people infected, with the highest number of deaths by more than 77.280. Spain has the largest number of cases in Europe, with 222,875 people and 26,299 deaths. In Italy, there are 217,185 thousand infected and 30201 dead. The United Kingdom has 212,629 infected, and more than 31,316 dead, the highest number of deaths in Europe, and higher than China, the main source of the virus, with 83,976 cases and 4,637 deaths.

The Coronavirus has paralyzed the global economy for months, hence, a severe global economic recession. It was the catalyst for many of the record gains in gold prices.

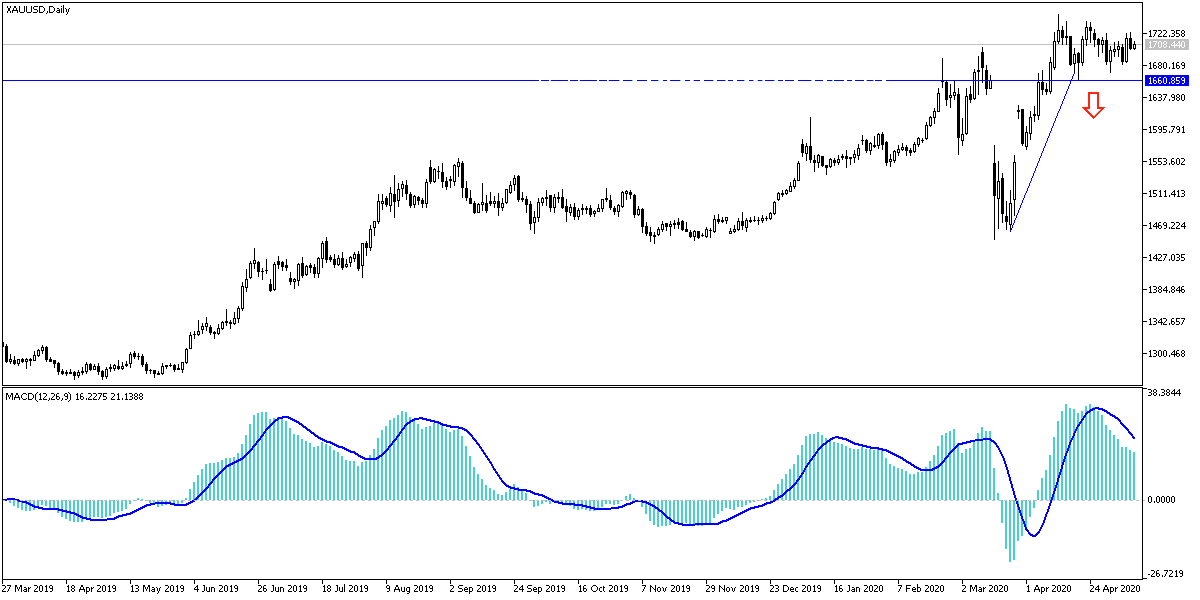

According to gold technical analysis of gold: On the monthly chart, the general trend of gold continues towards further rise, while taking into account that it is trading near the top of the channel. Therefore, the bullish price movement may continue to be limited near the top of the channel at the present time. Gold could reverse and start moving downwards from the current level with profit taking sales. As for the gold price on the weekly chart, it is steady and maintains the positions near the top of the channel. There is no strong downward reaction from the top of the channel so far. We believe that the gold trend will continue to the upside, but the correction may occur before more upward movement. On the daily chart, the price of gold is neutral and the $1700 peak represents a strong momentum for bulls to continue controlling performance.

You should beware of profit taking sales, and resistance levels 1715, 1727, and 1740 may be the beginning of that, taking into account that a drop in prices due to profit-taking may motivate gold investors to think about buying gold again, as gain factors are continuing and increasing.