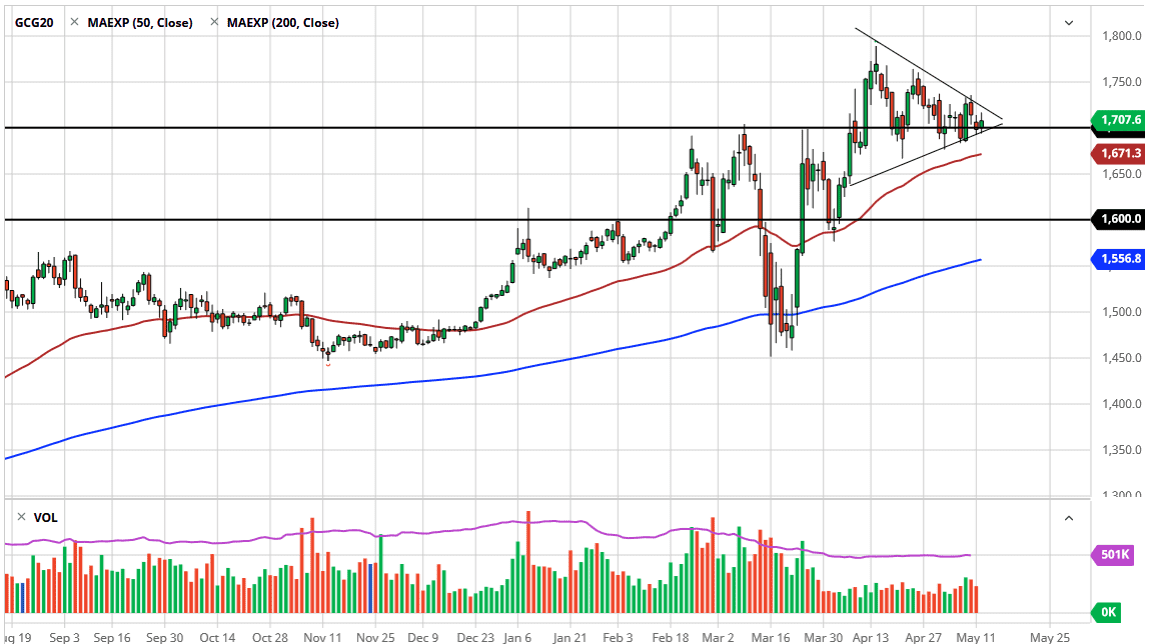

Gold markets have rallied a bit during the trading session on Tuesday but did not hang on to all of the gains. The market is currently looking at the $1700 level with interest, and it should be noted that we have a couple of trendlines that define a nice symmetrical triangle. Looking at the candlestick for the day, it shows a lackluster bullish session, but the overall picture of the market is bullish in general. Because of the lack of directionality during the day, it makes sense that we will probably continue to see a bit of volatility. However, there are a lot of different reasons like gold at this point.

The first thing that you can think of is the fact that the 50 day EMA sits just below the triangle. That of course is a very bullish sign and something that a lot of longer-term traders will pay attention to. It does seem to work quite well in the gold futures market, which of course influences everything else. The market breaking above the top of the symmetric triangle is what I expect, mainly because of the uptrend that we have been in. Furthermore though, there are plenty of fundamental reasons to think that the gold market should continue to rally from this point.

The central banks around the world continue to loosen monetary policy and that of course will be good for gold longer term. In fact, that is part of what has been driving gold market higher due to the fact that there is a lot of central bank printing which of course drives up inflation longer term. Furthermore though, and perhaps more pertinent to the situation we find ourselves in, the market has to deal with a lot of uncertainty around the world and that of course will drive up the “safety trade” that gold offers. The one thing that is working against gold in general though is going to be the US dollar strengthening over the longer term. At this point, it is a bit of a “push pull” trade but one thing is certain at this point, shorting gold is not going to be much of a trade anytime soon. In fact, I would need to see the market break down below the $1600 level to even consider that. That does not look likely at this point, so I remain bullish overall.