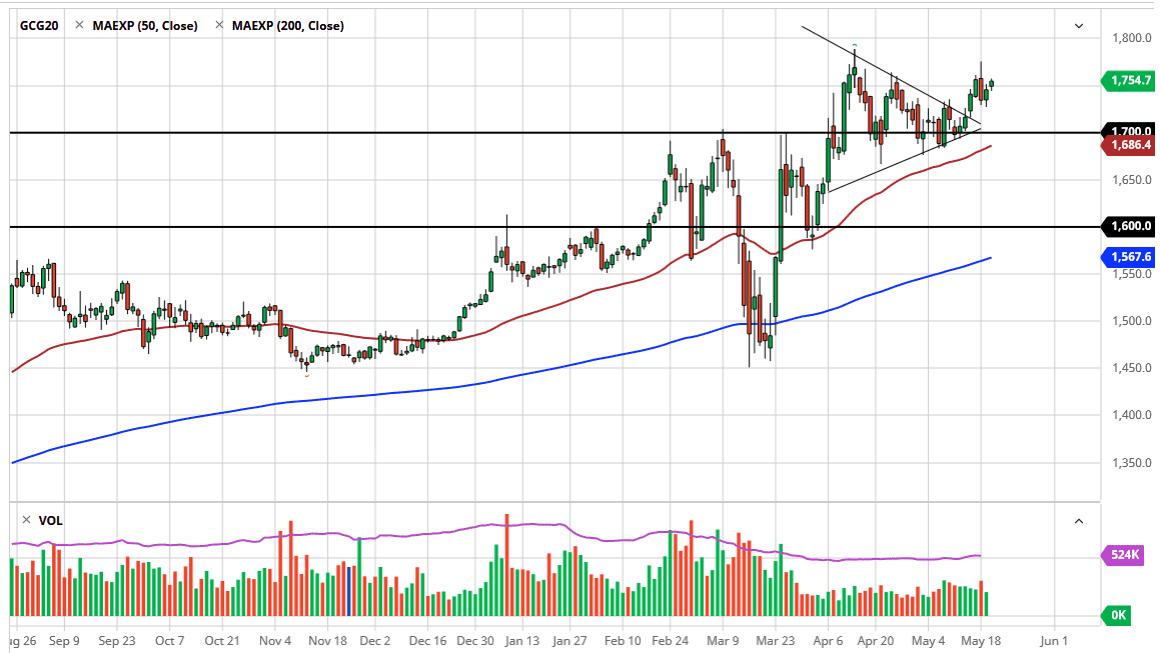

Gold markets have been pretty choppy during the trading session on Wednesday, gapping higher to kick off the session before pulling back to fill the gap and then rallying again, only to turn around and form completely lost. The one thing that the market looks at right now is the $1750 level as a magnet for price. It is the beginning of significant resistance that extends to the $1775 level. At this point, the market breaking above there would be a bullish sign, perhaps looking towards the $1800 level in the short term, before breaking well above there and going to look at the $2000 level.

One of the biggest problems gold seems to have right now though is the fact that there are a lot of various factors that people are paying attention to. For example, sometimes people focus on the coronavirus solution, and when you get a fraudulent statement come out at the beginning of the day, you can see that it is certainly a “risk on” type of session. However, when the news gets swatted down, suddenly it is a “risk off” type of session, which of course is good for gold.

The US dollar of course has a major influence on this market as well, as it is priced in those very same US dollars. Ultimately, this is a market that is bullish but also has a lot of different things moving for and against it. This market will continue to be difficult to trade from short-term standpoint, but this is a market that I think you should be looking for value in the sense of short-term pullbacks offering “cheap gold.” After all, the very essence of trading is finding an asset that is cheap and then buying it. That is going to be no different in gold than it is any other market. Because of this, it simply is a matter of time before you can buy gold again on the day. However, if we did break out above that previously mentioned $1775 level, I would probably start to add to a core position there as well. I have no interest whatsoever in shorting gold, because it would require not only a major “risk on” type scenario but it would also require central banks to start loosening monetary policy, something that is not going to happen very soon, perhaps not even for decades with the amount of debt issues there are. Gold is just getting started.