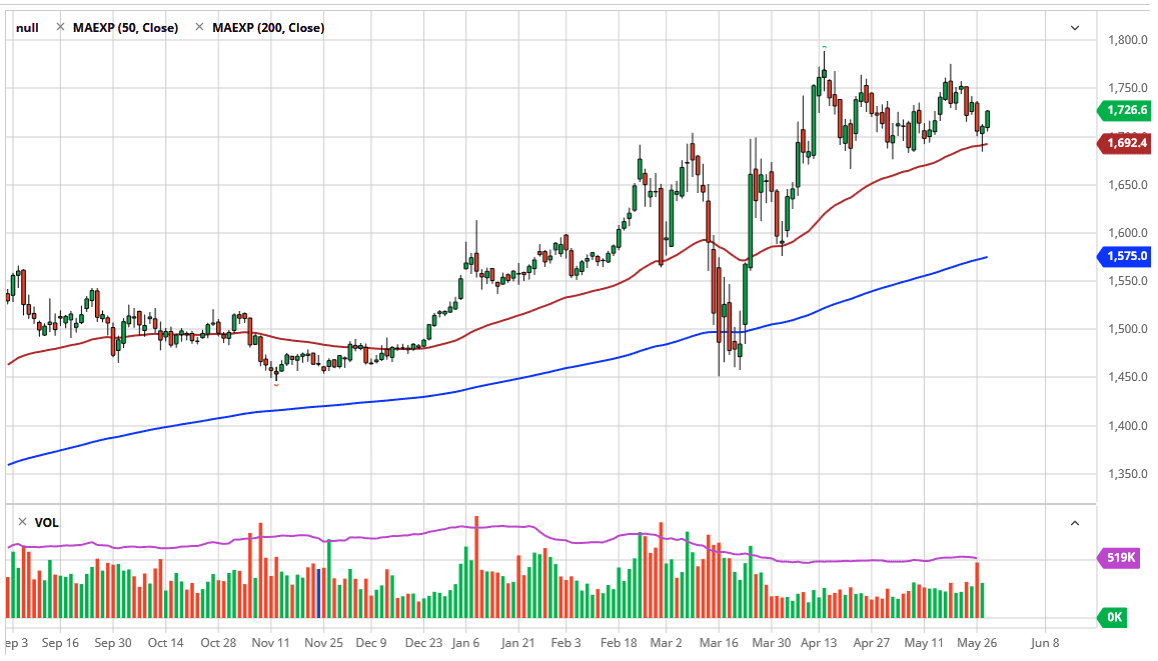

Gold markets rallied significantly during the trading session on Thursday to reach towards the $1728 level, and close near that level again. This is an area that starts to see a bit of resistance though, so we very well could see a pullback in order to pick up gold at lower levels. The $1700 level is essentially the “floor” in the market, but it should be noted that the floor extends down to the $1690 level. The more, the 50 day EMA underneath signifies that there is a certain amount of technical support there as well.

To the upside I believe that the $1750 level begins pretty significant resistance that extends all the way to the $1760 level. If we can break above all of that, then gold is highly likely to go searching for the $1800 level above. That is a large, round, psychologically significant barrier, and the scene of (or at least near it) massive selling at the most recent high. I think we are going to try to grind our way up to that level, but it is going to take a lot of work.

Central banks around the world continue to print money like it is their job, which is essentially it is. With that in mind, gold should continue to strengthen over the longer term, as fiat currencies will lose value over time. I believe that a lot of traders are holding gold right now on the idea of his central bank monetary policy easing, and the fact that we are getting close to negative rates in several countries around the world. If that is going to be the case, then it is difficult to imagine a scenario where you should be selling gold.

Do not get me wrong, there will be pullbacks occasionally, but this pullback should offer plenty of buying opportunities. In fact, I do not really have a scenario in which a willing to start selling gold short of having the pandemic disappear, because then it would probably be a huge “risk on rally” and just about any asset you can name. Ultimately, gold is entering a multi-you are bullish market, but right now simply digesting the gains it had enjoyed over the previous several months. Buying on dips and then adding on a breakout would be the best way to play this, but I do not know that the breakouts coming in the short term.