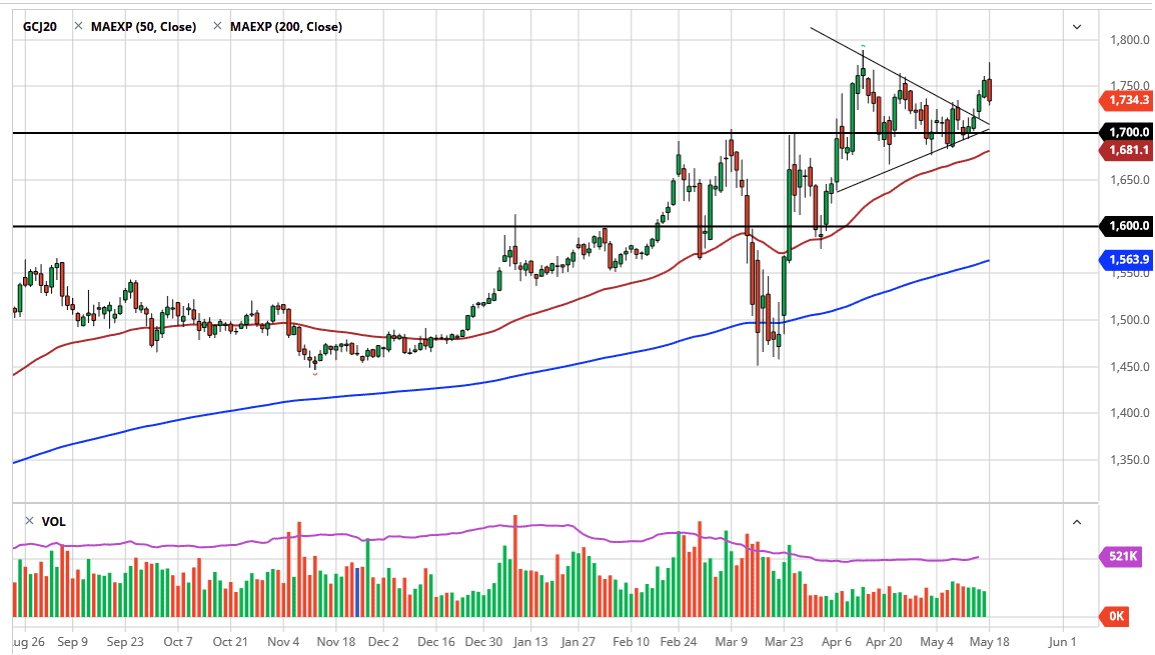

Gold markets initially tried to rally during the trading session on Monday but gave back the gains to break below the $1750 level to find even more weakness later in the day. That being said, the market does have a significant amount of support underneath it, so I believe that it is only a matter of time before buyers come back into pick up “cheap gold.” If they do, then the $1700 level would make quite a bit of sense. Furthermore, the 50 day EMA is just below and that also offers support. Regardless, it is difficult to imagine a scenario where gold sells over the long term, despite the fact that the market was extraordinarily bullish on risk during the Monday session.

This is a market that has a lot of resistance above, so it makes sense that we would continue to see a lot of noise, and a lot of back and forth. Ultimately, we could be trying to carve out a short-term range but if we can get above the $1800 level, I think that it is highly likely this market goes racing towards the $2000 level over the longer term. Furthermore, all it would take is a little bit of bad news to get people buying gold again, as there is more than likely going to be plenty to go around. For example, we have the coronavirus figures which are starting to spike again, and we also have central bank printing which of course drives up the value of gold over the longer term anyway. Because of this I am anticipating that the market is entering a longer-term bullish run, and with the dire economic scenario out there it makes quite a bit of sense that gold will continue to be one of the few bullish markets.

One thing I think you can count on is a lot of volatility, but ultimately this is a market that I think will continue to favor the upside longer-term, and therefore one would have to think that value hunting is the best way to go. I have no interest in shorting gold, because quite frankly it is a very bullish market from a longer-term standpoint anyway. With that in mind, I believe that the prudent thing to do is to simply add little bits and pieces along the way, as you can build up a larger core position for what is more than likely going to be a long-term cyclical move.