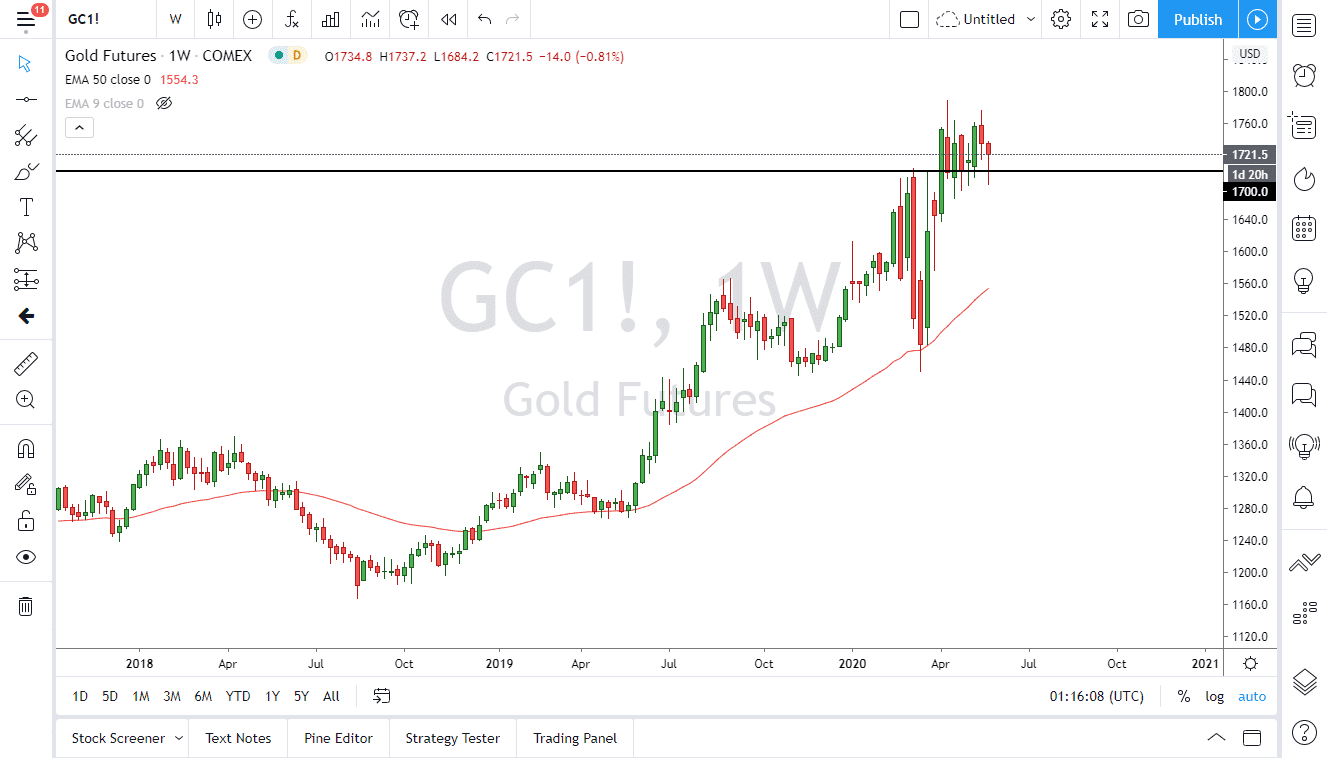

Gold markets have been sideways during most of the month of May, using the $1700 level as support. Furthermore, gold markets have also found the $1750 level as resistance, extending all the way to the $1760 level. In other words, we have been consolidating in after a massive breakdown, then recovery. You will notice that the market recovered at the 50 week EMA, and then shot straight up in the air during the month of March.

Most of the selling in the market was more or less due to forced liquidation, as the larger funds had to sell to collect profits, in order to cover margin calls in stocks. At this point, the trading community then started to buy gold again, and as a result had significant gains in a truly short amount of time. The $1700 level was previous resistance, so once we broke above there, it made a lot of sense that the markets now see this as a major support level, due to “market memory.”

There are several reasons that I see gold rallying over the longer-term. However, it should be noted that the gold markets move on their own time. In other words, they do not move much, and then suddenly take off. This is because there are a lot of nervous traders that will panic buy if things are not going so well in other markets, or the global macroeconomy. The gold markets will continue to attract inflows due to the fears of the global economy slowing down further. Also, the US/China trade war is almost certainly going to flare up again. With both parties in the US hawkish when it comes to dealing with China, its likely that we will see more tension between the two countries. Remember, this is an election year, and we could see a race to see who is tougher on the Chinese.

The other thing that I am paying attention to is the money printing by central banks around the world. Its not just the Fed, but the ECB, China, and several others. This is an environment that breeds uncertainty as well as devaluing of fiat currency. This is typically good for gold, and we are in an uptrend to begin with. I look at all dips for the month of June as a buying opportunity, and fully anticipate seeing another attempt – or two – at the $1750 region. Eventually, I would anticipate that we get to the $1800 level.