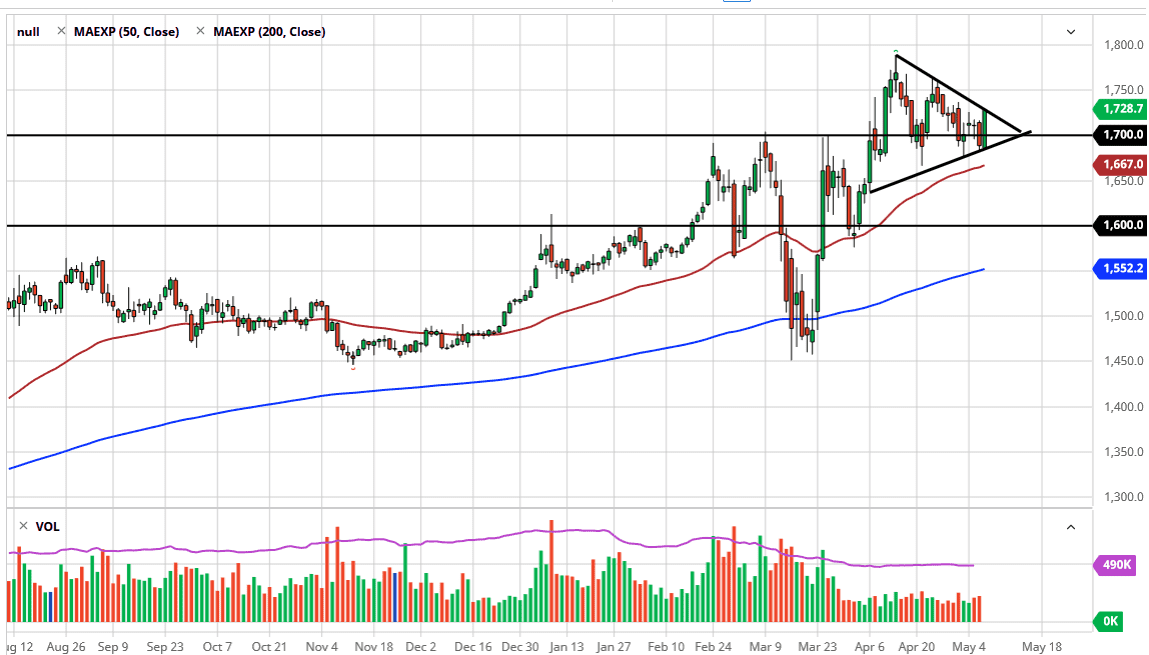

The gold markets rallied significantly during the trading session on Thursday as the Fed Funds Futures rate went negative for December 20. At this point, the market looks highly likely to continue going higher based upon a whole host of reasons, not the least of which is the fact that the market has been in a significant uptrend anyway. At the end of the day, the market ended up forming a massive engulfing candlestick. We are at the top of the overall triangle, and if we can break above the top of the candlestick for the trading session on Thursday, then it opens up a move towards the $1750 level. Quite frankly, considering what we have seen as of late, there is little doubt in my mind that we will see volatility regardless.

To the downside, the uptrend line should continue to hold the market somewhat supported, but with the jobs number coming out at 830 in the morning New York time, it is highly likely that we will see a lot of back and forth in the short term. With this being the case, the market is probably one that you will be looking to buy on dips, even if we do not get the breakout above the top of the triangle.

If we did break down below the uptrend line, then the 50 day EMA will come into play, followed by the $1650 level. At this point, I think we are much more likely to see this market go looking towards the $1750 level, and then the $1800 level. After that, then we will fulfill the idea of running into the $2000 level. The size of the candlestick alone tells you that there is a significant amount of demand and interest in this market.

Gold will continue to be looked at through the prism of risk appetite, which of course is going to be a lot of back and forth. Gold is a great “safety trade” for traders in general, and as people worry about interest rates going negative, it makes quite a bit of sense that people will run towards gold in order to protect their wealth. Simply put, if you cannot put money into bonds and get some type of return, then you need to protect your fund or portfolio. We have been in an uptrend for quite some time, and most of the time these consolidation areas do lead to continuation.